Question: please do in excel and show all steps and formulas. please answer part a,b,c please answer on microsoft excel and show formulas. please answer questions

please do in excel and show all steps and formulas. please answer part a,b,c

please answer on microsoft excel and show formulas. please answer questions a,b,c

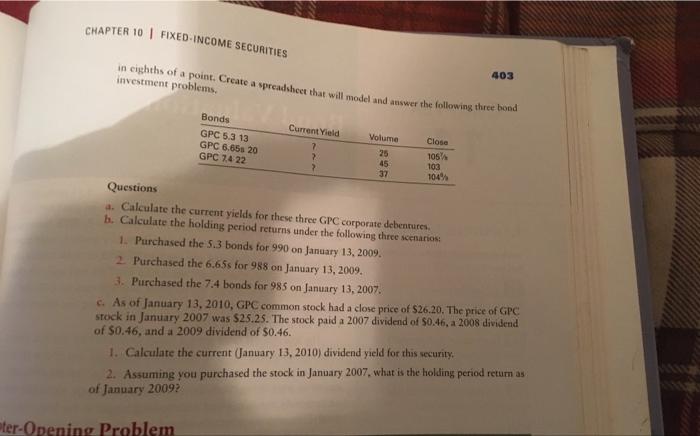

c. Of the remaining four companies, one carries a AA rating, one carries an A rating, and two are BB-rated. Which companies are they? eadsheets The cash flow component of bond investments is made up of the annual interest payments and the future redemption value or its par value. Just like orher time-value-of-moncy considerations, the bond cash flows are discounted back in order to determine their present value. In comparing bonds to stocks, many investors look at the respective returns. The total returns in the bond market are made up of both current income and capital gains. Bond invetment analysis should include the determination of the current yield as well as a specific holding period return. On January 13, 2010, you gather the following information on three corporate bonds issucd by the General Pincapple Corp (GPC). Remember that corporate bonds are quoted as a percent of their par value. Assume the par value of each bond to be $1,000. These debentures are quoted in eighths of a point. Create a spreadsheet that will model and 403 investment problems. Questions 4. Calculate the current yields for rhese three GPC corporate debentures. b. Calculate the holding period returns under the following thece scenarios: 1. Purchased the 5.3 bonds for 990 on January 13,2009. 2. Purchased the 6.655 for 958 on January 13, 2009. 3. Purchased the 7.4 bonds for 985 on January 13, 2007 . c. As of January 13,2010, GPC common stock had a close price of $26.20. The price of GPC stock in January 2007 was \$25.25. The stock paid a 2007 dividend of 50.46, a 2008 dividend of 50.46, and a 2009 dividend of 50.46. 1. Calculare the current (January 13, 2010) dividend yield for this security. 2. Assuming you purchased the stock in January 2007, what is the holding period retum as of January 2009? c. Of the remaining four companies, one carries a AA rating, one carries an A rating, and two are BB-rated. Which companies are they? eadsheets The cash flow component of bond investments is made up of the annual interest payments and the future redemption value or its par value. Just like orher time-value-of-moncy considerations, the bond cash flows are discounted back in order to determine their present value. In comparing bonds to stocks, many investors look at the respective returns. The total returns in the bond market are made up of both current income and capital gains. Bond invetment analysis should include the determination of the current yield as well as a specific holding period return. On January 13, 2010, you gather the following information on three corporate bonds issucd by the General Pincapple Corp (GPC). Remember that corporate bonds are quoted as a percent of their par value. Assume the par value of each bond to be $1,000. These debentures are quoted in eighths of a point. Create a spreadsheet that will model and 403 investment problems. Questions 4. Calculate the current yields for rhese three GPC corporate debentures. b. Calculate the holding period returns under the following thece scenarios: 1. Purchased the 5.3 bonds for 990 on January 13,2009. 2. Purchased the 6.655 for 958 on January 13, 2009. 3. Purchased the 7.4 bonds for 985 on January 13, 2007 . c. As of January 13,2010, GPC common stock had a close price of $26.20. The price of GPC stock in January 2007 was \$25.25. The stock paid a 2007 dividend of 50.46, a 2008 dividend of 50.46, and a 2009 dividend of 50.46. 1. Calculare the current (January 13, 2010) dividend yield for this security. 2. Assuming you purchased the stock in January 2007, what is the holding period retum as of January 2009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts