Question: Please do all Answer questions 18 and 19 based upon the following information: The shares of Company A stock are trading at $40 each. A

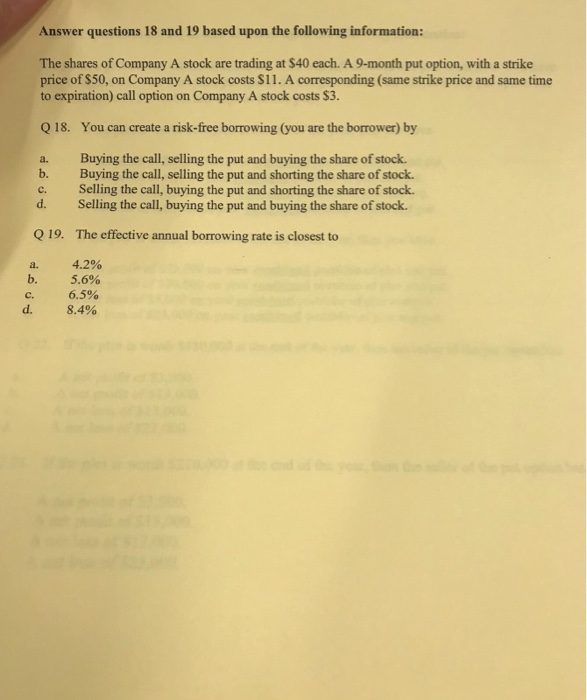

Answer questions 18 and 19 based upon the following information: The shares of Company A stock are trading at $40 each. A 9-month put option, with a strike price of $50, on Company A stock costs S11. A corresponding (same strike price and same time to expiration) call option on Company A stock costs $3. Q18. You can create a risk-free borrowing (you are the borrower) by a. Buying the call, selling the put and buying the share of stock. b. Buying the call, selling the put and shorting the share of stock. c. Selling the call, buying the put and shorting the share of stock. d. Selling the call, buying the put and buying the share of stock. Q19. a. b. c. The effective annual borrowing rate is closest to 4.2% 5.6% 6.5% d. 8.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts