Question: Please do a 10 year cash flow analysis for a single tenant office building. Assumptions are listed below and a template is provided. Assumptions: 60,000sf

Please do a 10 year cash flow analysis for a single tenant office building. Assumptions are listed below and a template is provided.

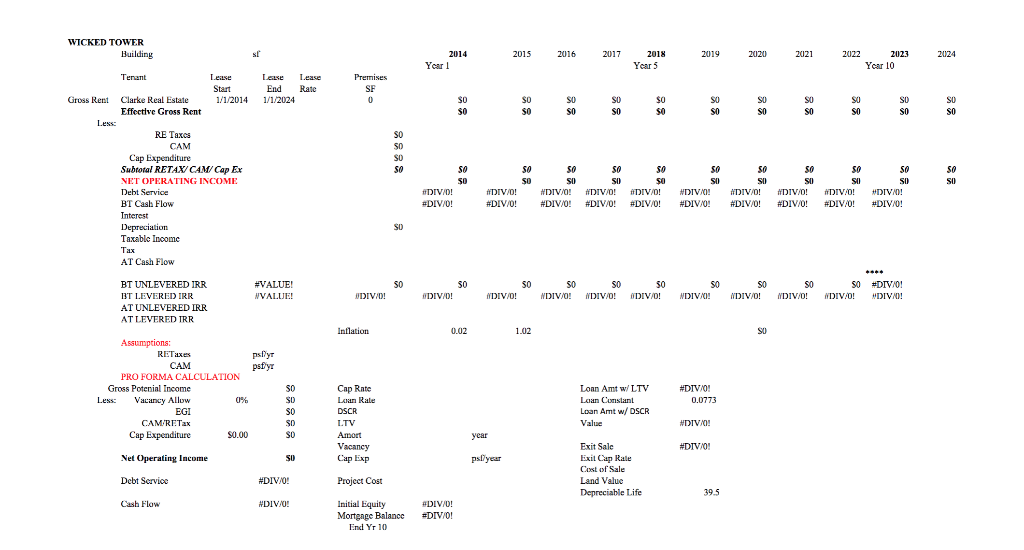

Assumptions: 60,000sf building, Rent $10.50psf; RETax $1.65psf; CAM $3psf; Going in cap: 8%; Exit Cap: 8.5%; Cost of Sales: 3%; LTV: 75%; Loan- 6%, 25 yr amort; DSCR: 1.2 Vacancy allowance: 3% (apply only to the proforma, not the 10 year cash flow), Cap Exp Reserve: $.10 psf (apply both to proforma and cash flow); Project Cost: $4.3M; Land: $300K; Use first year Gross Income to do the proforma and then to calculate loan.

Using above and the template, please calculate the: BT Unlevered IRR and the BT Levered IRR.

Please provide formulas for excel

WICKED TOWER Building st 2015 2016 2017 2019 2020 2021 2022 2024 2014 Year! 2018 Year 3 2023 Year 10 Lease Rate End 1/1/2024 Premises SF 0 SO SO SO SO SU SO SO SO $0 SO SU SO SU SO SU SO SO SO SO SO SU SO Tenant Lease Start Gross Rent Clarke Real Estate 1/1/2014 Effective Gross Rent Less: RE Taxes CAM Cap Expenditure Subtotal RETAX/CAM/ Cap Ex NET OPERATING INCOME Debt Service BT Cash Flow Interest Depreciation Taxable Income Tax AT Cash Flow SO SO SO so so so SO SO so SO so SU #DIV/0! #DIV/0! so so SO $0 #DIV/0! #DIV/0! ! #DIV/0! #DIV/0! SO sa SU #DIV/ #DIV/0! #DIV/0! 0 #DIV/0! so SO #DIV/0! #DIV/0! so SO #DIV/0! #DIV/0! so su #DIV/0! #DIV/0! SO SO #DIVAO! ! #DIV/0! #DIV/0! #DIV/0! SO .. SO SO #VALUE! NVALUE! SO DIV/0! SO NDIV/0! SO NDIV/0! SO ODIV/0! SO NDIVANI SO NDIV/0! SO NDIV/0! so #DIV/0! DIV/0! WDIVAO! 0! DIVADI DIV/0! BT UNLEVERED IRR II'T LEVERED IRR AT UNLEVERED IRR AT LEVERED IRR inflation Inflation 0.02 1.02 SU Assumptions: RETaxes psily CAM psfy PRO FORMA CALCULATION Gross Potenial Income Less Vacancy Allow 0% EGI CAMRETax Cap Expenditure S0.00 #DIV/0! 0.0773 SO SO SO SO SO Cap Rate Lean Race DSCR LTV Amort Vacancy Cap Exp Loan Amt w/LTV Luan Constant Loan Amt w/ DSCR Value NDIV/0! year #DIV/0! Net Operating Income SO psllyear Exit Sale Exit Cup Hale Cost of Sale Land Value Depreciable Life Debt Service #DIV/0! Project Cost 39.5 Cash Flow #DIV/0! Initial Equity Mortgnge Balance End Yr 10 #DIV/0! #DIV/0! WICKED TOWER Building st 2015 2016 2017 2019 2020 2021 2022 2024 2014 Year! 2018 Year 3 2023 Year 10 Lease Rate End 1/1/2024 Premises SF 0 SO SO SO SO SU SO SO SO $0 SO SU SO SU SO SU SO SO SO SO SO SU SO Tenant Lease Start Gross Rent Clarke Real Estate 1/1/2014 Effective Gross Rent Less: RE Taxes CAM Cap Expenditure Subtotal RETAX/CAM/ Cap Ex NET OPERATING INCOME Debt Service BT Cash Flow Interest Depreciation Taxable Income Tax AT Cash Flow SO SO SO so so so SO SO so SO so SU #DIV/0! #DIV/0! so so SO $0 #DIV/0! #DIV/0! ! #DIV/0! #DIV/0! SO sa SU #DIV/ #DIV/0! #DIV/0! 0 #DIV/0! so SO #DIV/0! #DIV/0! so SO #DIV/0! #DIV/0! so su #DIV/0! #DIV/0! SO SO #DIVAO! ! #DIV/0! #DIV/0! #DIV/0! SO .. SO SO #VALUE! NVALUE! SO DIV/0! SO NDIV/0! SO NDIV/0! SO ODIV/0! SO NDIVANI SO NDIV/0! SO NDIV/0! so #DIV/0! DIV/0! WDIVAO! 0! DIVADI DIV/0! BT UNLEVERED IRR II'T LEVERED IRR AT UNLEVERED IRR AT LEVERED IRR inflation Inflation 0.02 1.02 SU Assumptions: RETaxes psily CAM psfy PRO FORMA CALCULATION Gross Potenial Income Less Vacancy Allow 0% EGI CAMRETax Cap Expenditure S0.00 #DIV/0! 0.0773 SO SO SO SO SO Cap Rate Lean Race DSCR LTV Amort Vacancy Cap Exp Loan Amt w/LTV Luan Constant Loan Amt w/ DSCR Value NDIV/0! year #DIV/0! Net Operating Income SO psllyear Exit Sale Exit Cup Hale Cost of Sale Land Value Depreciable Life Debt Service #DIV/0! Project Cost 39.5 Cash Flow #DIV/0! Initial Equity Mortgnge Balance End Yr 10 #DIV/0! #DIV/0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts