Question: Please do B and C please answer b and c Suppose your company needs to raise $40.2 million and you want to issue 25 -year

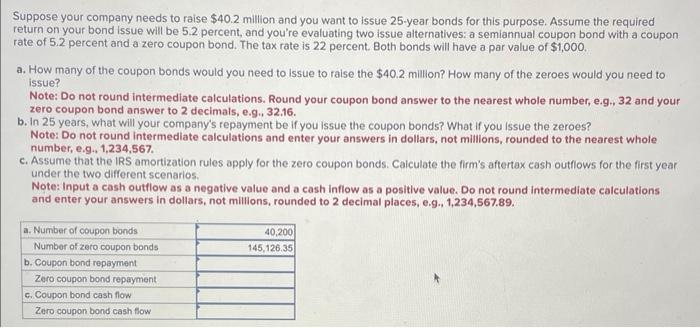

Suppose your company needs to raise $40.2 million and you want to issue 25 -year bonds for this purpose. Assume the required return on your bond issue will be 5.2 percent, and you're evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 5.2 percent and a zero coupon bond. The tax rate is 22 percent. Both bonds will have a par value of $1,000. a. How many of the coupon bonds would you need to issue to raise the $40.2 million? How many of the zeroes would you need to issue? Note: Do not round intermediate calculations. Round your coupon bond answer to the nearest whole number, e.g., 32 and your zero coupon bond answer to 2 decimals, e.g. 32.16. b. In 25 years, what will your company's repayment be if you issue the coupon bonds? What if you issue the zeroes? Note: Do not round intermedlate calculations and enter your answers in dollars, not millions, rounded to the nearest whole number, e.94,1,234,567. c. Assume that the IRS amortization rules apply for the zero coupon bonds. Caiculate the firm's aftertax cash outfiows for the first year under the two different scenarios. Note: Input a cash outflow as a negative value and a cash inflow as a positlve value. Do not round intermediate calculations and enter your answers in dollars, not millions, rounded to 2 decimal places, e.9., 1,234,567.89. Suppose your company needs to raise $40.2 million and you want to issue 25 -year bonds for this purpose. Assume the required return on your bond issue will be 5.2 percent, and you're evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 5.2 percent and a zero coupon bond. The tax rate is 22 percent. Both bonds will have a par value of $1,000. a. How many of the coupon bonds would you need to issue to raise the $40.2 million? How many of the zeroes would you need to issue? Note: Do not round intermediate calculations. Round your coupon bond answer to the nearest whole number, e.g., 32 and your zero coupon bond answer to 2 decimals, e.g. 32.16. b. In 25 years, what will your company's repayment be if you issue the coupon bonds? What if you issue the zeroes? Note: Do not round intermedlate calculations and enter your answers in dollars, not millions, rounded to the nearest whole number, e.94,1,234,567. c. Assume that the IRS amortization rules apply for the zero coupon bonds. Caiculate the firm's aftertax cash outfiows for the first year under the two different scenarios. Note: Input a cash outflow as a negative value and a cash inflow as a positlve value. Do not round intermediate calculations and enter your answers in dollars, not millions, rounded to 2 decimal places, e.9., 1,234,567.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts