Question: Please demonstrate the steps / calculation taken t o inquire the answer. To finance construction of the building, a $ 6 1 2 , 0

Please demonstrate the stepscalculation taken t o inquire the answer.

To finance construction of the building, a $ construction loan was taken out on February At the beginning of the

project, Blossom invested the portion of the construction loan that was not yet expended and earned investment income of $

The loan was repaid on November when the construction was completed. The firm had $ of other outstanding debt during

the year at a borrowing rate of and a $ loan payable outstanding at a borrowing rate of

What was the effective interest rate used in negotiating the note payable used to acquire the machinery in Asset Use Excel or a

financial calculator to arrive at your answer. Round final answer to decimal places, eg

Effective interest rate

eTextbook and Media

Assistance Used

List of Accounts

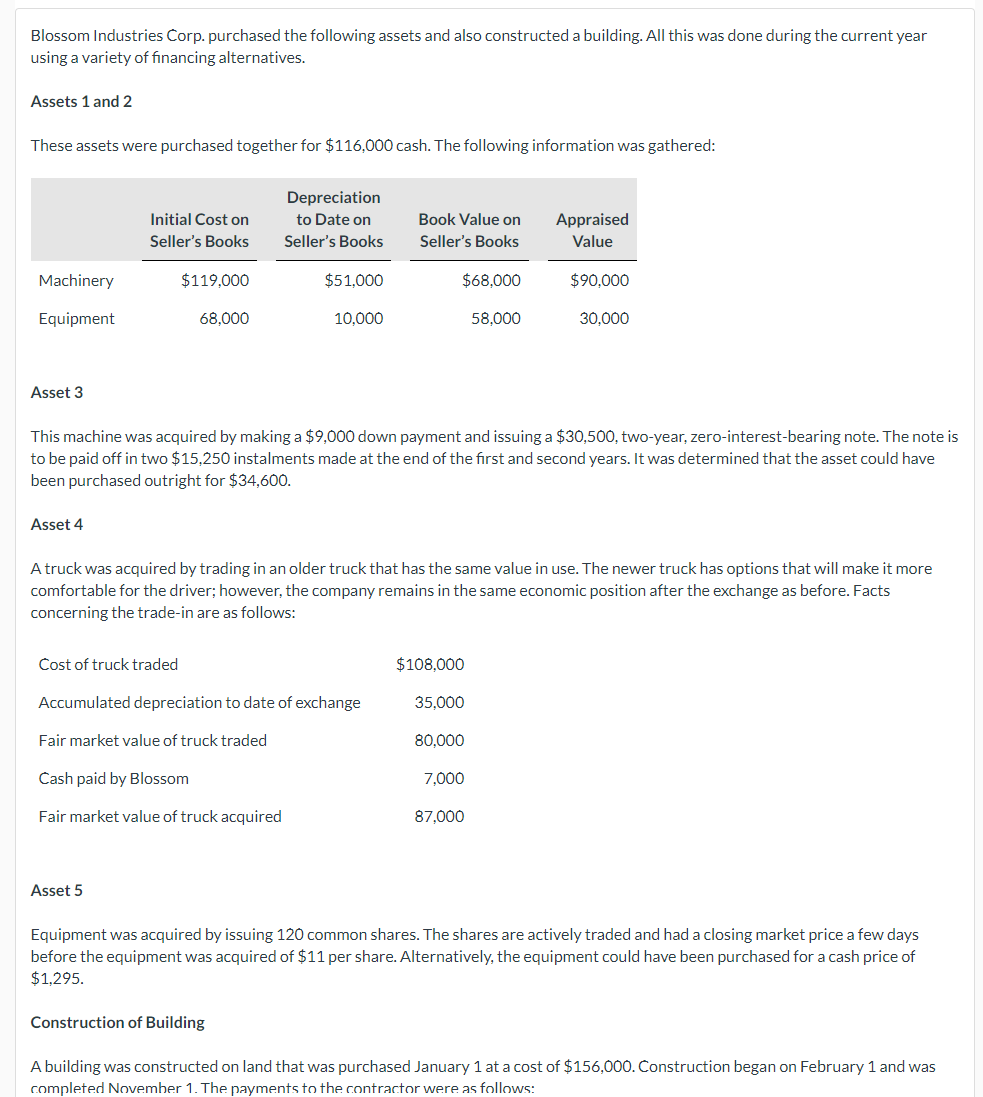

Attempts: of used Blossom Industries Corp. purchased the following assets and also constructed a building. All this was done during the current year

using a variety of financing alternatives.

Assets and

These assets were purchased together for $ cash. The following information was gathered:

Asset

This machine was acquired by making a $ down payment and issuing a $ twoyear, zerointerestbearing note. The note is

to be paid off in two $ instalments made at the end of the first and second years. It was determined that the asset could have

been purchased outright for $

Asset

A truck was acquired by trading in an older truck that has the same value in use. The newer truck has options that will make it more

comfortable for the driver; however, the company remains in the same economic position after the exchange as before. Facts

concerning the tradein are as follows:

Cost of truck traded

Accumulated depreciation to date of exchange

Fair market value of truck traded

Cash paid by Blossom

Fair market value of truck acquired

$

Asset

Equipment was acquired by issuing common shares. The shares are actively traded and had a closing market price a few days

before the equipment was acquired of $ per share. Alternatively, the equipment could have been purchased for a cash price of

$

Construction of Building

A building was constructed on land that was purchased January at a cost of $ Construction began on February and was

rompleted November The payments to the rontractor were as follows:MENTOON LIBRARY LE NING COMMUNS ALD DIGGING DEEPER FINANCE CHAPTER IO ad bonust Property, Plant, and Equipment: Accounting Model Basics c From the perspective of a potential investor, what are the financial statement effects of capitalizing borrowing costs related to qualifying assets? LO EAsset Acquisition Hayes Industries Corp. purchased the following assets and also constructed a building. All this was done during the current year using a variety of financing alternatives. Srp dar d What effects, if any, will the recording of purchases to an incorrect account land building, machinery, or any other property, plant, and equipment asset have on the financial statements? Provide an example.or Jepanuods Asset Assets and soud snorkes you to beszil These assets were purchased together for $ cash. The following information was gathered: Description Machinery Office Equipment DOAR er ODE.I UND anco vanidosm Initial Cost on Seller's Book

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock