Question: PLEASE DO IN EXCEL 3. Sallinger, Inc., is considering a project that will result in initial after-tax cash savings of $4 million at the end

PLEASE DO IN EXCEL

PLEASE DO IN EXCEL

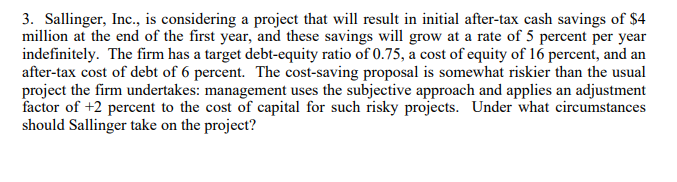

3. Sallinger, Inc., is considering a project that will result in initial after-tax cash savings of $4 million at the end of the first year, and these savings will grow at a rate of 5 percent per year indefinitely. The firm has a target debt-equity ratio of 0.75, a cost of equity of 16 percent, and an after-tax cost of debt of 6 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes: management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. Under what circumstances should Sallinger take on the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts