Question: Please do all the requirements up to 4 ! ! Thank youuuu! Suppose that on January 1 , Warnock Ltd . paid cash of

Please do all the requirements up to Thank youuuu!

Suppose that on January Warnock Ltd paid cash of $ for computers that are expected to remain useful for four years. At the end of four years, the computers' values are expected to be zero.

Required

Make journal entries to record a the purchase of the computers on January and b the annual depreciation on December Include dates and explanations, and use the following accounts: Computer Equipment; Accumulated DepreciationComputer Equipment; and Depreciation ExpenseComputer Equipment.

Post to the accounts and show their balances at December

What is the computers' carrying amount at December

Which accounts will Warnock report on the income statement for the year? Which accounts will appear on the balance sheet of December Show the amount to report for each item on both financial statements.

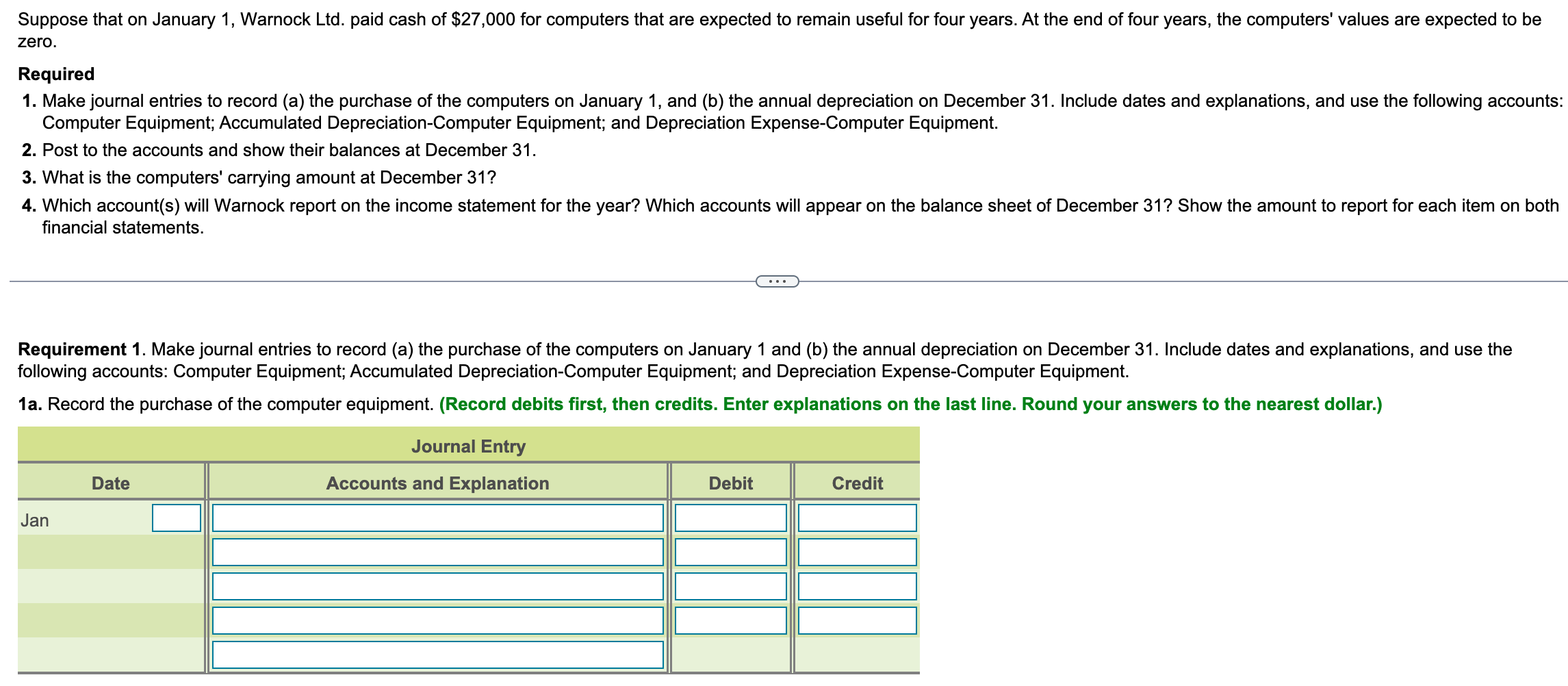

Requirement Make journal entries to record a the purchase of the computers on January and b the annual depreciation on December Include dates and explanations, and use the following accounts: Computer Equipment; Accumulated DepreciationComputer Equipment; and Depreciation ExpenseComputer Equipment.

a Record the purchase of the computer equipment. Record debits first, then credits. Enter explanations on the last line. Round your answers to the nearest dollar. Suppose that on January Warnock Ltd paid cash of $ for computers that are expected to remain useful for four years. At the end of four years, the computers' values are expected to be zero.

Required

Make journal entries to record a the purchase of the computers on January and b the annual depreciation on December Include dates and explanations, and use the following accounts: Computer Equipment; Accumulated DepreciationComputer Equipment; and Depreciation ExpenseComputer Equipment.

Post to the accounts and show their balances at December

What is the computers' carrying amount at December

Which accounts will Warnock report on the income statement for the year? Which accounts will appear on the balance sheet of December Show the amount to report for each item on both financial statements.

b Record the entry for the annual depreciation. Round your answers to the nearest dollar.

Requirement Post to the accounts and show their balances at December Leave unused cells blank. Suppose that on January Warnock Ltd paid cash of $ for computers that are expected to remain useful for four years. At the end of four years, the computers' values are expected to be zero.

Required

Make journal entries to record a the purchase of the computers on January and b the annual depreciation on December Include dates and explanations, and use the following accounts: Computer Equipment; Accumulated DepreciationComputer Equipment; and Depreciation ExpenseComputer Equipment.

Post to the accounts and show their balances at December

What is the computers' carrying amount at December

Which accounts will Warnock report on the income statement for the year? Which accounts will appear on the balance sheet of December Show the amount to report for each item on both financial statements.

Requirement Post to the accounts and show their balances at December Leave unused cells blank.

Requirement What is the computers' carrying amount at December Use the table below to calculate the carrying amount of the computer equipment.

Less

Carrying amount at December Suppose that on January Warnock Ltd paid cash of $ for computers that are expected to remain useful for four years. At the end of four years, the computers' values are expected to be zero.

Required

Make journal entries to record a the purchase of the computers on January and b the annual depreciation on December Include dates and explanations, and use the following accounts: Computer Equipment; Accumulated DepreciationComputer Equipment; and Depreciation ExpenseComputer Equipment.

Post to the accounts and show their balances at December

What is the computers' carrying amount at December

Which accounts will Warnock report on the income statement for the year? Which accounts will appear on the balance sheet of December Show the amount to report for each item on both financial statements.

Requirement What is the computers' carrying amount at December Use the table below to calculate the carrying amount of the computer equipment.

Requirement Which accounts will Warnock report on the income statement for the year? Which accounts will appear on the balance sheet of December Show the amount to report for each item on both financial statements.

Begin with the Income Statement. Chose the account that Warnock Ltd will report on this statement and then, using your computations from above, enter the amount for the account you selected. Complete the table by choosing the accounts and th

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock