Question: Please create a financial analysis and include all of the criteria it asks for. (directions seen in second image below) Post a screenshot of the

Please create a financial analysis and include all of the criteria it asks for. (directions seen in second image below) Post a screenshot of the final product, as well as the NPV, ROI, Discount Rate (5%), etc. Below is an example of how to do it. Below the example is are the actual directions.

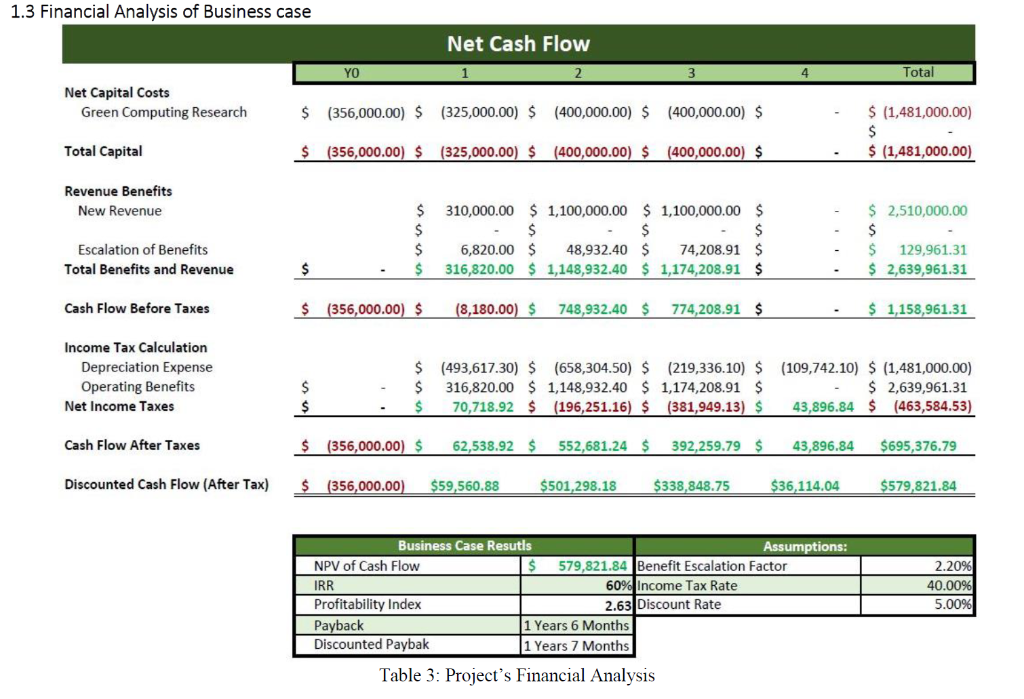

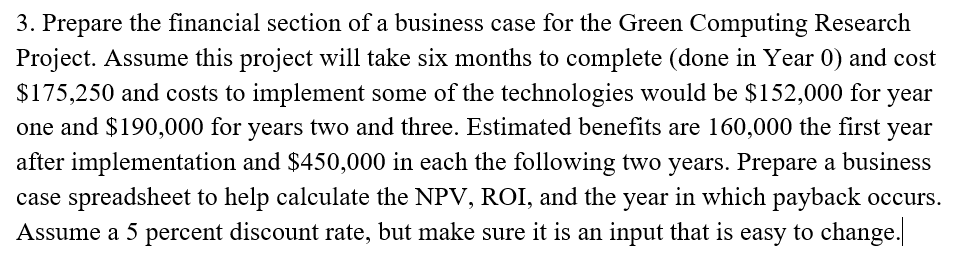

1.3 Financial Analysis of Business case Net Cash Flow YO Total Net Capital Costs Green Computing Research $ (356,000.00) $ (325,000.00) $ (400,000.00) $ (400,000.00) $ $ (1,481,000.00) $ $ (1,481,000.00) Total Capital $ (356,000.00) $ (325,000.00) $ (400,000.00) $ (400,000.00 $ Revenue Benefits New Revenue $ $ $ $ 310,000.00 $ 1,100,000.00 $ 1,100,000.00 $ $ $ $ 6,820.00 $ 48,932.40 $ 74,208.91 $ 316,820.00 $ 1,148,932.40 $ 1,174,208.91 $ $ 2,510,000.00 $ $ 129,961.31 $ 2,639,961.31 Escalation of Benefits Total Benefits and Revenue $ Cash Flow Before Taxes $ (356,000.00) $ (8,180.00) $ 748,932.40 $ 774,208.91 $ $ 1,158,961.31 Income Tax Calculation Depreciation Expense Operating Benefits Net Income Taxes $ $ $ (493,617.30) $ (658,304.50) $ (219,336.10) $ (109,742.10) $ (1,481,000.00) $ 316,820.00 $ 1,148,932.40 $ 1,174,208.91 $ $ 2,639,961.31 $ 70,718.92 $ (196,251.16) $ (381,949.13) $ 43,896.84 $ (463,584.53) Cash Flow After Taxes $ (356,000.00) $ 62,538.92 $ 552,681.24 $ 392,259.79 $ 43,896.84 $695,376.79 Discounted Cash Flow (After Tax) $ (356,000.00) $59,560.88 $501,298.18 $338,848.75 $36,114.04 $579,821.84 Business Case Resutis Assumptions: NPV of Cash Flow 579,821.84 Benefit Escalation Factor IRR 60% Income Tax Rate Profitability Index 2.63 Discount Rate Payback 1 Years 6 Months Discounted Paybak 1 Years 7 Months 2.20% 40.00% 5.00% Table 3: Project's Financial Analysis 3. Prepare the financial section of a business case for the Green Computing Research Project. Assume this project will take six months to complete (done in Year 0) and cost $175,250 and costs to implement some of the technologies would be $152,000 for year one and $190,000 for years two and three. Estimated benefits are 160,000 the first year after implementation and $450,000 in each the following two years. Prepare a business case spreadsheet to help calculate the NPV, ROI, and the year in which payback occurs. Assume a 5 percent discount rate, but make sure it is an input that is easy to change. 1.3 Financial Analysis of Business case Net Cash Flow YO Total Net Capital Costs Green Computing Research $ (356,000.00) $ (325,000.00) $ (400,000.00) $ (400,000.00) $ $ (1,481,000.00) $ $ (1,481,000.00) Total Capital $ (356,000.00) $ (325,000.00) $ (400,000.00) $ (400,000.00 $ Revenue Benefits New Revenue $ $ $ $ 310,000.00 $ 1,100,000.00 $ 1,100,000.00 $ $ $ $ 6,820.00 $ 48,932.40 $ 74,208.91 $ 316,820.00 $ 1,148,932.40 $ 1,174,208.91 $ $ 2,510,000.00 $ $ 129,961.31 $ 2,639,961.31 Escalation of Benefits Total Benefits and Revenue $ Cash Flow Before Taxes $ (356,000.00) $ (8,180.00) $ 748,932.40 $ 774,208.91 $ $ 1,158,961.31 Income Tax Calculation Depreciation Expense Operating Benefits Net Income Taxes $ $ $ (493,617.30) $ (658,304.50) $ (219,336.10) $ (109,742.10) $ (1,481,000.00) $ 316,820.00 $ 1,148,932.40 $ 1,174,208.91 $ $ 2,639,961.31 $ 70,718.92 $ (196,251.16) $ (381,949.13) $ 43,896.84 $ (463,584.53) Cash Flow After Taxes $ (356,000.00) $ 62,538.92 $ 552,681.24 $ 392,259.79 $ 43,896.84 $695,376.79 Discounted Cash Flow (After Tax) $ (356,000.00) $59,560.88 $501,298.18 $338,848.75 $36,114.04 $579,821.84 Business Case Resutis Assumptions: NPV of Cash Flow 579,821.84 Benefit Escalation Factor IRR 60% Income Tax Rate Profitability Index 2.63 Discount Rate Payback 1 Years 6 Months Discounted Paybak 1 Years 7 Months 2.20% 40.00% 5.00% Table 3: Project's Financial Analysis 3. Prepare the financial section of a business case for the Green Computing Research Project. Assume this project will take six months to complete (done in Year 0) and cost $175,250 and costs to implement some of the technologies would be $152,000 for year one and $190,000 for years two and three. Estimated benefits are 160,000 the first year after implementation and $450,000 in each the following two years. Prepare a business case spreadsheet to help calculate the NPV, ROI, and the year in which payback occurs. Assume a 5 percent discount rate, but make sure it is an input that is easy to change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts