Question: Please do adjusting entries. Part 1 (70 points] Apex Consulting Corp. is a small computer consulting business. The company is organized as a corporation and

![Please do adjusting entries. Part 1 (70 points] Apex Consulting Corp. is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671794bf43658_654671794bed6604.jpg)

Please do adjusting entries.

Please do adjusting entries.

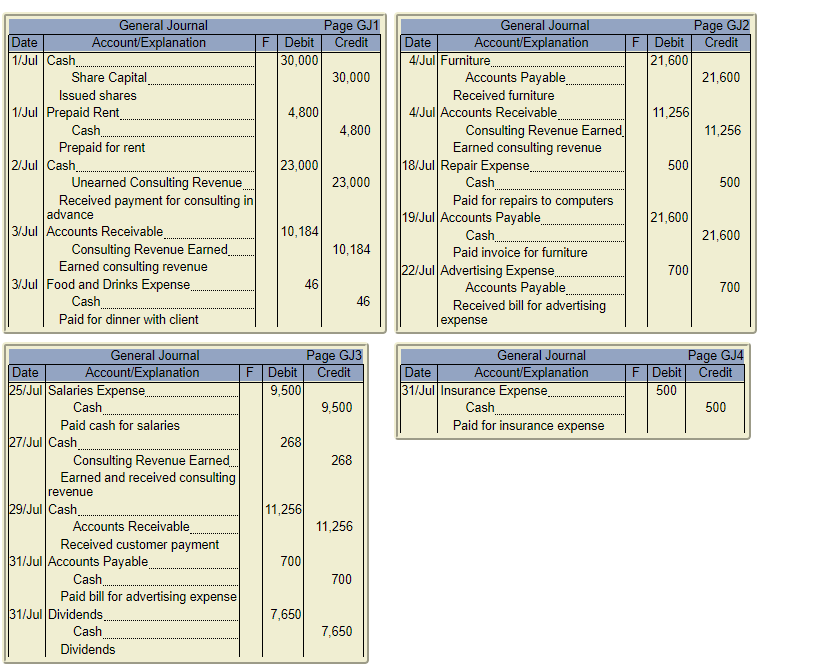

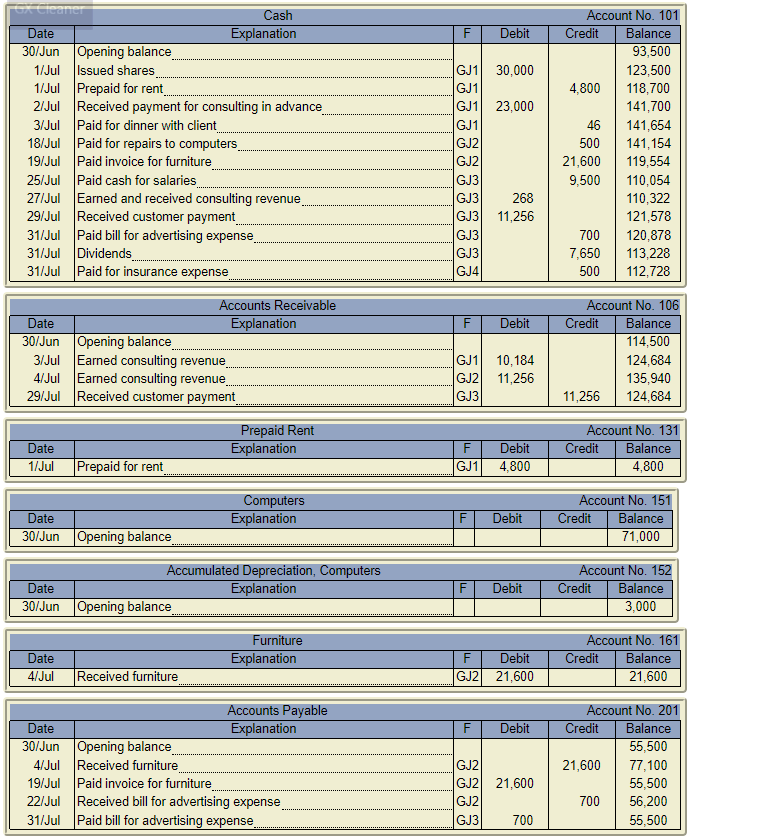

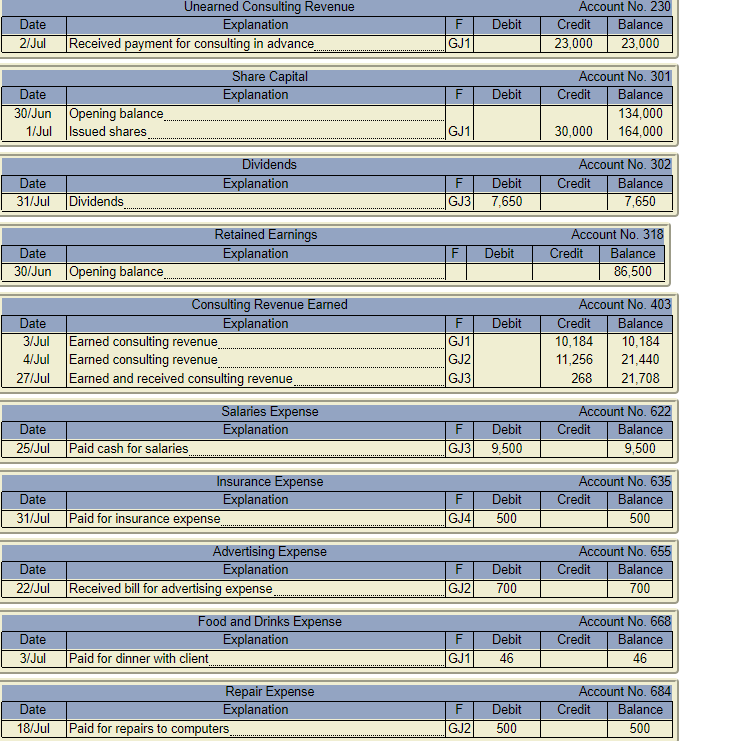

Part 1 (70 points] Apex Consulting Corp. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Apex Consulting Corp. showed the following alphabetized post-closing trial balance at June 30, 2014. Account Balance Accounts payable 55,500 Accounts receivable 114,500 Accumulated depreciation, computers 3,000 Cash Computers 71,000 Retained earnings 86,500 Share capital 134,000 Note: 93,500 There were 10,000 shares issued and outstanding on June 30, 2014 Depreciation on the computers is $700 per month Apex Consulting Corp.'s salaries expense is a total of $500 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). F Page Gj1 Debit Credit 30,000 30,000 Page GJ2 Debit Credit 21,600 21,600 4,800 11,256 4,800 11,256 General Journal Date Account/Explanation 1/Jul Cash Share Capital Issued shares 1/Jul Prepaid Rent Cash Prepaid for rent 2/Jul Cash Unearned Consulting Revenue Received payment for consulting in advance 3/Jul Accounts Receivable Consulting Revenue Earned. Earned consulting revenue 3/Jul Food and Drinks Expense. Cash Paid for dinner with client 23,000 500 General Journal Date Account/Explanation F 4/Jul Furniture Accounts Payable Received furniture 4/Jul Accounts Receivable. Consulting Revenue Earned. Earned consulting revenue 18/Jul Repair Expense... Cash Paid for repairs to computers 19/Jul Accounts Payable Cash Paid invoice for furniture 22/Jul Advertising Expense Accounts Payable Received bill for advertising expense 23,000 500 21,600 10,184 21,600 10,184 700 46 700 46 General Journal Date Account/Explanation 31/Jul Insurance Expense.. Cash Paid for insurance expense Page GJ4 F Debit Credit 500 500 General Journal Page GJ3 Date Account/Explanation F Debit Credit 25/Jul Salaries Expense 9,500 Cash 9,500 Paid cash for salaries 27/Jul Cash 268 Consulting Revenue Earned. 268 Earned and received consulting revenue 29/Jul Cash 11,256 Accounts Receivable 11,256 Received customer payment 31/Jul Accounts Payable 700 Cash 700 Paid bill for advertising expense 31/Jul Dividends 7,650 Cash 7,650 Dividends Part 4 [25 points] a) Prepare the appropriate adjusting entries on July 31, 2014. HINT: Where might you look to find information to prepare the adjusting entries? NOTE: The adjusting entries will be automatically posted to the general ledger when you click 'submit' and the correct adjusted general ledger balances will be available in the solution to Part 4. General Journal Page GJ5 Account/Explanation F Debit Date Credit + b) What is the next step in the accounting cycle? O Prepare a post-closing trial balance O Prepare an unadjusted trial balance O Prepare financial statements This is the last step O Prepare an adjusted trial balance O Post transactions O Analyze and journalize transactions O Prepare closing entries F Debit FER Cleaner Cash Date Explanation 30/Jun Opening balance 1/Jul Issued shares 1/Jul Prepaid for rent 2/Jul Received payment for consulting in advance 3/Jul Paid for dinner with client 18/Jul Paid for repairs to computers 19/Jul Paid invoice for furniture 25/Jul Paid cash for salaries 27/Jul Earned and received consulting revenue 29/Jul Received customer payment 31/Jul Paid bill for advertising expense 31/Jul Dividends 31/Jul Paid for insurance expense 22222 GJ1 30,000 GJ1 GJ1 23,000 GJ1 GJ2 GJ2 GJ3 GJ3 268 GJ3| 11,256 GJ3 GJ3| GJ4 Account No. 101 Credit Balance 93,500 123,500 4.800 118,700 141,700 46 141,654 500 141,154 21,600 119,554 9,500 110,054 110,322 121,578 700 120,878 7,650 113,228 500 112,728 F Debit Accounts Receivable Date Explanation 30/Jun Opening balance 3/Jul Earned consulting revenue 4/Jul Earned consulting revenue 29/Jul Received customer payment Account No. 106 Credit Balance 114,500 124,684 135,940 11,256 124,684 GJ1 10,184 GJ2 11,256 GJ3 Prepaid Rent Explanation Date 1/Jul Debit 4,800 Account No. 131 Credit Balance 4,800 Prepaid for rent GJ1 Computers Explanation F Debit Date 30/Jun Opening balance Account No. 151 Credit Balance 71,000 Accumulated Depreciation, Computers Date Explanation 30/Jun Opening balance F Debit Account No. 152 Credit Balance 3,000 Furniture Explanation Date 4/Jul F Debit GJ2 21,600 Account No. 161 Credit Balance 21,600 Received furniture F Debit Accounts Payable Date Explanation 30/Jun Opening balance 4/Jul Received furniture 19/Jul Paid invoice for furniture 22/Jul Received bill for advertising expense 31/Jul Paid bill for advertising expense GJ2 GJ2 21,600 GJ2 GJ3 700 Account No. 201 Credit Balance 55,500 21,600 77,100 55,500 700 56,200 55,500 Unearned Consulting Revenue Explanation Received payment for consulting in advance F Date 2/Jul Debit Account No. 230 Credit Balance 23,000 23,000 GJ1 Share Capital Explanation F Debit Date 30/Jun Opening balance 1/Jul Issued shares Account No. 301 Credit Balance 134,000 30,000 164,000 GJ1 Dividends Explanation Date 31/Jul F GJ3 Debit 7,650 Account No. 302 Credit Balance 7,650 Dividends F Debit Account No. 318 Credit Balance 86,500 Retained Earnings Date Explanation 30/Jun Opening balance. Consulting Revenue Earned Date Explanation 3/Jul Earned consulting revenue. 4/Jul Earned consulting revenue 27/Jul Earned and received consulting revenue Debit F GJ1 GJ2 GJ3 Account No. 403 Credit Balance 10,184 10,184 11,256 21,440 268 21,708 Salaries Expense Explanation F Date 25/Jul Debit 9,500 Account No. 622 Credit Balance 9,500 Paid cash for salaries GJ3 Date Insurance Expense Explanation Paid for insurance expense F GJ4| Debit 500 Account No. 635 Credit Balance 500 31/Jul Date 22/Jul Advertising Expense Explanation Received bill for advertising expense F GJ2 Debit 700 Account No. 655 Credit Balance 700 Food and Drinks Expense Explanation Paid for dinner with client Date 3/Jul F Debit 46 Account No. 668 Credit Balance 46 GJ1 Repair Expense Explanation Paid for repairs to computers Date 18/Jul F Debit 500 Account No. 684 Credit Balance 500 GJ2 Part 1 (70 points] Apex Consulting Corp. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Apex Consulting Corp. showed the following alphabetized post-closing trial balance at June 30, 2014. Account Balance Accounts payable 55,500 Accounts receivable 114,500 Accumulated depreciation, computers 3,000 Cash Computers 71,000 Retained earnings 86,500 Share capital 134,000 Note: 93,500 There were 10,000 shares issued and outstanding on June 30, 2014 Depreciation on the computers is $700 per month Apex Consulting Corp.'s salaries expense is a total of $500 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). F Page Gj1 Debit Credit 30,000 30,000 Page GJ2 Debit Credit 21,600 21,600 4,800 11,256 4,800 11,256 General Journal Date Account/Explanation 1/Jul Cash Share Capital Issued shares 1/Jul Prepaid Rent Cash Prepaid for rent 2/Jul Cash Unearned Consulting Revenue Received payment for consulting in advance 3/Jul Accounts Receivable Consulting Revenue Earned. Earned consulting revenue 3/Jul Food and Drinks Expense. Cash Paid for dinner with client 23,000 500 General Journal Date Account/Explanation F 4/Jul Furniture Accounts Payable Received furniture 4/Jul Accounts Receivable. Consulting Revenue Earned. Earned consulting revenue 18/Jul Repair Expense... Cash Paid for repairs to computers 19/Jul Accounts Payable Cash Paid invoice for furniture 22/Jul Advertising Expense Accounts Payable Received bill for advertising expense 23,000 500 21,600 10,184 21,600 10,184 700 46 700 46 General Journal Date Account/Explanation 31/Jul Insurance Expense.. Cash Paid for insurance expense Page GJ4 F Debit Credit 500 500 General Journal Page GJ3 Date Account/Explanation F Debit Credit 25/Jul Salaries Expense 9,500 Cash 9,500 Paid cash for salaries 27/Jul Cash 268 Consulting Revenue Earned. 268 Earned and received consulting revenue 29/Jul Cash 11,256 Accounts Receivable 11,256 Received customer payment 31/Jul Accounts Payable 700 Cash 700 Paid bill for advertising expense 31/Jul Dividends 7,650 Cash 7,650 Dividends Part 4 [25 points] a) Prepare the appropriate adjusting entries on July 31, 2014. HINT: Where might you look to find information to prepare the adjusting entries? NOTE: The adjusting entries will be automatically posted to the general ledger when you click 'submit' and the correct adjusted general ledger balances will be available in the solution to Part 4. General Journal Page GJ5 Account/Explanation F Debit Date Credit + b) What is the next step in the accounting cycle? O Prepare a post-closing trial balance O Prepare an unadjusted trial balance O Prepare financial statements This is the last step O Prepare an adjusted trial balance O Post transactions O Analyze and journalize transactions O Prepare closing entries F Debit FER Cleaner Cash Date Explanation 30/Jun Opening balance 1/Jul Issued shares 1/Jul Prepaid for rent 2/Jul Received payment for consulting in advance 3/Jul Paid for dinner with client 18/Jul Paid for repairs to computers 19/Jul Paid invoice for furniture 25/Jul Paid cash for salaries 27/Jul Earned and received consulting revenue 29/Jul Received customer payment 31/Jul Paid bill for advertising expense 31/Jul Dividends 31/Jul Paid for insurance expense 22222 GJ1 30,000 GJ1 GJ1 23,000 GJ1 GJ2 GJ2 GJ3 GJ3 268 GJ3| 11,256 GJ3 GJ3| GJ4 Account No. 101 Credit Balance 93,500 123,500 4.800 118,700 141,700 46 141,654 500 141,154 21,600 119,554 9,500 110,054 110,322 121,578 700 120,878 7,650 113,228 500 112,728 F Debit Accounts Receivable Date Explanation 30/Jun Opening balance 3/Jul Earned consulting revenue 4/Jul Earned consulting revenue 29/Jul Received customer payment Account No. 106 Credit Balance 114,500 124,684 135,940 11,256 124,684 GJ1 10,184 GJ2 11,256 GJ3 Prepaid Rent Explanation Date 1/Jul Debit 4,800 Account No. 131 Credit Balance 4,800 Prepaid for rent GJ1 Computers Explanation F Debit Date 30/Jun Opening balance Account No. 151 Credit Balance 71,000 Accumulated Depreciation, Computers Date Explanation 30/Jun Opening balance F Debit Account No. 152 Credit Balance 3,000 Furniture Explanation Date 4/Jul F Debit GJ2 21,600 Account No. 161 Credit Balance 21,600 Received furniture F Debit Accounts Payable Date Explanation 30/Jun Opening balance 4/Jul Received furniture 19/Jul Paid invoice for furniture 22/Jul Received bill for advertising expense 31/Jul Paid bill for advertising expense GJ2 GJ2 21,600 GJ2 GJ3 700 Account No. 201 Credit Balance 55,500 21,600 77,100 55,500 700 56,200 55,500 Unearned Consulting Revenue Explanation Received payment for consulting in advance F Date 2/Jul Debit Account No. 230 Credit Balance 23,000 23,000 GJ1 Share Capital Explanation F Debit Date 30/Jun Opening balance 1/Jul Issued shares Account No. 301 Credit Balance 134,000 30,000 164,000 GJ1 Dividends Explanation Date 31/Jul F GJ3 Debit 7,650 Account No. 302 Credit Balance 7,650 Dividends F Debit Account No. 318 Credit Balance 86,500 Retained Earnings Date Explanation 30/Jun Opening balance. Consulting Revenue Earned Date Explanation 3/Jul Earned consulting revenue. 4/Jul Earned consulting revenue 27/Jul Earned and received consulting revenue Debit F GJ1 GJ2 GJ3 Account No. 403 Credit Balance 10,184 10,184 11,256 21,440 268 21,708 Salaries Expense Explanation F Date 25/Jul Debit 9,500 Account No. 622 Credit Balance 9,500 Paid cash for salaries GJ3 Date Insurance Expense Explanation Paid for insurance expense F GJ4| Debit 500 Account No. 635 Credit Balance 500 31/Jul Date 22/Jul Advertising Expense Explanation Received bill for advertising expense F GJ2 Debit 700 Account No. 655 Credit Balance 700 Food and Drinks Expense Explanation Paid for dinner with client Date 3/Jul F Debit 46 Account No. 668 Credit Balance 46 GJ1 Repair Expense Explanation Paid for repairs to computers Date 18/Jul F Debit 500 Account No. 684 Credit Balance 500 GJ2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts