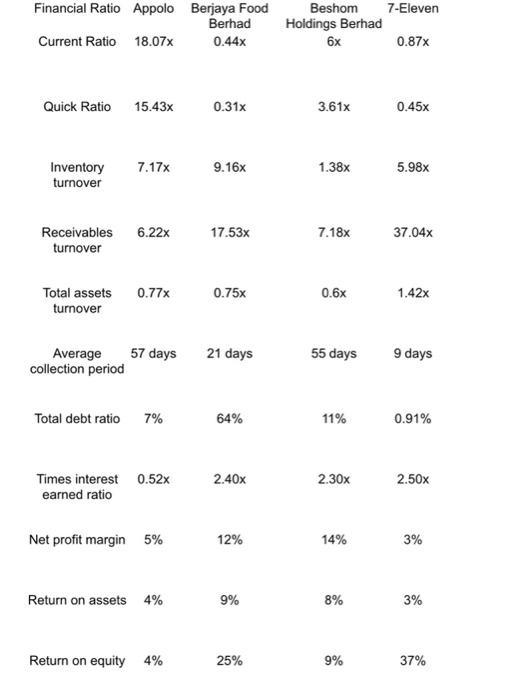

Question: please determine the performance for 4 company as given either its good or bad. privide the interpret for the 4 company too. thanks FinancialRatioCurrentRatioAppolo18.07xBerjayaFoodBerhad0.44xBeshomHoldingsBerhad6x7-Eleven0.87x QuickRatio15.43x0.31x3.61x0.45x

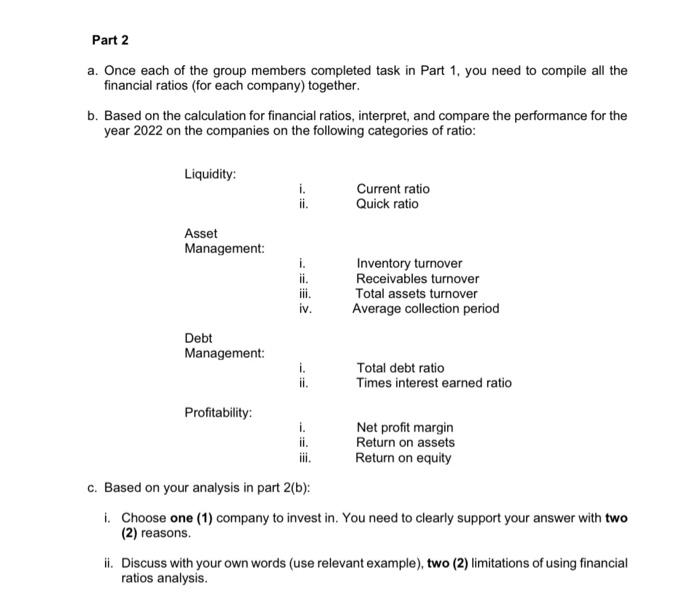

FinancialRatioCurrentRatioAppolo18.07xBerjayaFoodBerhad0.44xBeshomHoldingsBerhad6x7-Eleven0.87x QuickRatio15.43x0.31x3.61x0.45x Inventory7.17x9.16x1.38x5.98x turnover Receivables6.22x17.53x7.18x37.04x turnover Totalassets0.77x0.75x0.6x1.42x turnover collection period Totaldebtratio7%64%11%0.91% Timesinterest0.52x2.40x2.30x2.50x earned ratio 12% 14% 3% Return on assets 4%8%8%3% Returnonequity4%25%9%37% a. Once each of the group members completed task in Part 1, you need to compile all the financial ratios (for each company) together. b. Based on the calculation for financial ratios, interpret, and compare the performance for the year 2022 on the companies on the following categories of ratio: c. Based on your analysis in part 2(b): i. Choose one (1) company to invest in. You need to clearly support your answer with two (2) reasons. ii. Discuss with your own words (use relevant example), two (2) limitations of using financial ratios analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts