Question: Please do 7-76 and 7-78 tables. Please do both questions and show all the formulas used. Thanks 7-76 If the minimum attractive rate of return

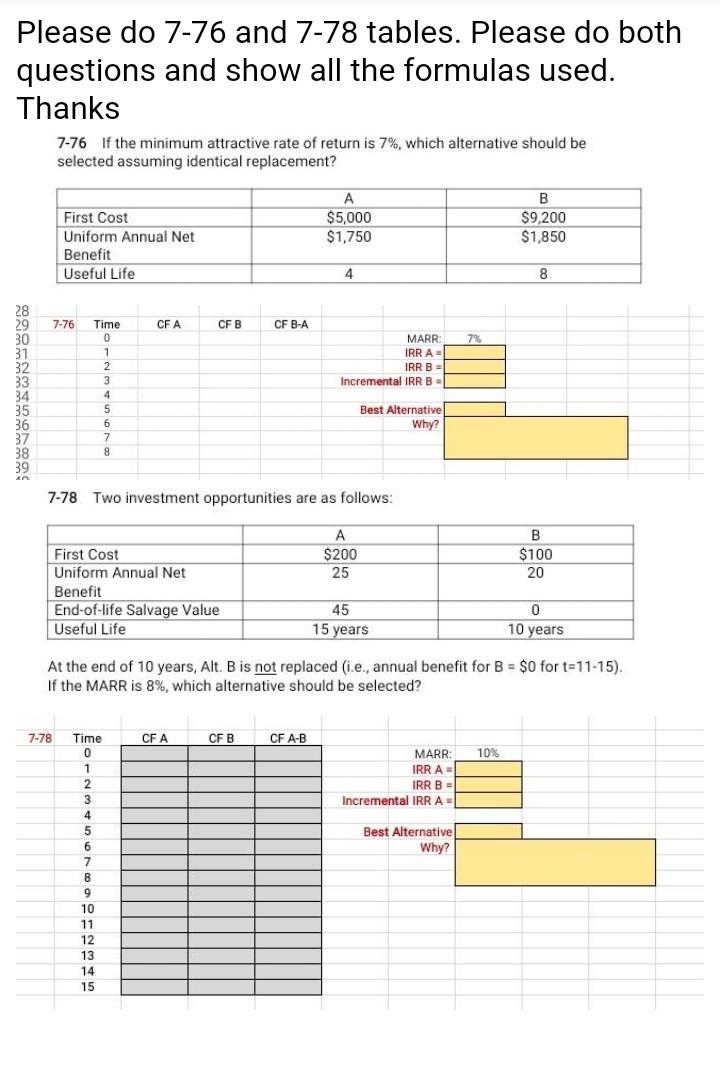

Please do 7-76 and 7-78 tables. Please do both questions and show all the formulas used. Thanks 7-76 If the minimum attractive rate of return is 7%, which alternative should be selected assuming identical replacement? A $5,000 $1,750 First Cost Uniform Annual Net Benefit Useful Life B $9,200 $1,850 4 8 7-76 CFA CFB CF B-A 78 28 29 30 31 32 33 34 35 36 37 38 39 Time 0 1 2 3 4 5 6 7 8 MARR IRRA IRR B = Incremental IRR B- Best Alternative Why? 7-78 Two investment opportunities are as follows: A $200 25 B $100 20 First Cost Uniform Annual Net Benefit End-of-life Salvage Value Useful Life 45 15 years 0 10 years At the end of 10 years, Alt. B is not replaced (i e., annual benefit for B = $0 for t=11-15). If the MARR is 8%, which alternative should be selected? 7-78 CFA CFB CF A-B 10% MARR: IRRA IRR BEI Incremental IRRA Best Alternative Why? Time 0 1 2 3 4 5 6 6 7 8 9 10 11 12 13 14 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts