Question: PLEASE DO ALL REQUIREMENTS PLEASE DO ALL REQUIREMENTS Tall Timber Company provided the following information for the current year: (Click the icon to view the

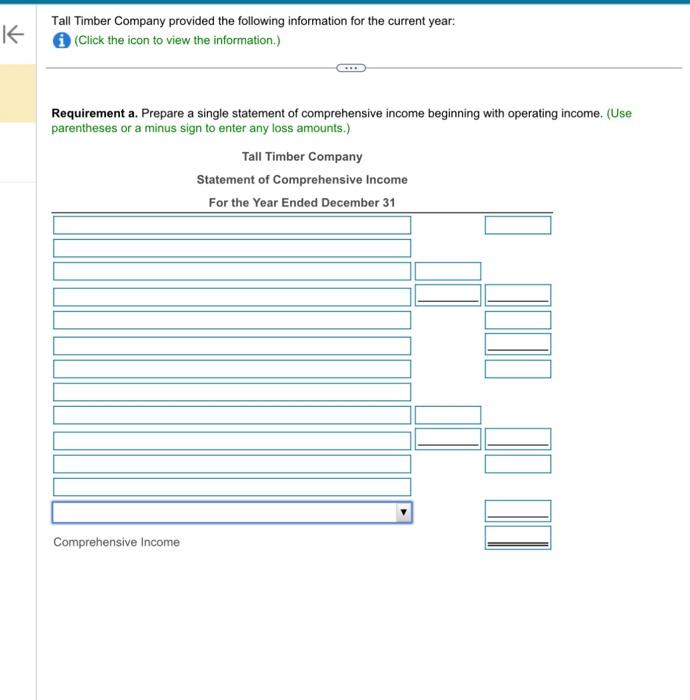

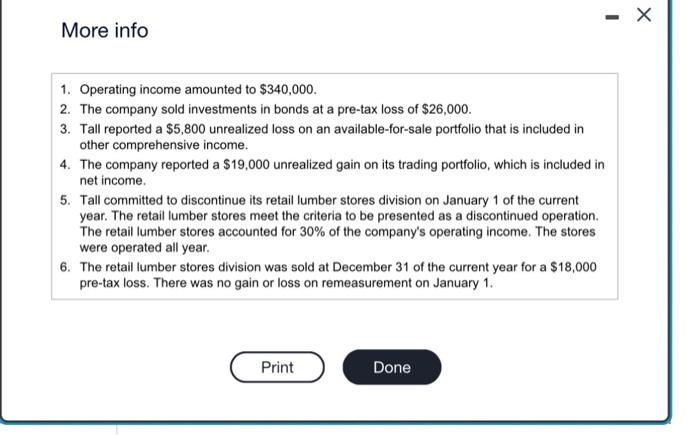

Tall Timber Company provided the following information for the current year: (Click the icon to view the information.) Requirement a. Prepare a single statement of comprehensive income beginning with operating income. (Use parentheses or a minus sign to enter any loss amounts.) Requirements a. Prepare a single statement of comprehensive income beginning with operating income. b. Prepare separate statements of net income and comprehensive income. More info 1. Operating income amounted to $340,000. 2. The company sold investments in bonds at a pre-tax loss of $26,000. 3. Tall reported a $5,800 unrealized loss on an available-for-sale portfolio that is included in other comprehensive income. 4. The company reported a $19,000 unrealized gain on its trading portfolio, which is included in net income. 5. Tall committed to discontinue its retail lumber stores division on January 1 of the current year. The retail lumber stores meet the criteria to be presented as a discontinued operation. The retail lumber stores accounted for 30% of the company's operating income. The stores were operated all year. 6. The retail lumber stores division was sold at December 31 of the current year for a $18,000 pre-tax loss. There was no gain or loss on remeasurement on January 1. Tall Timber Company provided the following information for the current year: (Click the icon to view the information.) Requirement a. Prepare a single statement of comprehensive income beginning with operating income. (Use parentheses or a minus sign to enter any loss amounts.) Requirements a. Prepare a single statement of comprehensive income beginning with operating income. b. Prepare separate statements of net income and comprehensive income. More info 1. Operating income amounted to $340,000. 2. The company sold investments in bonds at a pre-tax loss of $26,000. 3. Tall reported a $5,800 unrealized loss on an available-for-sale portfolio that is included in other comprehensive income. 4. The company reported a $19,000 unrealized gain on its trading portfolio, which is included in net income. 5. Tall committed to discontinue its retail lumber stores division on January 1 of the current year. The retail lumber stores meet the criteria to be presented as a discontinued operation. The retail lumber stores accounted for 30% of the company's operating income. The stores were operated all year. 6. The retail lumber stores division was sold at December 31 of the current year for a $18,000 pre-tax loss. There was no gain or loss on remeasurement on January 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts