Question: please help me ASAP and write neatly Question 3 [30 marks | 45 MINUTES) You are the accountant of Blatter Protective Wear (PTY) Limited a

please help me ASAP and write neatly

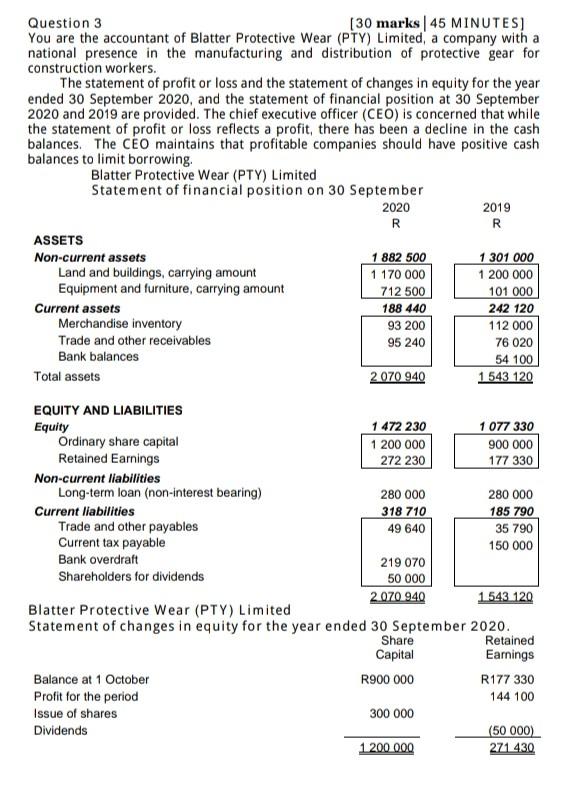

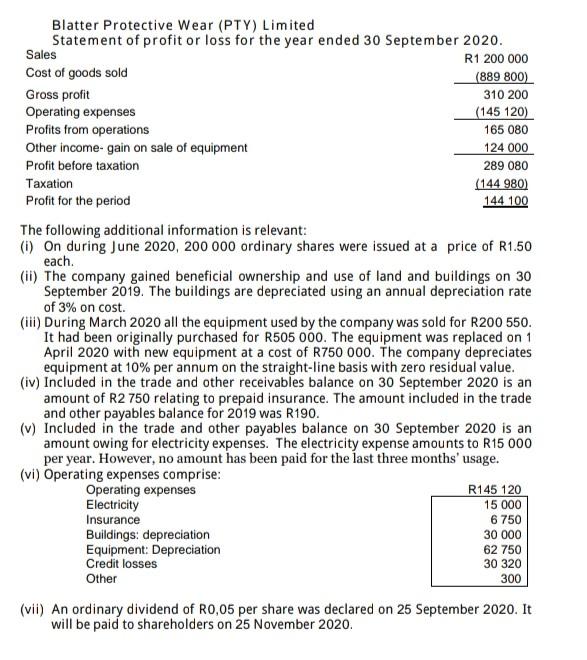

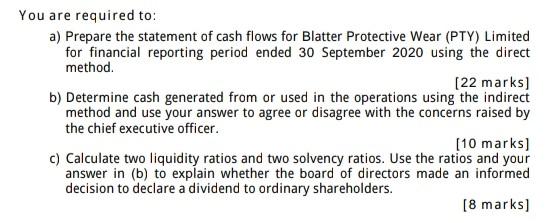

Question 3 [30 marks | 45 MINUTES) You are the accountant of Blatter Protective Wear (PTY) Limited a company with a national presence in the manufacturing and distribution of protective gear for construction workers. The statement of profit or loss and the statement of changes in equity for the year ended 30 September 2020, and the statement of financial position at 30 September 2020 and 2019 are provided. The chief executive officer (CEO) is concerned that while the statement of profit or loss reflects a profit, there has been a decline in the cash balances. The CEO maintains that profitable companies should have positive cash balances to limit borrowing. Blatter Protective Wear (PTY) Limited Statement of financial position on 30 September 2020 2019 R ASSETS Non-current assets 1 882 500 Land and buildings, carrying amount 1 170 000 1 200 000 Equipment and furniture, carrying amount 712 500 101 000 Current assets 188 440 242 120 Merchandise inventory 93 200 112 000 Trade and other receivables 95 240 76 020 Bank balances Total assets 2070 940 1 543 120 R 1 301 000 54 100 EQUITY AND LIABILITIES Equity 1 472 230 1 077 330 Ordinary share capital 1 200 000 900 000 Retained Earnings 272 230 177 330 Non-current liabilities Long-term loan (non-interest bearing) 280 000 280 000 Current liabilities 318 710 185 790 Trade and other payables 49 640 35 790 Current tax payable 150 000 Bank overdraft 219 070 Shareholders for dividends 50 000 2.070 940 1543 120 Blatter Protective Wear (PTY) Limited Statement of changes in equity for the year ended 30 September 2020. Share Retained Capital Earnings Balance at 1 October R900 000 R177 330 Profit for the period 144 100 Issue of shares 300 000 Dividends (50 000) 1 200 000 271430 Blatter Protective Wear (PTY) Limited Statement of profit or loss for the year ended 30 September 2020. Sales R1 200 000 Cost of goods sold (889 800) Gross profit 310 200 Operating expenses (145 120) Profits from operations 165 080 Other income-gain on sale of equipment 124 000 Profit before taxation 289 080 Taxation (144980) Profit for the period 144 100 The following additional information is relevant: (1) On during June 2020, 200 000 ordinary shares were issued at a price of R1.50 each. (ii) The company gained beneficial ownership and use of land and buildings on 30 September 2019. The buildings are depreciated using an annual depreciation rate of 3% on cost. (ill) During March 2020 all the equipment used by the company was sold for R200 550. It had been originally purchased for R505 000. The equipment was replaced on 1 April 2020 with new equipment at a cost of R750 000. The company depreciates equipment at 10% per annum on the straight-line basis with zero residual value. (iv) Included in the trade and other receivables balance on 30 September 2020 is an amount of R2750 relating to prepaid insurance. The amount included in the trade and other payables balance for 2019 was R190. (v) Included in the trade and other payables balance on 30 September 2020 is an amount owing for electricity expenses. The electricity expense amounts to R15 000 per year. However, no amount has been paid for the last three months' usage. (vi) Operating expenses comprise: Operating expenses R145 120 Electricity 15 000 Insurance 6 750 Buildings: depreciation 30 000 Equipment: Depreciation 62 750 Credit losses 30 320 Other (vii) An ordinary dividend of R0,05 per share was declared on 25 September 2020. It will be paid to shareholders on 25 November 2020. 300 You are required to: a) Prepare the statement of cash flows for Blatter Protective Wear (PTY) Limited for financial reporting period ended 30 September 2020 using the direct method. (22 marks] b) Determine cash generated from or used in the operations using the indirect method and use your answer to agree or disagree with the concerns raised by the chief executive officer. [10 marks) c) Calculate two liquidity ratios and two solvency ratios. Use the ratios and your answer in (b) to explain whether the board of directors made an informed decision to declare a dividend to ordinary shareholders. [8 marks) Question 3 [30 marks | 45 MINUTES) You are the accountant of Blatter Protective Wear (PTY) Limited a company with a national presence in the manufacturing and distribution of protective gear for construction workers. The statement of profit or loss and the statement of changes in equity for the year ended 30 September 2020, and the statement of financial position at 30 September 2020 and 2019 are provided. The chief executive officer (CEO) is concerned that while the statement of profit or loss reflects a profit, there has been a decline in the cash balances. The CEO maintains that profitable companies should have positive cash balances to limit borrowing. Blatter Protective Wear (PTY) Limited Statement of financial position on 30 September 2020 2019 R ASSETS Non-current assets 1 882 500 Land and buildings, carrying amount 1 170 000 1 200 000 Equipment and furniture, carrying amount 712 500 101 000 Current assets 188 440 242 120 Merchandise inventory 93 200 112 000 Trade and other receivables 95 240 76 020 Bank balances Total assets 2070 940 1 543 120 R 1 301 000 54 100 EQUITY AND LIABILITIES Equity 1 472 230 1 077 330 Ordinary share capital 1 200 000 900 000 Retained Earnings 272 230 177 330 Non-current liabilities Long-term loan (non-interest bearing) 280 000 280 000 Current liabilities 318 710 185 790 Trade and other payables 49 640 35 790 Current tax payable 150 000 Bank overdraft 219 070 Shareholders for dividends 50 000 2.070 940 1543 120 Blatter Protective Wear (PTY) Limited Statement of changes in equity for the year ended 30 September 2020. Share Retained Capital Earnings Balance at 1 October R900 000 R177 330 Profit for the period 144 100 Issue of shares 300 000 Dividends (50 000) 1 200 000 271430 Blatter Protective Wear (PTY) Limited Statement of profit or loss for the year ended 30 September 2020. Sales R1 200 000 Cost of goods sold (889 800) Gross profit 310 200 Operating expenses (145 120) Profits from operations 165 080 Other income-gain on sale of equipment 124 000 Profit before taxation 289 080 Taxation (144980) Profit for the period 144 100 The following additional information is relevant: (1) On during June 2020, 200 000 ordinary shares were issued at a price of R1.50 each. (ii) The company gained beneficial ownership and use of land and buildings on 30 September 2019. The buildings are depreciated using an annual depreciation rate of 3% on cost. (ill) During March 2020 all the equipment used by the company was sold for R200 550. It had been originally purchased for R505 000. The equipment was replaced on 1 April 2020 with new equipment at a cost of R750 000. The company depreciates equipment at 10% per annum on the straight-line basis with zero residual value. (iv) Included in the trade and other receivables balance on 30 September 2020 is an amount of R2750 relating to prepaid insurance. The amount included in the trade and other payables balance for 2019 was R190. (v) Included in the trade and other payables balance on 30 September 2020 is an amount owing for electricity expenses. The electricity expense amounts to R15 000 per year. However, no amount has been paid for the last three months' usage. (vi) Operating expenses comprise: Operating expenses R145 120 Electricity 15 000 Insurance 6 750 Buildings: depreciation 30 000 Equipment: Depreciation 62 750 Credit losses 30 320 Other (vii) An ordinary dividend of R0,05 per share was declared on 25 September 2020. It will be paid to shareholders on 25 November 2020. 300 You are required to: a) Prepare the statement of cash flows for Blatter Protective Wear (PTY) Limited for financial reporting period ended 30 September 2020 using the direct method. (22 marks] b) Determine cash generated from or used in the operations using the indirect method and use your answer to agree or disagree with the concerns raised by the chief executive officer. [10 marks) c) Calculate two liquidity ratios and two solvency ratios. Use the ratios and your answer in (b) to explain whether the board of directors made an informed decision to declare a dividend to ordinary shareholders. [8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts