Question: please do a-d P15-7A On January 1, 2017, Alberta Hydro Ltd. issued bonds with a maturity value of $8 million when the market rate of

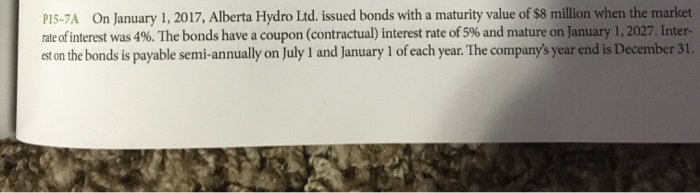

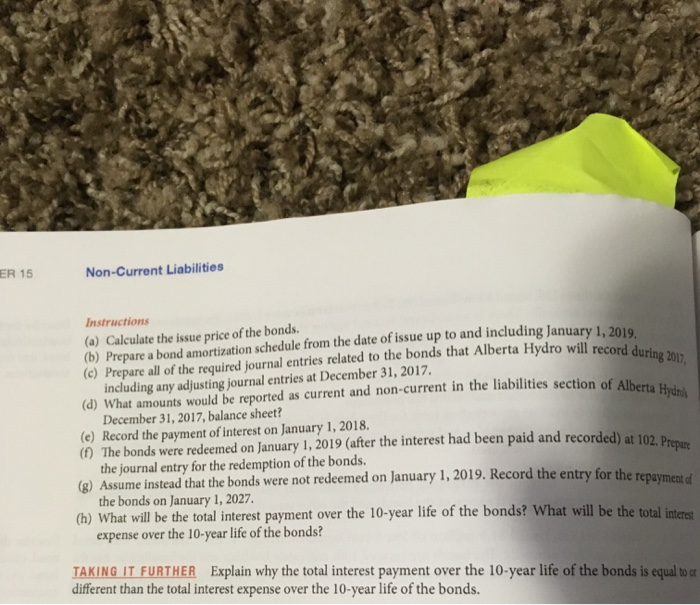

P15-7A On January 1, 2017, Alberta Hydro Ltd. issued bonds with a maturity value of $8 million when the market rate of interest was 4%. The bonds have a coupon (contractual) interest rate of 5% and mature on January 1, 2027. Inter- est on the bonds is payable semi-annually on July 1 and January 1 of each year. The company's year end is December 31. ER 15 Non-Current Liabilities ta Hydro will record during 2017, ilities section of Alberta Hydrk Instructions (a) Calculate the issue price of the bonds. (b) Prepare a bond amortization schedule from the date of issue up to and including January 1, 2016 (c) Prepare all of the required journal entries related to the bonds that Alberta Hydro will rece including any adjusting journal entries at December 31, 2017 (d) What amounts would be reported as current and non-current in the liabilities section of Albe December 31, 2017, balance sheet? (e) Record the payment of interest on January 1, 2018. (f) The bonds were redeemed on January 1, 2019 (after the interest had been paid and recorded) at 102 the journal entry for the redemption of the bonds. (8) Assume instead that the bonds were not redeemed on January 1, 2019. Record the entry for the renam the bonds on January 1, 2027. (h) What will be the total interest payment over the 10-year life of the bonds? What will be the total expense over the 10-year life of the bonds? ecorded) at 102. Prepare TAKING IT FURTHER Explain why the total interest payment over the 10-year life of the bonds is equal to different than the total interest expense over the 10-year life of the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts