Question: PLEASE DO ALL THESE QUESTIONS!! Question 2 Project Selection Dragon Products Company is considering two projects. The projects' cash flows are as follows: EXPECTED NET

PLEASE DO ALL THESE QUESTIONS!!

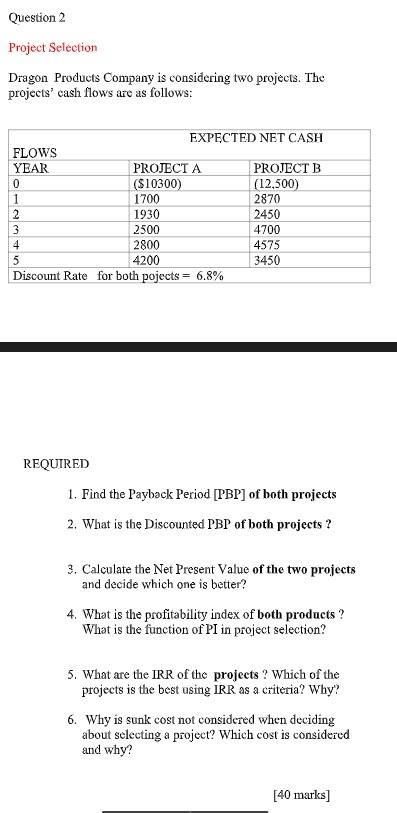

Question 2 Project Selection Dragon Products Company is considering two projects. The projects' cash flows are as follows: EXPECTED NET CASH FLOWS YEAR PROJECT A PROJECT B 0 ($10300) (12,500) 1 1700 2870 2 1930 2450 3 2500 4700 4 2800 4575 5 4200 3450 Discount Rate for both pojects = 6.8% REQUIRED 1. Find the Payback Period (PBP] of both projects 2. What is the Discounted PBP of both projects ? 3. Calculate the Net Present Value of the two projects and decide which one is better? 4. What is the profitability index of both products ? What is the function of PI in project selection? 5. What are the IRR of the projects? Which of the projects is the best using IRR as a criteria? Why? 6. Why is sunk cost not considered when deciding about selecting a project? Which cost is considered and why? [40 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts