Question: please help with this journal here is number 2. number 3. number 4. number 5. thank you! [The following information applies to the questions displayed

![questions displayed below.] On October 29, Lobo Company began operations by purchasing](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671794b7975e4_647671794b736d51.jpg)

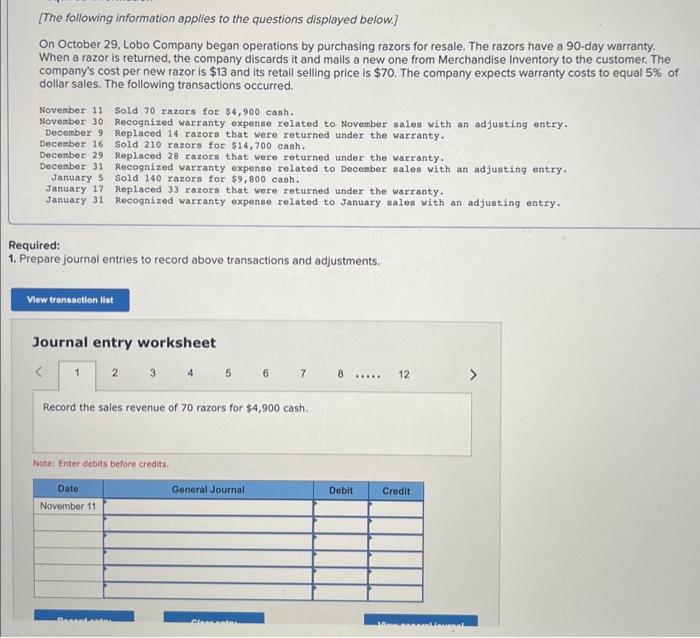

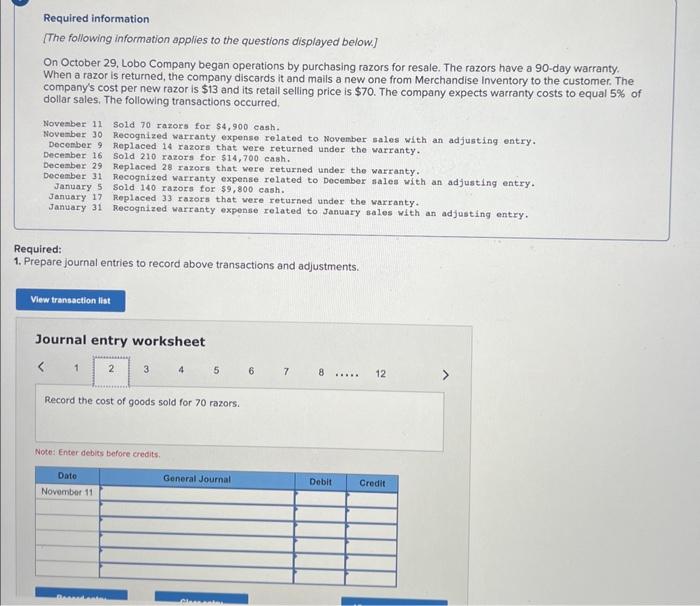

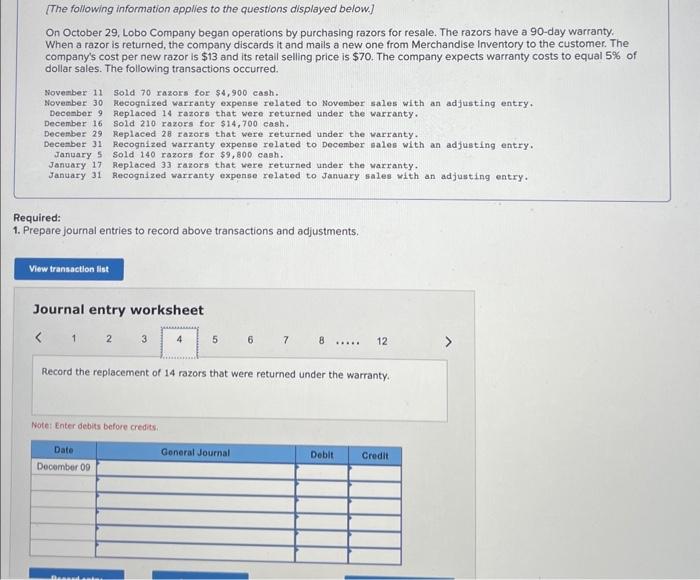

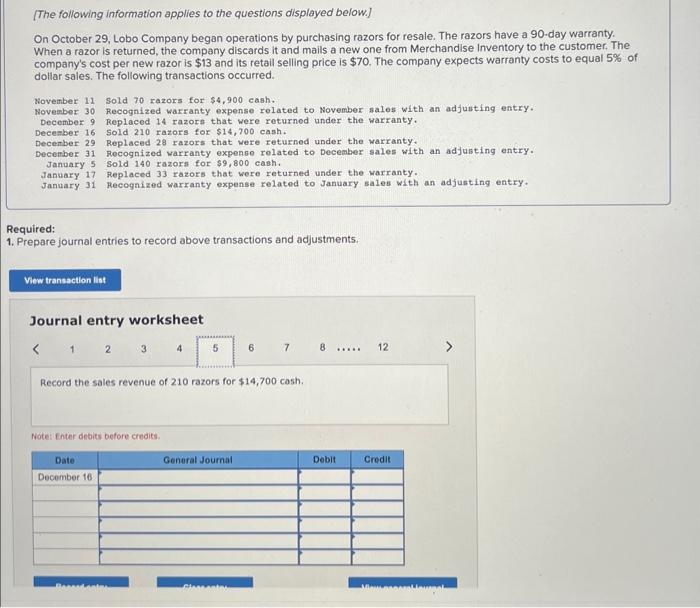

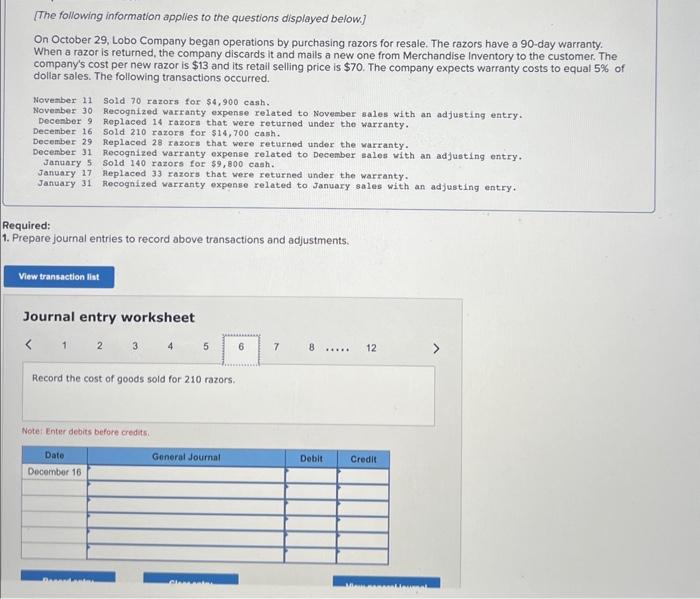

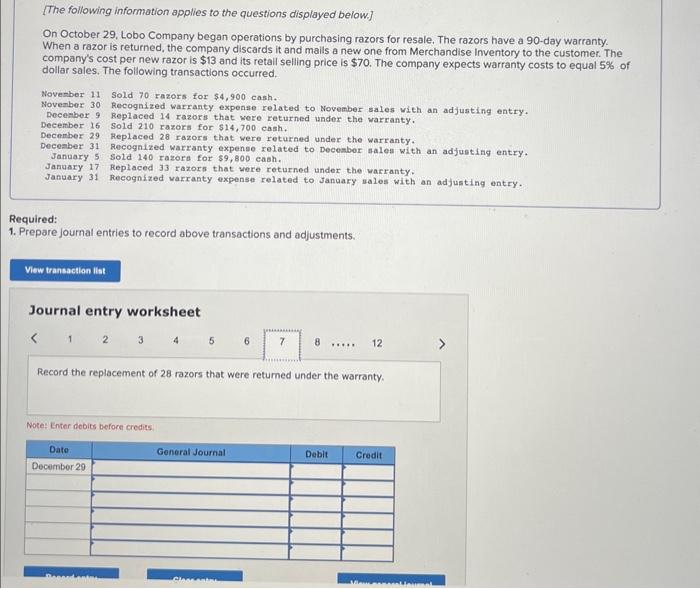

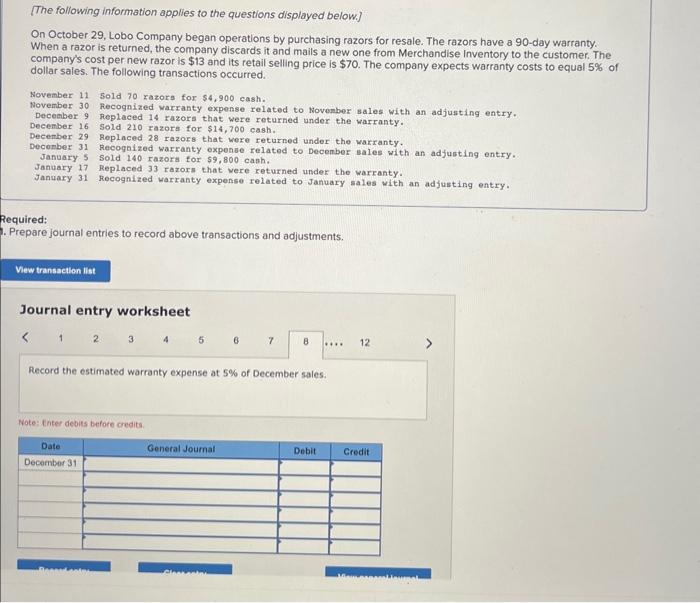

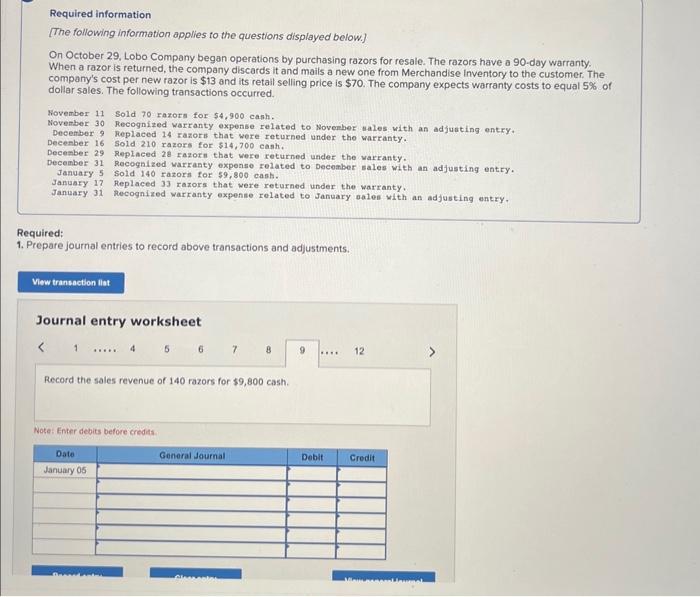

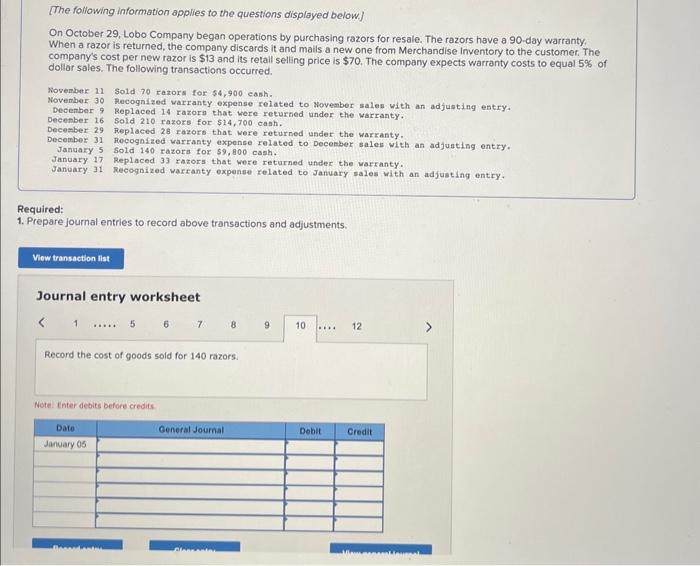

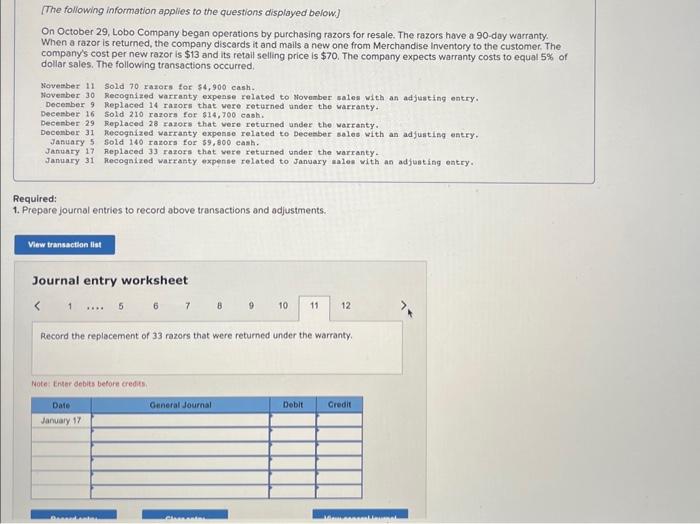

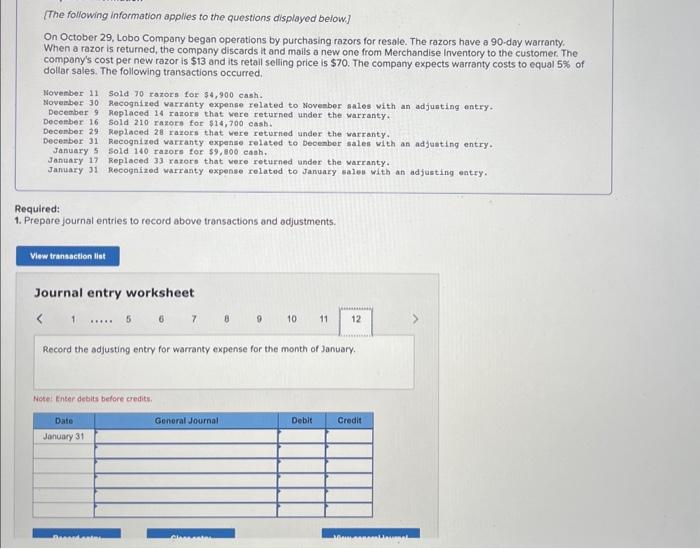

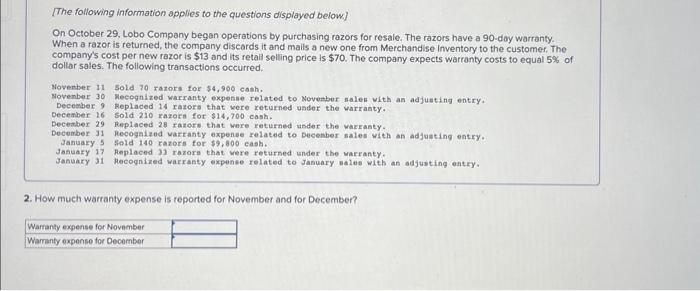

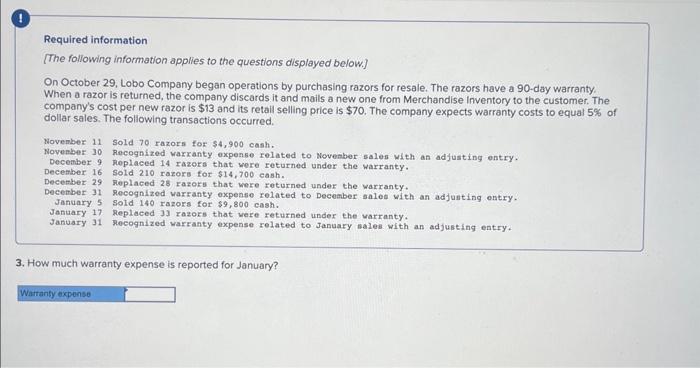

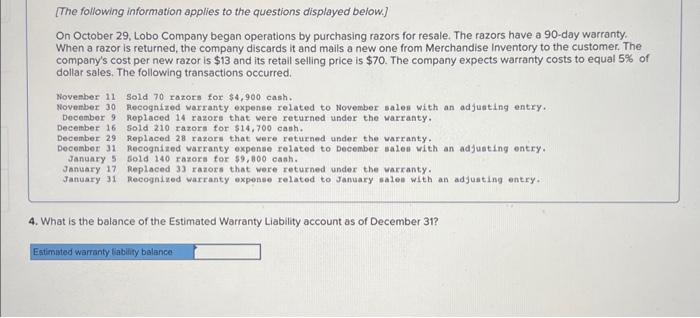

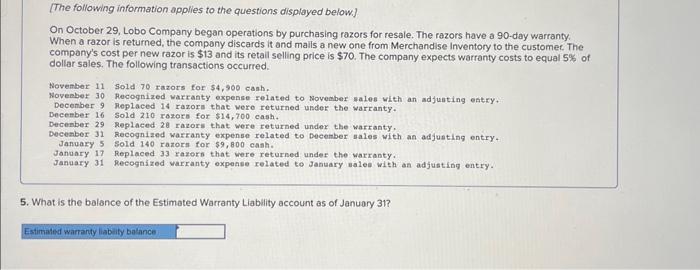

[The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $4,900 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 14 razors that were returned under the warranty. Decenber 16 sold 210 razors for $14,700 cash. December 29 Replaced 28 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 140 razors for $9,800 cash. January 17 Replaced 33 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entrv worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred, Noveaber 11 Sold 70 razors for $4,900 cash. Novenber 30 Recognized warranty expense related to November sales with an adjusting entry. Decenber 9 Replaced 14 razors that were returned under the varranty. Deceaber 16 Sold 210 razors for $14,700 cash. December 31 Recognt 28 razors that were returned under the warranty. January 5 Sold 140 - warranty expense related to Docember sales with an adjusting entry. Jenuary 17 Replaced razors for $9,800 cash. January 31 Recognized razors that were returned under the varranty. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $4,900 cash. Hovember 30 Recognized warranty expense related to Novenber salen with an adjusting entry. Docember 9 Replaced 14 razors that wore returned tnder the warranty. December 16 sold 210 razors for $14,700 cash. Decenber 29 Replaced 28 razers that were returned under the warranty. December 31 Recognized warranty expense related to pecember sales with an adjusting entry. January 5 Sold 140 razors for $9,800 canh. January 17 Replaced 33 razors that were returned under the varranty ; January 31 Recognized warranty expense related to January nales wth an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet 4567812 Record the estimated warranty expense at 5% of November sales. Note: Enter debits before credits. [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $4,900 cash. November 30 hecognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 14 razors that were returned under the warranty. December 16 Sold 210 razors for $14,700 cash. Decenber 29 Replaced 28 razors that were returned under the warranty. Deceaber 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 sold 140 razors for $9,800 cash. January 17 Replaced 33 razors that were returned under the varranty. January 31 Recognized warranty expense related to January salee with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet Record the replacement of 14 razors that were returned under the warranty. Note: Enter debits before credits: [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards. it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $4,900 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 14 razors that were returned under the warranty. December 16 sold 210 razors for $14,700 cash. December 29 Replaced 28 razors that were returned under the warranty. December 31 Recognized varranty expeneo related to December sales with an adjusting entry. January 5 sold 140 razors for $9,800 cash. January 17 peplaced 33 razors that were returned under the varranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet Record the sales revenue of 210 razors for $14,700 cash. Note: Enter debits before credits. [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of doliar sales. The following transactions occurred. November 11 Sold 70 razors for $4,900 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 14 razors that were returned under tho warranty. December 16 Sold 210 razors for: $14,700 cash. December 29 Replaced 28 razors that were returned under the varranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 140 razors for $9,800 cash. January 17 Peplaced 33 razors that were returned under the warranty. January 31 Pecognized warranty expense related to January sales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. Novezber 11 Sold 70 razors for $4,900 cash. November 30 . Recognized warranty expense related to November sales with an adjusting entry. Decenber 9 Replaced 14 razors that were returned under the warranty. December 16 Sold 210 razors for $14,700 caah, December 29 Heplaced 28 razors that were returned under the warranty. Deceaber 31 Recognized warranty expense related to Decembor salea with an adjusting entry. January 5 sold 140 razora for $9,800 eash. January 17 Replaced 33 razors that were returned under the varranty. January 31 Recognized warranty expense related to January wales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet \begin{tabular}{lllllll|rrr|} \hline & 1 & 2 & 3 & 4 & 5 & 6 & 8 & & 12 \\ \hline Record the replacement of 28 razors that were returned under the warranty. \end{tabular} Note: Enter debits before credits: [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 5old 70 razors for $4,900 cash. November 30 Recognized warranty expense related to Novenber sales with an adjusting entry. December 9 Replaced 14 razors that were returned under the warranty. December 16 Sold 210 razora for $14,700 cash. December 29 Roplaced 28 razors that were returned under the warranty. Decomber 31 Recognized warranty expenee related to Decenber iales with an adfusting entry. January 5 sold 140 razora for. $9,800 canh. January 17 Replaced 33 razors that vere returned under the warranty. January 31 Rocognized warranty expense related to January sales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet \begin{tabular}{llllllll|l|ll} & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & & 12 \end{tabular} Record the estimated warranty expense at 5% of December sales. Note: thiter debits before credits. Required information [The following information applies to the questions displayed below.] On October 29. Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 raxors for 54,900 cash. Novenber 30 Recognized warranty expense related to November nales with an adjusting entry. Decenber 9 Replaced 14 razors that were returned under the warranty. Decenber 16 sold 210 razors for $14,700 eash. Decenber 29 Replaced 28 razorn that were returned under the warranty. December 31 Rocognized varranty expenso related to Deconber sales with an adjusting entry. January 5 sold 140 razors for 59,800 cash. January 17 Replaced 33 razors that were returned under the warranty, January 31 Recognized warranty expense related to January sales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entrv worksheet [The following information applies to the questions displayed below. On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for 54,900 canh. November 30 . Heeognized warranty expense related to November sales with an adjusting entry. Decenber 9 Replaced 14 razors that were returned under the warranty. Decenber 16 Sold 210 razors for $14,700canh. December 29 preplaced 28 razore that were returned under the warranty. December 31 Rocognized warranty expense related to Decenber sales with an adjunting entry. January 5 sold 140 razors for $9, f00 cash. January 17 Replaced 33 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales vith an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments: [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred, Noveaber 11 Sold 70 raxora for $4,900 cash. Novenber 30 Recognized warranty expense related to November sales with an adjusting entry. Decenber 9 Replaced 14 razors that were returned under the warranty. Deceeber 16 sold 210 razora for $14,700 cash. Decepber 29 Deplaced 28 razors that vere returned under the varranty. Deceaber 31 Recognized warranty expense related to Decenber sales with an adjusting entry. January 5 sold 140 razors for 59,800 cash. January 17 Replaced 33 razors that vere returned under the varranty. January 31 Recognized warranty expense related to Janvary nales vith an adjusting eatry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet Record the replacement of 33 razors that were returned under the warranty. Kote: Enser debits before credies [The following information applles to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. Novenber 11 Sold 70 razors for $4,900 cash. Noveeber 30 Recognized varranty expense related to Novenber sales with an adjunting entry . Decenber 9 Replaced 14 razorn that were returned under the warranty; December 16 sold 210 razors for $14,700 cash. Decenber 29 Replaced 28 razors that were returned under the varranty. Deceeber 31 Recognized varranty expense related to becenber sales with an adjuating entry. January. 5 sold 140 razors for $9,800 ealah. January 17 Replaced 33 rarore that vere returned under the varrantyo January 31 Recognized warranty expense related to January sales with an adjesting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Journal entry worksheet Record the adjusting entry for warranty expense for the month of January. Fose: tinter deblits before credits. [The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -doy warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer, The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. Movenber 11 Sold 70 razors for $4,900 eath. Novenbar 30 Mecognized warranty expenae related to Nevenber sales with an adjusting entry. Deceember 9 Repladed 14 razore that were returned uader the varranty. December 16 sold 210 razora for \$14, 700 cash. Deceaber 29 Replaced 28 razors that were returned tander the varranty. December 31 Recogalzed varranty expenee related to Decenber sales yith an adjuating entry, January 5 iold 140 razora for $9,800 cash. 3anuazy 17 Aeplaced 31 razora that vere returned under the marranty. January 31 Recognired warranty expenee related to January sales with an adjusting eatry. 2. How much warranty expense is reported for November and for December? Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 sold 70 razors for $4,900 cash. Novenber 30 Recognized warranty expense related to Novenber sales with an adfusting entry. Decenber 9 rroplaced 14 razors that were returned under the warranty. December 16 sold 210 razors for $14,700 cash. Decenber 29 Meplaced 28 razors that were returned under the warranty, December 31 recognized warranty expense related to December saleo with an adjusting ontry. January 5 sold 140 razors for $9,800 eash. January 17 Replaced 33 razors that vere returned under the warranty. January 31 roeognized warranty expense related to January nales with an adjusting entry. 3. How much warranty expense is reported for January? [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. Novenher 11 Sold 70 razors for $4,900 cash, Novenber 30 fecognized warranty expense related to November salen with an adjunting entry. Docembor 9 Roplaced 14 razore that were returned under the varranty. December 16 fold 210 razora for 514,700 cash. December 29 Replaced 28 razorit that were returned under the warranty, December 31 Recognized varranty expense rolated to December galeo with an adjusting entry. January 5 5old 140 razort for 59,800 canh. January 17 Replaced 33 razors that were returned under the yarranty . January 31 Recognized warranty exponse related to January salea with an adjusting entry. 4. What is the balance of the Estimated Warranty Liability account as of December 31 ? [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customet. The company's cost per new razor is $13 and its retail selling price is $70. The company expects warranty costs to equal 5% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $4,900 canh. Novenber 30 Recognized warranty expense related to Noyember sales with an adjuating eatry, Decenber 9 Replaced 14 razori that were returned under the warranty. December 16 Sold 210 rozora for $14,700 cash. Decenber 29 Replaced 28 razors that were returned under the warranty. Deceaber 31 Recognized warranty expense related to Decenber sales with an adjusting entry January. 5 Sold 140 razorn for $9,800 cash. January 17 Replaced 33 razers that were returned under the varranty. Janaary 31 Recognzed varranty expense related to January nale with an adjusting entry. 5. What is the balance of the Estimated Warranty Liability account as of January 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts