Question: Please do asap and show all your workings June 2016.pdf - Adobe Acrobat Reader DC File Edit View Sign Window Help Home Tools June 2015.pdf

Please do asap and show all your workings

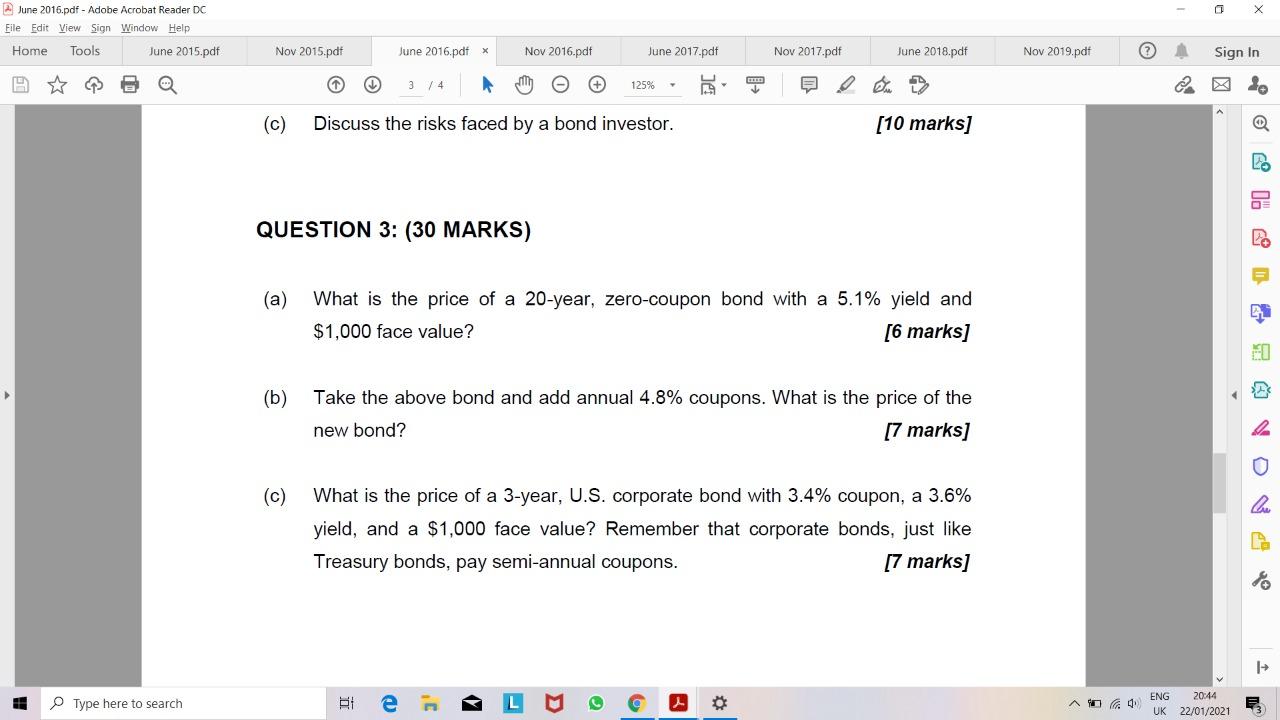

June 2016.pdf - Adobe Acrobat Reader DC File Edit View Sign Window Help Home Tools June 2015.pdf Nov 2015.pdf June 2016.pdf Nov 2016.pdf June 2017.pdf Nov 2017.pdf June 2018.pdf Nov 2019.pdf Sign In 3 14 125% = 2 . Discuss the risks faced by a bond investor. [10 marks] QUESTION 3: (30 MARKS) 14 (a) What is the price of a 20-year, zero-coupon bond with a 5.1% yield and $1,000 face value? [6 marks] FI SA (b) Take the above bond and add annual 4.8% coupons. What is the price of the new bond? [7 marks] 0 (C) la What is the price of a 3-year, U.S. corporate bond with 3.4% coupon, a 3.6% yield, and a $1,000 face value? Remember that corporate bonds, just like Treasury bonds, pay semi-annual coupons. [7 marks] | Type here to search BI V 2 AO G. ENG 20:44 UK 22/01/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts