Question: please do 1.3 Consider two risky assets with prices S.(0) = 100, S2(0) = 200. Assume that in the future we can have the following

please do 1.3

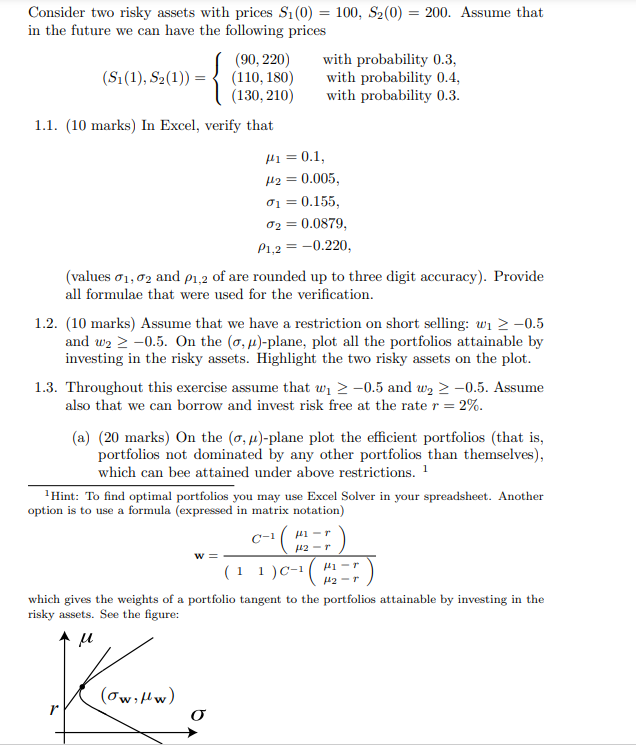

Consider two risky assets with prices S.(0) = 100, S2(0) = 200. Assume that in the future we can have the following prices (90,220) with probability 0.3, (S.(1), S2(1)) = {(110,180) with probability 0.4, (130,210) with probability 0.3. 1.1. (10 marks) In Excel, verify that Mi = 0.1, H2 = 0.005, 01 = 0.155, 02 = 0.0879, P1.2 = -0.220, (values 01, 02 and p1,2 of are rounded up to three digit accuracy). Provide all formulae that were used for the verification. 1.2. (10 marks) Assume that we have a restriction on short selling: w1 > -0.5 and W2 > -0.5. On the (0,2)-plane, plot all the portfolios attainable by investing in the risky assets. Highlight the two risky assets on the plot. 1.3. Throughout this exercise assume that w > -0.5 and w, > -0.5. Assume also that we can borrow and invest risk free at the rate r = 2%. (a) (20 marks) On the (0,4)-plane plot the efficient portfolios (that is, portfolios not dominated by any other portfolios than themselves), which can bee attained under above restrictions. 1 Hint: To find optimal portfolios you may use Excel Solver in your spreadsheet. Another option is to use a formula (expressed in matrix notation) W= HI-T H2-T Hi-T H2-T (11)C-( which gives the weights of a portfolio tangent to the portfolios attainable by investing in the risky assets. See the figure: u Ka (Owillw) o Consider two risky assets with prices S.(0) = 100, S2(0) = 200. Assume that in the future we can have the following prices (90,220) with probability 0.3, (S.(1), S2(1)) = {(110,180) with probability 0.4, (130,210) with probability 0.3. 1.1. (10 marks) In Excel, verify that Mi = 0.1, H2 = 0.005, 01 = 0.155, 02 = 0.0879, P1.2 = -0.220, (values 01, 02 and p1,2 of are rounded up to three digit accuracy). Provide all formulae that were used for the verification. 1.2. (10 marks) Assume that we have a restriction on short selling: w1 > -0.5 and W2 > -0.5. On the (0,2)-plane, plot all the portfolios attainable by investing in the risky assets. Highlight the two risky assets on the plot. 1.3. Throughout this exercise assume that w > -0.5 and w, > -0.5. Assume also that we can borrow and invest risk free at the rate r = 2%. (a) (20 marks) On the (0,4)-plane plot the efficient portfolios (that is, portfolios not dominated by any other portfolios than themselves), which can bee attained under above restrictions. 1 Hint: To find optimal portfolios you may use Excel Solver in your spreadsheet. Another option is to use a formula (expressed in matrix notation) W= HI-T H2-T Hi-T H2-T (11)C-( which gives the weights of a portfolio tangent to the portfolios attainable by investing in the risky assets. See the figure: u Ka (Owillw) o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts