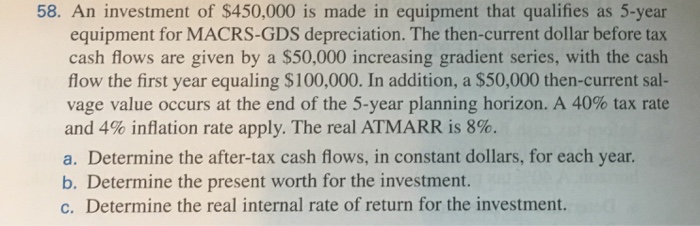

Question: Please demonstrate how to work the problem without using excel, Thank you 58. An investment of $450,000 is made in equipment that qualifies as 5-year

58. An investment of $450,000 is made in equipment that qualifies as 5-year equipment for MACRS-GDS depreciation. The then-current dollar before tax cash flows are given by a $50,000 increasing gradient series, with the cash flow the first year equaling $100,000. In addition, a $50,000 then-current sal- vage value occurs at the end of the 5-year planning horizon. A 40% tax rate and 4% inflation rate apply. The real ATMARR is 8%. a. Determine the after-tax cash flows, in constant dollars, for each year b. Determine the present worth for the investment. c. Determine the real internal rate of return for the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts