Question: Please help to answer the following question. Thank you! IT IS MENTIONED AT BOTTOM FOR QUESTION 3. Please take a look before commenting. On January

Please help to answer the following question. Thank you! IT IS MENTIONED AT BOTTOM FOR QUESTION 3. Please take a look before commenting.

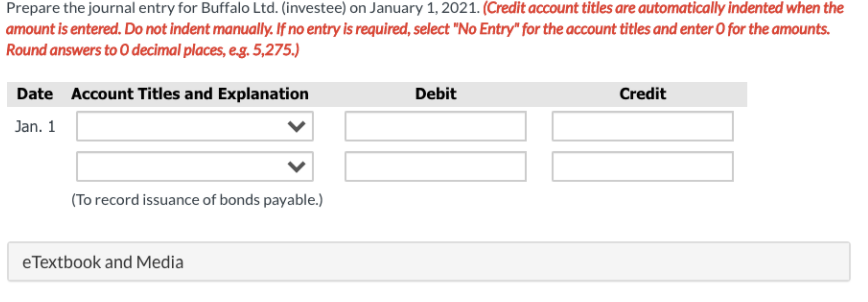

On January 1, 2021. Sweet Acacia Ltd, issued bonds with a maturity value of $5.00 million for $4.786.500, when the market rate of interest was 6%. The bonds have a contractual interest rate of 5% and mature on January 1. 2026, Interest on the bonds is payable semi-annually on Juty 1 and January 1 of each year. On January 1, 2021, Wildhorse Company: a public company, purchased Swee Acacia Ltd. bonds with a maturity value of $1.00 million to earn interest. On December 31, 2021. the bonds were trading at 98. Both companies year end december 31. prepare the journal entry for sweet acacia ltd to record the payment of interest on july 1 2021.

It's supposed to say entry for Sweet Acacai, I do not know why it says Buffalo LTD in that question alone.

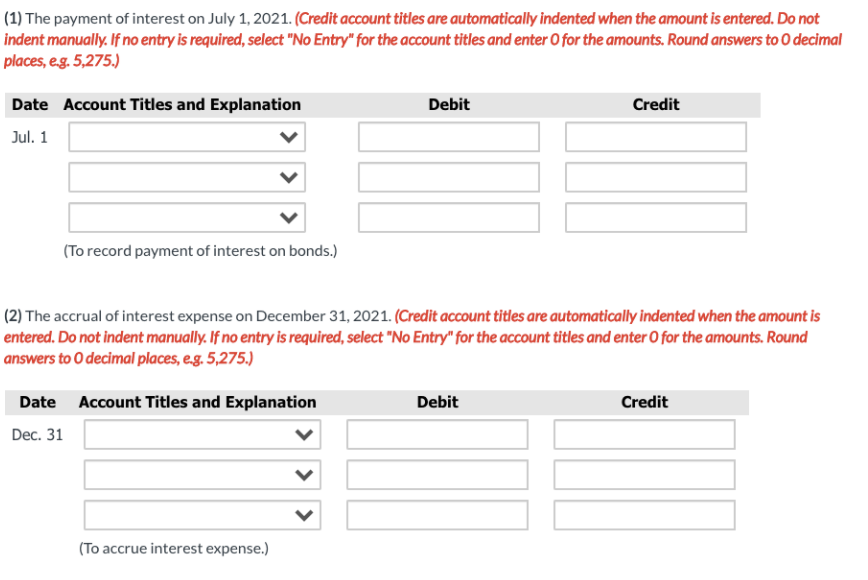

(1) The payment of interest on July 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to O decimal places, eg. 5,275.) Debit Credit Date Account Titles and Explanation Jul. 1 (To record payment of interest on bonds.) (2) The accrual of interest expense on December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to decimal places, e.g. 5,275.) Debit Credit Date Account Titles and Explanation Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts