Question: Please create an excel file showing the formulas for each cell which consitutes part of the solution. Note that you have to show the formulas

Note that you have to show the formulas where there is a computation involved. You cannot merely copy the numbers on the pdf file.

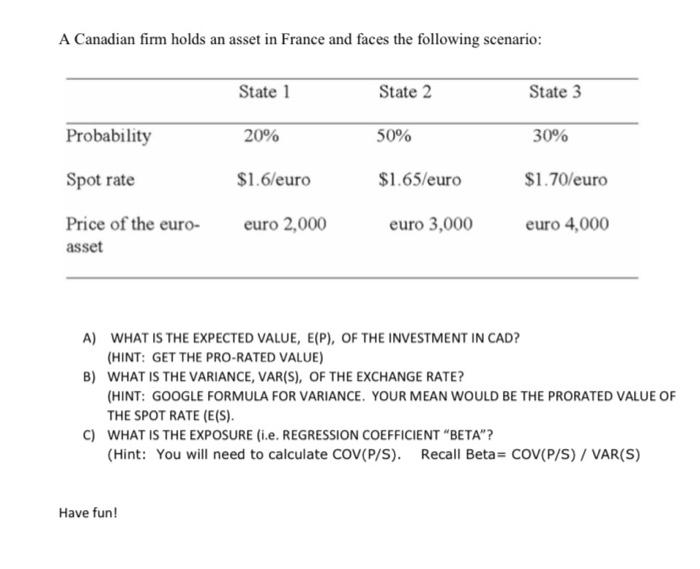

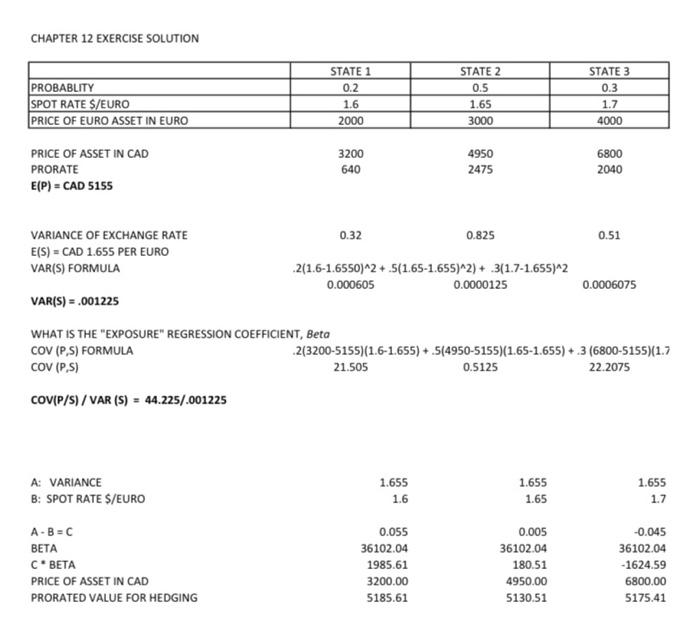

A Canadian firm holds an asset in France and faces the following scenario: State 1 State 2 State 3 Probability 20% 50% 30% Spot rate $1.6/euro $1.65/euro $1.70/euro Price of the euro- asset euro 2,000 euro 3,000 euro 4,000 A) WHAT IS THE EXPECTED VALUE, E(P), OF THE INVESTMENT IN CAD? (HINT: GET THE PRO-RATED VALUE) B) WHAT IS THE VARIANCE, VAR(S), OF THE EXCHANGE RATE? (HINT: GOOGLE FORMULA FOR VARIANCE. YOUR MEAN WOULD BE THE PRORATED VALUE OF THE SPOT RATE (E(S). C) WHAT IS THE EXPOSURE (i.e. REGRESSION COEFFICIENT "BETA"? (Hint: You will need to calculate COV(P/S). Recall Beta= COV(P/S) / VAR(S) Have fun! CHAPTER 12 EXERCISE SOLUTION PROBABLITY SPOT RATE S/EURO PRICE OF EURO ASSET IN EURO STATE 1 0.2 1.6 2000 STATE 2 0.5 1.65 3000 STATE 3 0.3 1.7 4000 PRICE OF ASSET IN CAD PRORATE E(P) = CAD 5155 3200 640 4950 2475 6800 2040 0.32 0.825 0.51 VARIANCE OF EXCHANGE RATE E(S) = CAD 1.655 PER EURO VAR(S) FORMULA 2(1.6-1.6550)^2 + 5(1.65-1.655)^2)+ 3(1.7-1.655)^2 0.000605 0.0000125 0.0006075 VAR(S) = .001225 WHAT IS THE "EXPOSURE" REGRESSION COEFFICIENT, Beta COV (P.S) FORMULA 2(3200-5155)(1.6-1.655) + 5(4950-5155)1.65-1.655) + 3 (6800-5155)1.7 COV (P.S) 21.505 0.5125 22.2075 COVIP/S) /VAR (S) = 44.225/.001225 A: VARIANCE B: SPOT RATE S/EURO 1.655 1.6 1.655 1.65 1.655 1.7 A-B-C BETA c PRICE OF ASSET IN CAD PRORATED VALUE FOR HEDGING 0.055 36102.04 1985.61 3200.00 5185.61 0.005 36102.04 180.51 4950.00 5130.51 -0.045 36102.04 - 1624.59 6800.00 5175.41 5155 1.655 0.001225 -1.655) 44.225 36,102.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts