Question: Please determine Pete's depreciation deduction (without $179 expensing or first year additional depreciation). Pete acquired the following new assets during the year: A breeding hog

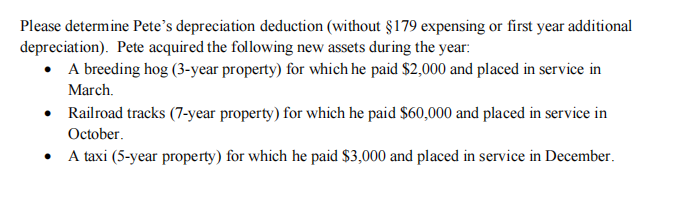

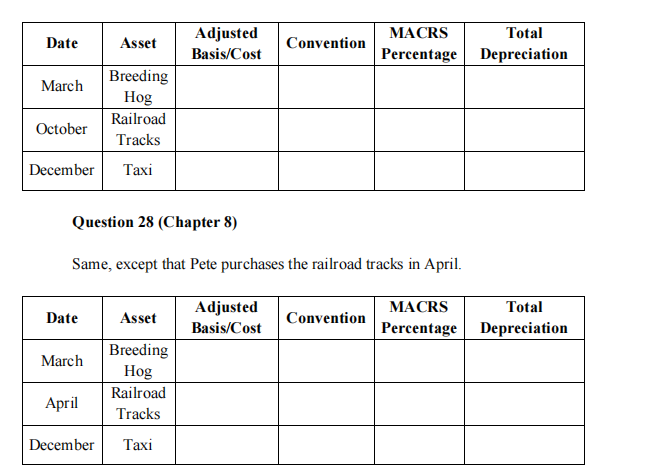

Please determine Pete's depreciation deduction (without $179 expensing or first year additional depreciation). Pete acquired the following new assets during the year: A breeding hog (3-year property) for which he paid $2,000 and placed in service in March Railroad tracks (7-year property) for which he paid $60,000 and placed in service in October A taxi (5-year property) for which he paid $3,000 and placed in service in December. Date Asset Adjusted Basis/Cost Convention MACRS Total Percentage Depreciation March October Breeding Hog Railroad Tracks Taxi December Question 28 (Chapter 8) Same, except that Pete purchases the railroad tracks in April. Date Asset Adjusted Basis/Cost Convention MACRS Total Percentage Depreciation March Breeding Hog Railroad Tracks April December Taxi Please determine Pete's depreciation deduction (without $179 expensing or first year additional depreciation). Pete acquired the following new assets during the year: A breeding hog (3-year property) for which he paid $2,000 and placed in service in March Railroad tracks (7-year property) for which he paid $60,000 and placed in service in October A taxi (5-year property) for which he paid $3,000 and placed in service in December. Date Asset Adjusted Basis/Cost Convention MACRS Total Percentage Depreciation March October Breeding Hog Railroad Tracks Taxi December Question 28 (Chapter 8) Same, except that Pete purchases the railroad tracks in April. Date Asset Adjusted Basis/Cost Convention MACRS Total Percentage Depreciation March Breeding Hog Railroad Tracks April December Taxi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts