Question: Please do A and B P11-27 (similar to) Question Help A hedge fund has created a portfolio using just two stocks. It has shorted $44,000,000

Please do A and B

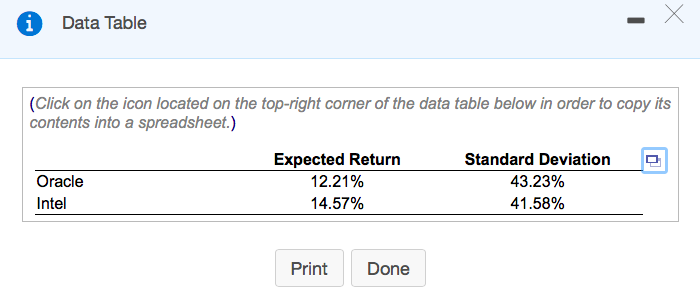

P11-27 (similar to) Question Help A hedge fund has created a portfolio using just two stocks. It has shorted $44,000,000 worth of Oracle stock and has purchased $72,000,000 of Intel stock. The correlation between Oracle's and Intel's returns is 0.65. The expected returns and standard deviations of the two stocks are given in the table below: a. What is the expected return of the hedge fund's portfolio? b. What is the standard deviation of the hedge fund's portfolio? 1 Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Expected Return 12.21% 14.57% Standard Deviation 43.23% 41.58% Oracle Intel Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts