Question: Please create a Statement of Profit or Loss, a Statement of Changes in Partners' Equity, and the Direct Method of the Statement of Cash Flows

Please create a Statement of Profit or Loss, a Statement of Changes in Partners' Equity, and the Direct Method of the Statement of Cash Flows under No.3 :

*change in Cash balance, January 1, 2024 to 1,446,000

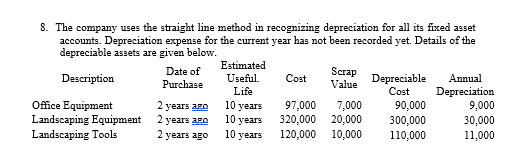

This is the 10-column Worksheet prepared:

| RP Landscaping and Plant Services | ||||||||||

| Adjusted Trial Balance | ||||||||||

| December 31, 2024 | ||||||||||

| Unadjusted | Adjusted | Income | Statement of | |||||||

| Trial balance | Adjustments | Trial balance | Statement | Financial Position | ||||||

| Account Title | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit |

| Cash | 2,828,500 | 2,828,500 | 2,828,500 | |||||||

| Accounts Receivable | 145,000 | 145,000 | 145,000 | |||||||

| Allowance for Bad Debts | 7,500 | 7,000 | 14,500 | 14,500 | ||||||

| Notes Receivable | 80,000 | 80,000 | 80,000 | |||||||

| Interest Receivable | 9,600 | 9,600 | 9,600 | |||||||

| Advances to Employees | 12,000 | 12,000 | 12,000 | |||||||

| Prepaid Rent | 240,000 | 120,000 | 120,000 | 120,000 | ||||||

| Landscaping Supplies on Hand | 218,750 | 158,500 | 60,250 | 60,250 | ||||||

| Office Equipment | 97,000 | 97,000 | 97,000 | |||||||

| Accumulated Depreciation - Office Equipment | 18,000 | 9,000 | 27,000 | 27,000 | ||||||

| Landscaping Equipment | 320,000 | 320,000 | 320,000 | |||||||

| Accumulated Depreciation - Landscaping Equipment | 60,000 | 30,000 | 90,000 | 90,000 | ||||||

| Landscaping Tools | 120,000 | 120,000 | 120,000 | |||||||

| Accumulated Depreciation - Landscaping Tools | 22,000 | 11,000 | 33,000 | 33,000 | ||||||

| Accounts Payable | 35,500 | 35,500 | 35,500 | |||||||

| Unearned Service Income | 48,000 | 24,000 | 24,000 | 24,000 | ||||||

| Income Tax Payable | ||||||||||

| Utilities Payable | 14,500 | 14,500 | 14,500 | |||||||

| Interest Payable | 3,000 | 3,000 | 3,000 | |||||||

| Notes Payable due in 3 years | 75,000 | 75,000 | 75,000 | |||||||

| Romy, Capital | 1,000,000 | 1,000,000 | 1,000,000 | |||||||

| Romy, Drawing | 25,000 | 25,000 | 25,000 | |||||||

| Pio, Capital | 1,000,000 | 1,000,000 | 1,000,000 | |||||||

| Pio, Drawing | 10,000 | 10,000 | 10,000 | |||||||

| Service Income | 2,700,000 | 24,000 | 2,724,000 | 2,724,000 | ||||||

| Interest Income | 9,600 | 9,600 | 9,600 | |||||||

| Salaries and Wages Expense | 656,000 | 656,000 | 656,000 | |||||||

| Income Tax Expense | ||||||||||

| Utilities Expense | 90,750 | 14,500 | 105,250 | 105,250 | ||||||

| Landscaping Supplies Expense | 158,500 | 158,500 | 158,500 | |||||||

| Transportation Expense | 90,000 | 90,000 | 90,000 | |||||||

| Rent Expense | 120,000 | 120,000 | 120,000 | |||||||

| Repairs and Maintenance Expense | 14,400 | 14,400 | 14,400 | |||||||

| Depreciation Expense | 50,000 | 50,000 | 50,000 | |||||||

| Bad Debts Expense | 7,000 | 7,000 | 7,000 | |||||||

| Advertising Expense | 12,000 | 12,000 | 12,000 | |||||||

| Miscellaneous Expense | 6,600 | 6,600 | 6,600 | |||||||

| Interest Expense | 3,000 | 3,000 | 3,000 | |||||||

| Total | 4,966,000 | 4,966,000 | 386,600 | 386,600 | 5,050,100 | 5,050,100 | 1,222,750 | 2,733,600 | 3,827,350 | 2,316,500 |

| Net Income | 1,510,850 | 1,510,850 | ||||||||

| Total | 2,733,600 | 2,733,600 | 3,827,350 | 3,827,350 | ||||||

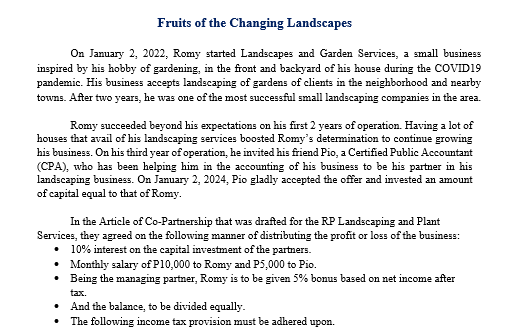

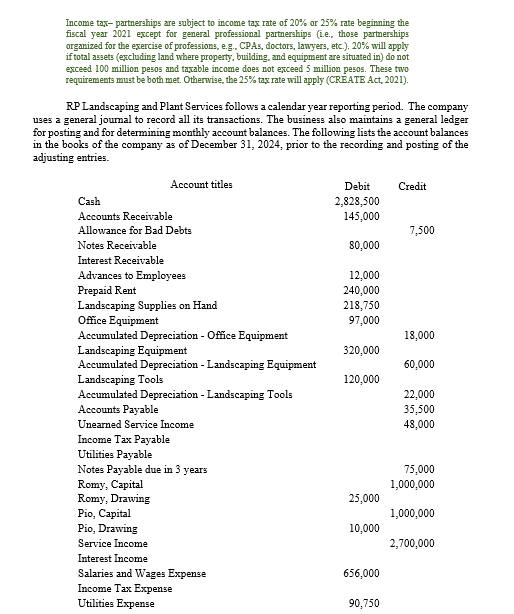

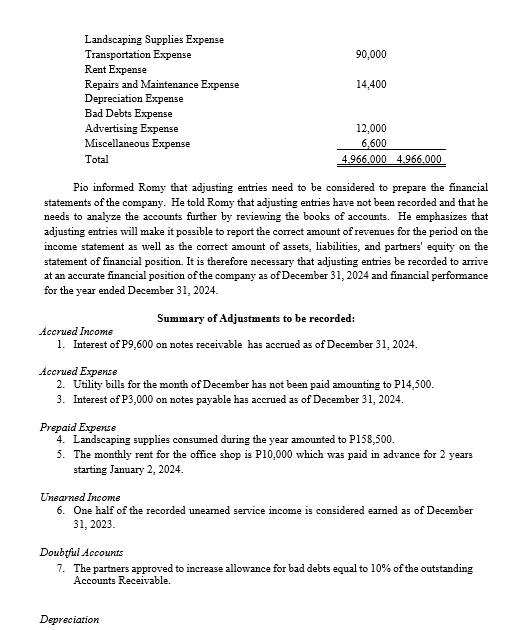

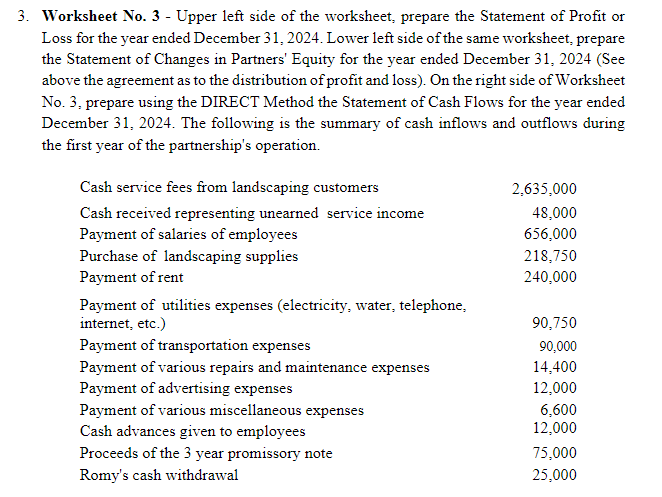

Fruits of the Changing Landscapes On January 2, 2022, Romy started Landscapes and Garden Services, a small business inspired by his hobby of gardening, in the front and backyard of his house during the COVID19 pandemic. His business accepts landscaping of gardens of clients in the neighborhood and nearby towns. After two years, he was one of the most successful small landscaping companies in the area. Romy succeeded beyond his expectations on his first 2 years of operation. Having a lot of houses that avail of his landscaping services boosted Romy's determination to continue growing his business. On his third year of operation, he invited his friend Pio, a Certified Public Accountant (CPA), who has been helping him in the accounting of his business to be his partner in his landscaping business. On January 2, 2024, Pio gladly accepted the offer and invested an amount of capital equal to that of Romy. In the Article of Co-Partnership that was drafted for the RP Landscaping and Plant Services, they agreed on the following manner of distributing the profit or loss of the business: - 10% interest on the capital investment of the partners. - Monthly salary of P10,000 to Romy and P5,000 to Pio. - Being the managing partner, Romy is to be given 5% bonus based on net income after tax. - And the balance, to be divided equally. - The following income tax provision must be adhered upon. Income tak- partnerships are subject to income tax rate of 20% or 25% rate beginning the fiscal year 2021 except for general professional partnerships (1.e., those partnerships organized for the exercise of professions, e.g., CPA5, doctors, lawyers, etc.). 20% will apply if total assets (excluding land where property, building, and equipment are situated in) do not exceed 100 million pesos and tarrable income does not exceed 5 million pesos. These two requirements must be both met. Othervise, the 25% tax rate will apply (CREATE Act, 2021). RP L andscaping and Plant Services follows a calendar year reporting period. The company uges a general journal to record all its transactions. The business also maintains a general ledger for posting and for determining monthly account balances. The following lists the account balances in the books of the company as of December 31, 2024, prior to the recording and posting of the adjusting entries. Pio informed Romy that adjusting entries need to be considered to prepare the financial statements of the company. He told Romy that adjusting entries have not been recorded and that he needs to analyze the accounts further by reviewing the books of accounts. He emphasizes that adjusting entries will make it possible to report the correct amount of revenues for the period on the income statement as well as the correct amount of assets, liabilities, and partners' equity on the statement of financial position. It is therefore necessary that adjusting entries be recorded to arrive at an accurate financial position of the company as of December 31, 2024 and financial performance for the year ended December 31, 2024. Summary of Adjustments to be recorded: Accrued Income 1. Interest of P9,600 on notes receivable has accrued as of December 31,2024. Accrued Expense 2. Utility bills for the month of December has not been paid amounting to P14,500. 3. Interest of P3,000 on notes payable has accrued as of December 31, 2024. Prepaid Expense 4. Landscaping supplies consumed during the year amounted to P158,500. 5. The monthly rent for the office shop is P10,000 which was paid in advance for 2 years starting January 2, 2024 . Unearned Income 6. One half of the recorded unearned service income is considered earned as of December 31,2023 Doubtful Accounts 7. The partners approved to increase allowance for bad debts equal to 10% of the outstanding Accounts Receivable. Depreciation 8. The company uses the straight line method in recognizing depreciation for all its fixed asset accounts. Depreciation expense for the current year has not been recorded yet. Details of the depreciable assets are given below. Worksheet No. 3 - Upper left side of the worksheet, prepare the Statement of Profit or Loss for the year ended December 31, 2024. Lower left side of the same worksheet, prepare the Statement of Changes in Partners' Equity for the year ended December 31, 2024 (See above the agreement as to the distribution of profit and loss). On the right side of Worksheet No. 3, prepare using the DIRECT Method the Statement of Cash Flows for the year ended December 31, 2024. The following is the summary of cash inflows and outflows during the first year of the partnership's operation. Pio's cash withdrawal Cash balance, January 1, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts