Question: Please do all the work in excel The Assignment The fiscal 2022 year-end values in your employer's financial accounts are shown below. All figures are

Please do all the work in excel

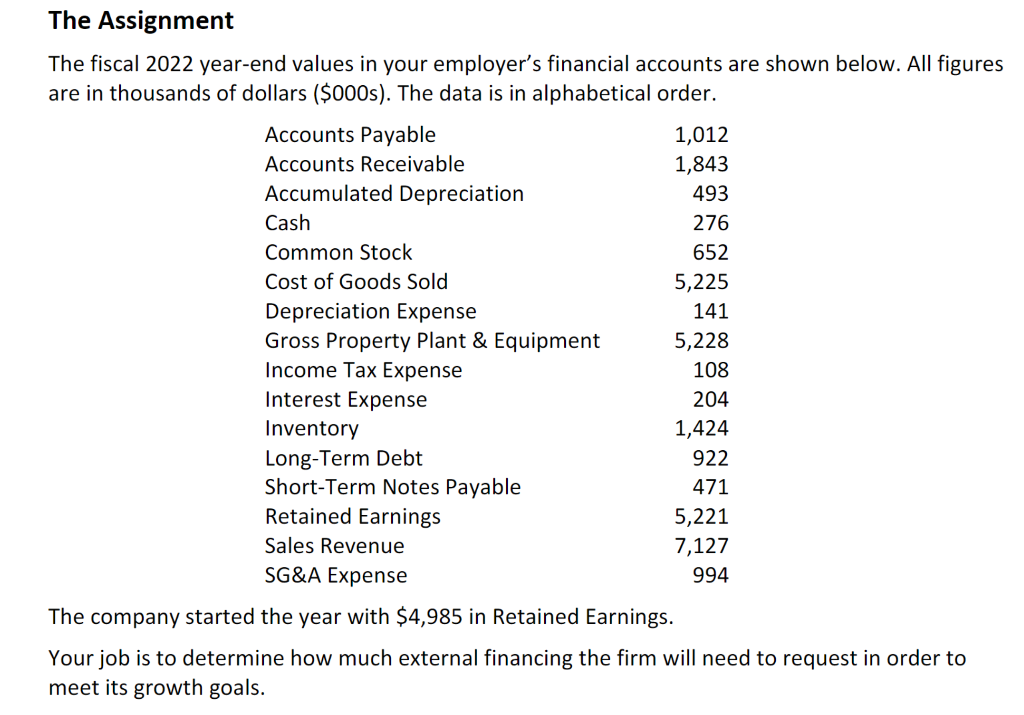

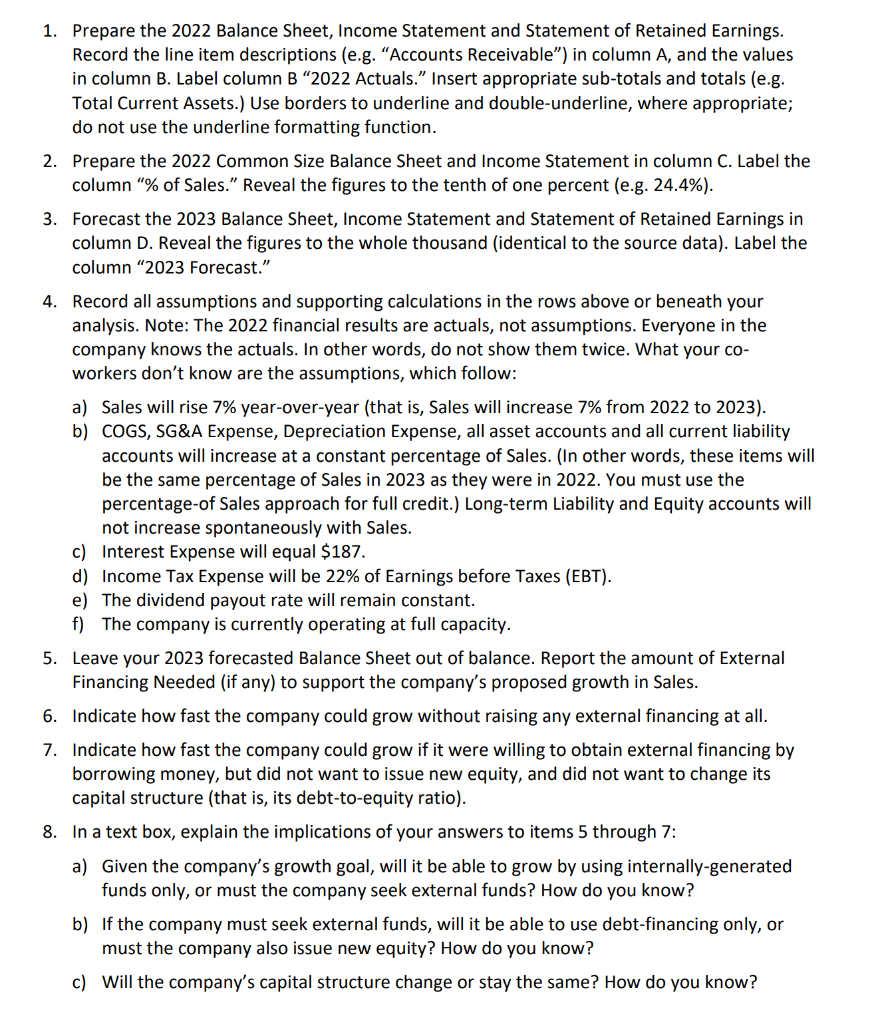

The Assignment The fiscal 2022 year-end values in your employer's financial accounts are shown below. All figures are in thousands of dollars ($000 s). The data is in alphabetical order. The company started the year with $4,985 in Retained Earnings. Your job is to determine how much external financing the firm will need to request in order to meet its growth goals. 1. Prepare the 2022 Balance Sheet, Income Statement and Statement of Retained Earnings. Record the line item descriptions (e.g. "Accounts Receivable") in column A, and the values in column B. Label column B "2022 Actuals." Insert appropriate sub-totals and totals (e.g. Total Current Assets.) Use borders to underline and double-underline, where appropriate; do not use the underline formatting function. 2. Prepare the 2022 Common Size Balance Sheet and Income Statement in column C. Label the column "\% of Sales." Reveal the figures to the tenth of one percent (e.g. 24.4\%). 3. Forecast the 2023 Balance Sheet, Income Statement and Statement of Retained Earnings in column D. Reveal the figures to the whole thousand (identical to the source data). Label the column "2023 Forecast." 4. Record all assumptions and supporting calculations in the rows above or beneath your analysis. Note: The 2022 financial results are actuals, not assumptions. Everyone in the company knows the actuals. In other words, do not show them twice. What your coworkers don't know are the assumptions, which follow: a) Sales will rise 7\% year-over-year (that is, Sales will increase 7\% from 2022 to 2023). b) COGS, SG\&A Expense, Depreciation Expense, all asset accounts and all current liability accounts will increase at a constant percentage of Sales. (In other words, these items will be the same percentage of Sales in 2023 as they were in 2022. You must use the percentage-of Sales approach for full credit.) Long-term Liability and Equity accounts will not increase spontaneously with Sales. c) Interest Expense will equal $187. d) Income Tax Expense will be 22% of Earnings before Taxes (EBT). e) The dividend payout rate will remain constant. f) The company is currently operating at full capacity. 5. Leave your 2023 forecasted Balance Sheet out of balance. Report the amount of External Financing Needed (if any) to support the company's proposed growth in Sales. 6. Indicate how fast the company could grow without raising any external financing at all. 7. Indicate how fast the company could grow if it were willing to obtain external financing by borrowing money, but did not want to issue new equity, and did not want to change its capital structure (that is, its debt-to-equity ratio). 8. In a text box, explain the implications of your answers to items 5 through 7: a) Given the company's growth goal, will it be able to grow by using internally-generated funds only, or must the company seek external funds? How do you know? b) If the company must seek external funds, will it be able to use debt-financing only, or must the company also issue new equity? How do you know? c) Will the company's capital structure change or stay the same? How do you know

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts