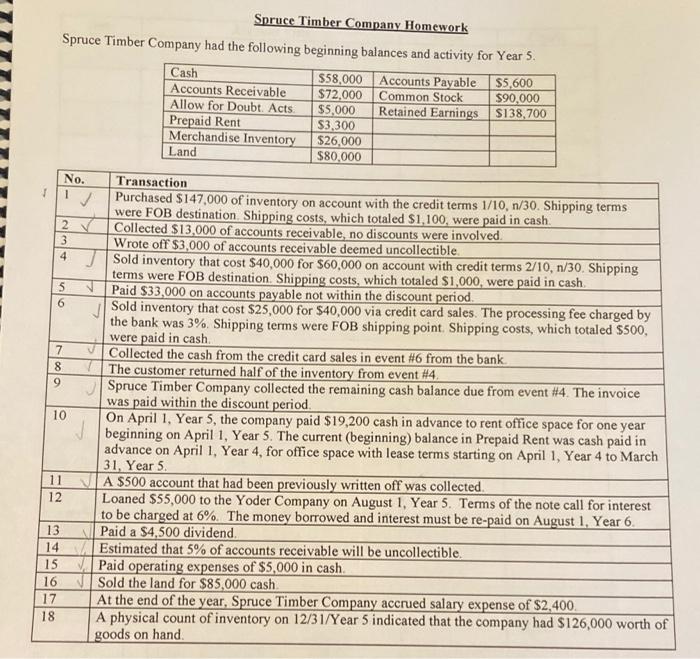

Question: please create an income statement, statement of stockholders equity, statement of cashflow, and balance sheet Spruce Timber Company Homework Spruce Timber Company had the following

Spruce Timber Company Homework Spruce Timber Company had the following beginning balances and activity for Year 5. Cash $58,000 Accounts Payable $5,600 Accounts Receivable $72,000 Common Stock $90,000 Allow for Doubt. Acts $5,000 Retained Earnings $138,700 Prepaid Rent $3,300 Merchandise Inventory $26,000 Land $80,000 6 7 9 No. Transaction 1 Purchased $147,000 of inventory on account with the credit terms 1/10, n/30. Shipping terms were FOB destination Shipping costs, which totaled $1,100, were paid in cash. 2 Collected $13,000 of accounts receivable, no discounts were involved. 3 Wrote off $3,000 of accounts receivable deemed uncollectible. 4 Sold inventory that cost $40,000 for $60,000 on account with credit terms 2/10, n/30. Shipping terms were FOB destination. Shipping costs, which totaled $1,000, were paid in cash 5 Paid $33,000 on accounts payable not within the discount period Sold inventory that cost $25,000 for $40,000 via credit card sales. The processing fee charged by the bank was 3% Shipping terms were FOB shipping point Shipping costs, which totaled $500, v were paid in cash Collected the cash from the credit card sales in event #6 from the bank 8 The customer returned half of the inventory from event #4 Spruce Timber Company collected the remaining cash balance due from event #4. The invoice was paid within the discount period On April 1, Year 5, the company paid $19,200 cash in advance to rent office space for one year beginning on April 1, Year 5. The current (beginning) balance in Prepaid Rent was cash paid in advance on April 1, Year 4, for office space with lease terms starting on April 1, Year 4 to March 31, Year 5. 11 VIA $500 account that had been previously written off was collected Loaned $55,000 to the Yoder Company on August 1, Year 5. Terms of the note call for interest to be charged at 6%. The money borrowed and interest must be re-paid on August 1, Year 6. 13 Paid a $4,500 dividend. 14 WA Estimated that 5% of accounts receivable will be uncollectible. 15 Paid operating expenses of $5,000 in cash 16 Sold the land for $85,000 cash 17 At the end of the year, Spruce Timber Company accrued salary expense of $2,400. 18 A physical count of inventory on 12/31/Year 5 indicated that the company had $126,000 worth of goods on hand 10 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts