Question: * ***PLEASE DO ALL OR DO NOT RESPOND *** Elle Mae Industries has a cash balance of $65,000, accounts payable of $225,000; inventory of $265,000;

****PLEASE DO ALL OR DO NOT RESPOND ***

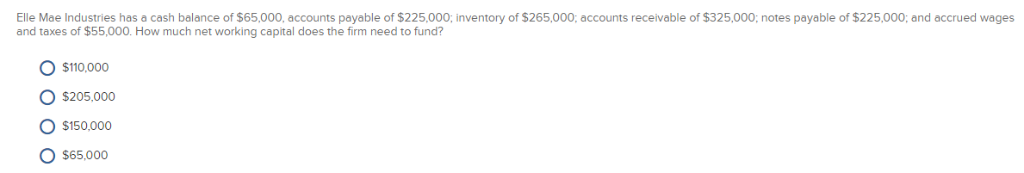

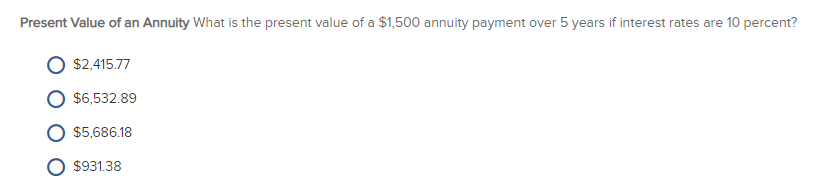

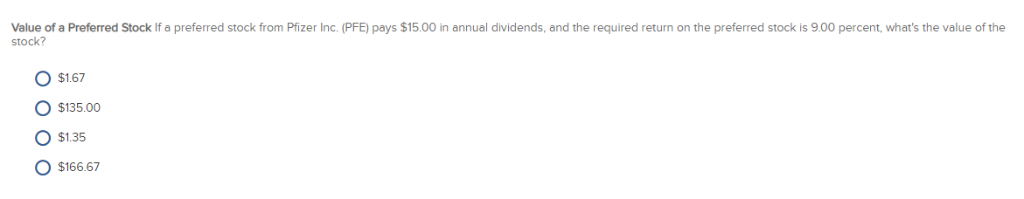

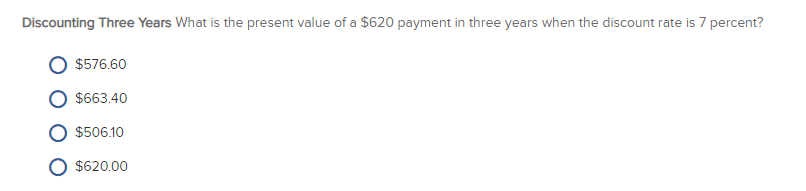

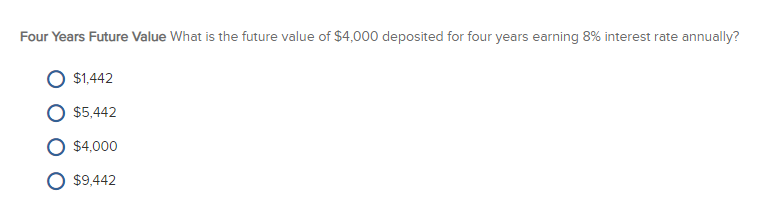

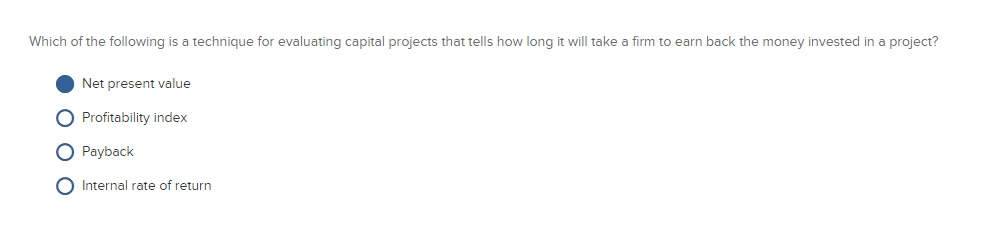

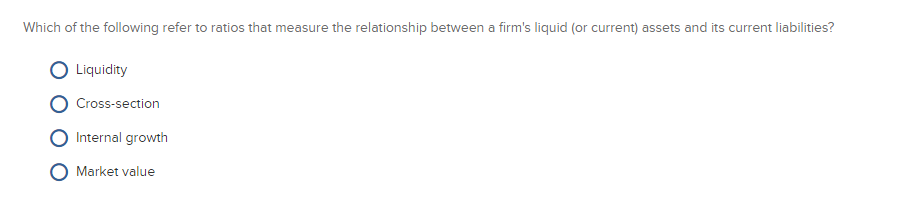

Elle Mae Industries has a cash balance of $65,000, accounts payable of $225,000; inventory of $265,000; accounts receivable of $325,000; notes payable of $225,000; and accrued wages and taxes of $55,000. How much net working capital does the firm need to fund? O $110.000 $205,000 O $150,000 O $65,000 Value of a Preferred Stock If a preferred stock from Pfizer Inc. (PFE) pays $15.00 in annual dividends, and the required return on the preferred stock is 9.00 percent, what's the value of the stock? $1.67 $135.00 $1.35 $166.67 Discounting Three Years What is the present value of a $620 payment in three years when the discount rate is 7 percent? $576.60 $663.40 $506.10 O $620.00 Four Years Future Value What is the future value of $4,000 deposited for four years earning 8% interest rate annually? $1,442 $5,442 $4,000 $9.442 O Which of the following is a technique for evaluating capital projects that tells how long it will take a firm to earn back the money invested in a project? Net present value O Profitability index O Payback Internal rate of return Which of the following refer to ratios that measure the relationship between a firm's liquid (or current) assets and its current liabilities? Liquidity O Cross-section O Internal growth O Market value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts