Question: please do it as Excel file thank you never mind you don't need to do it as excel , just show me the answer for

please do it as Excel file

thank you

never mind you don't need to do it as excel , just show me the answer for Payroll Summary, Payroll Transaction Detail, Journal, Employee State Taxes Detail.

Which picture isnt clear? the pictures i added at the end it shows clear to me so Im not sure which one youre talking about

Thank you

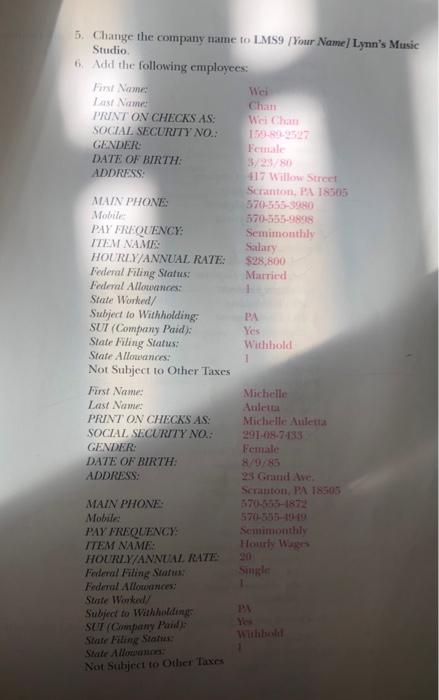

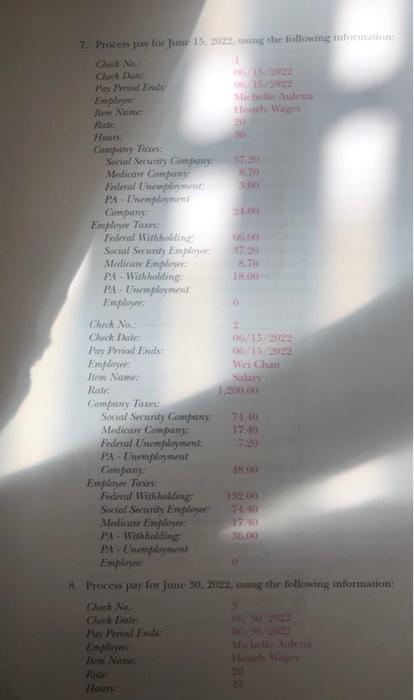

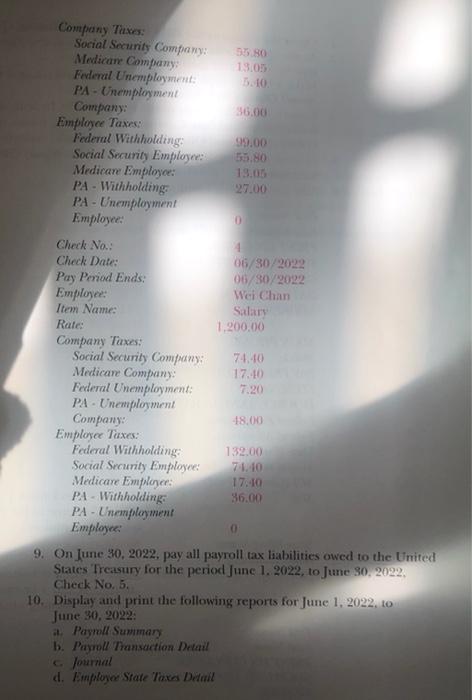

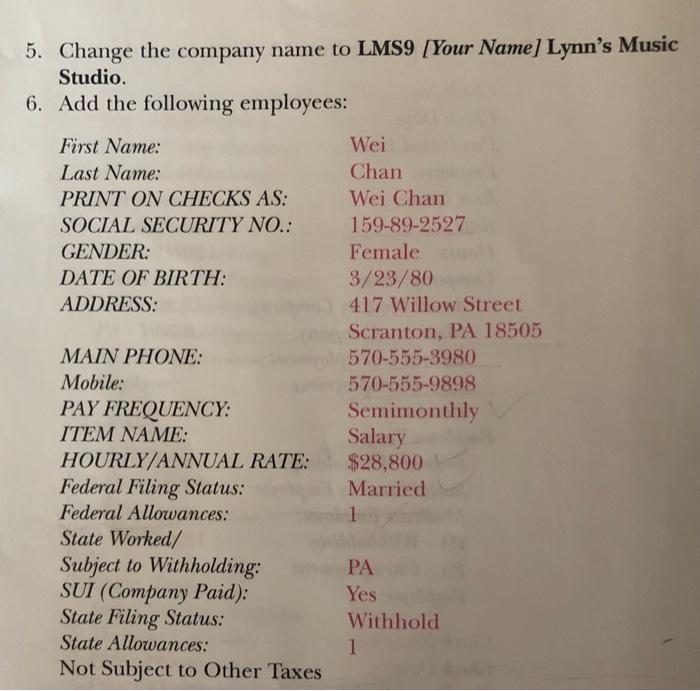

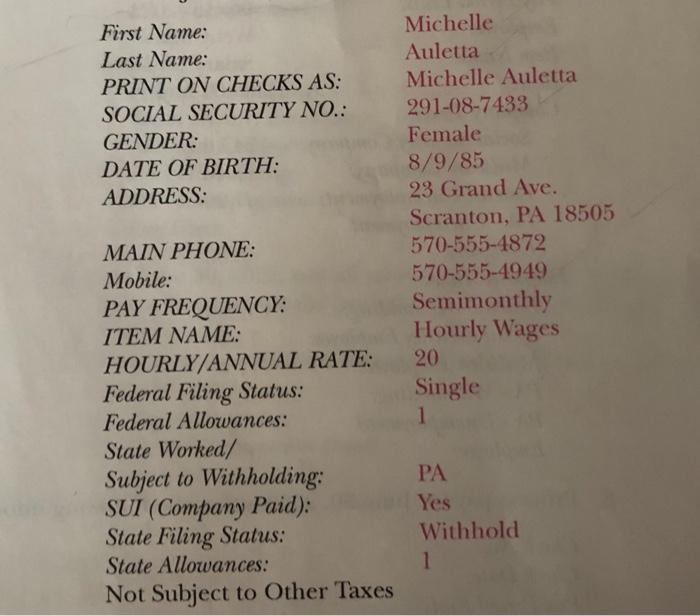

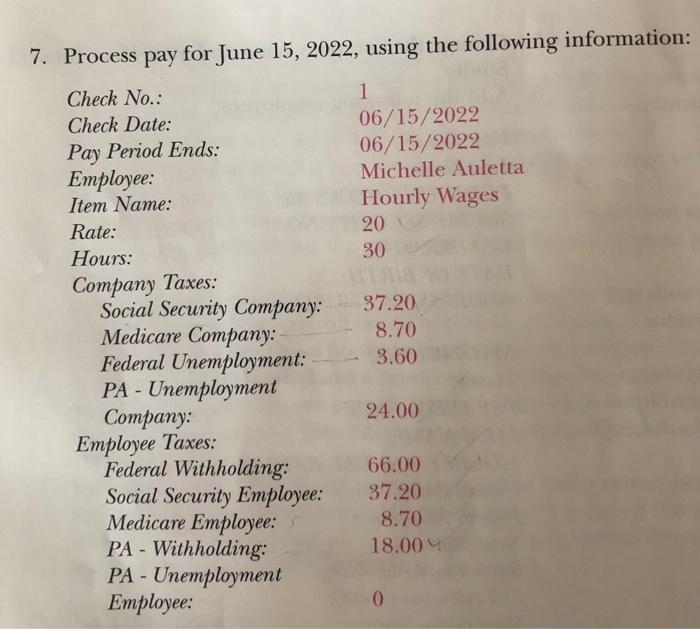

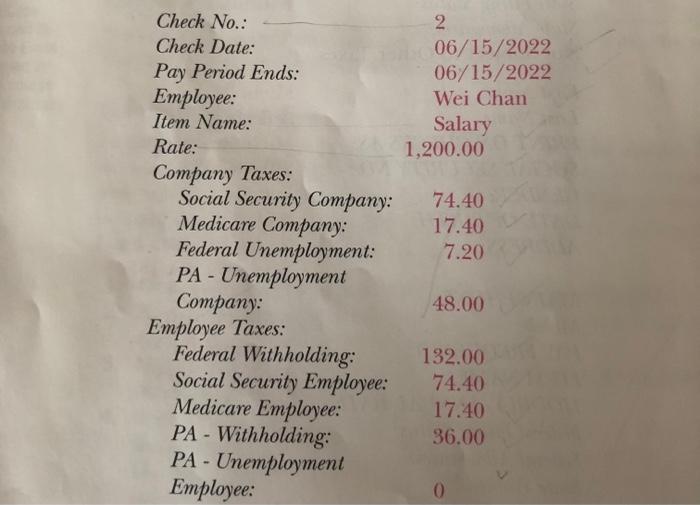

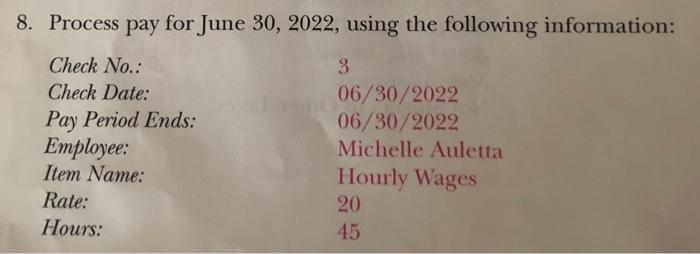

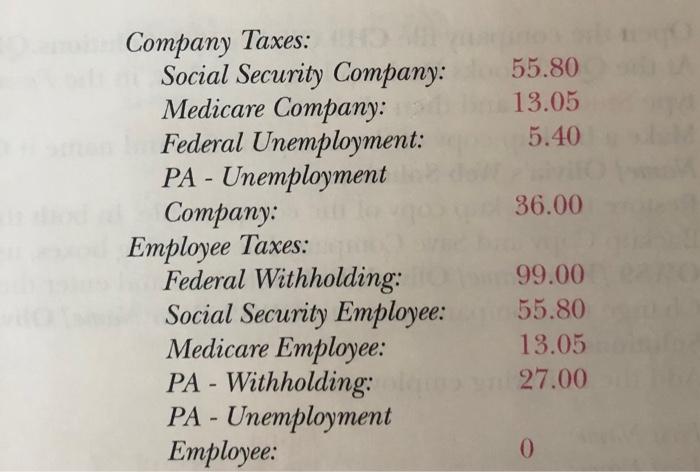

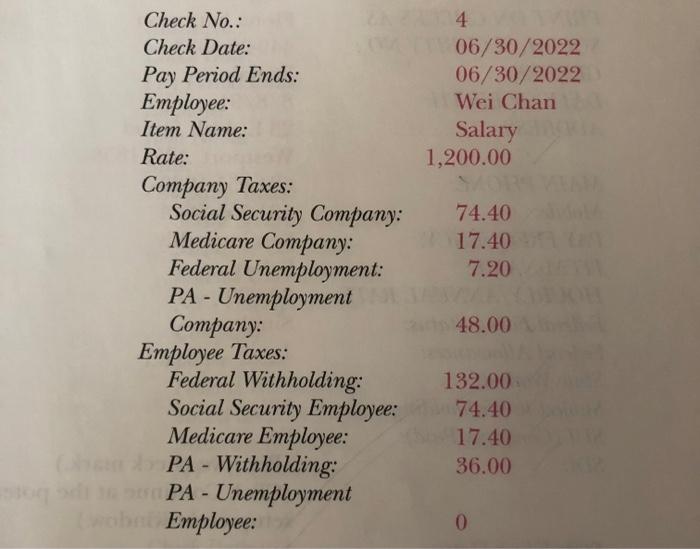

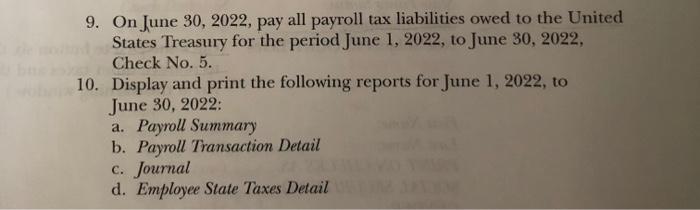

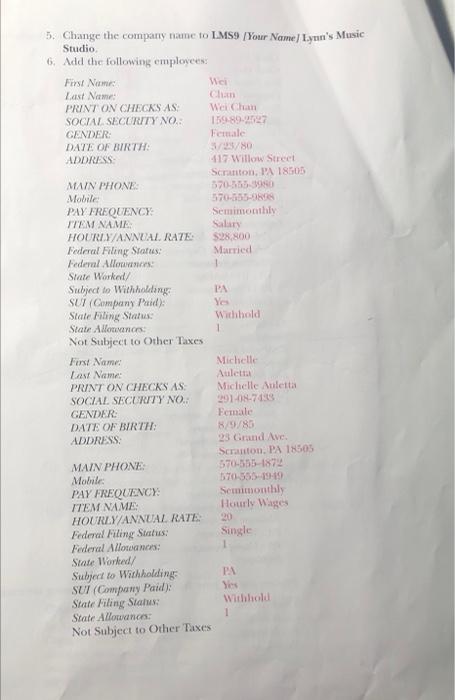

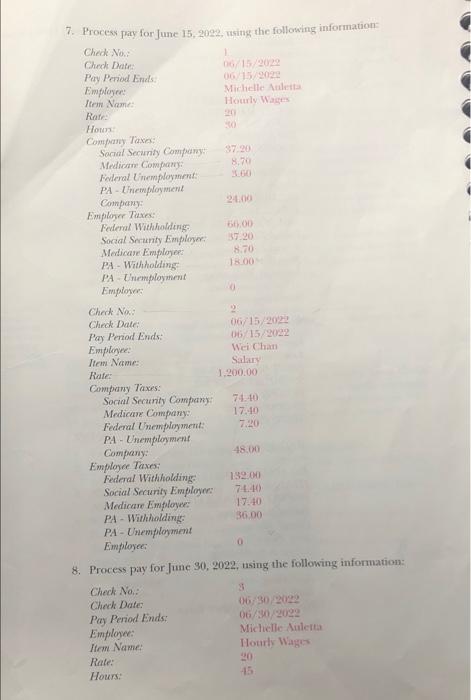

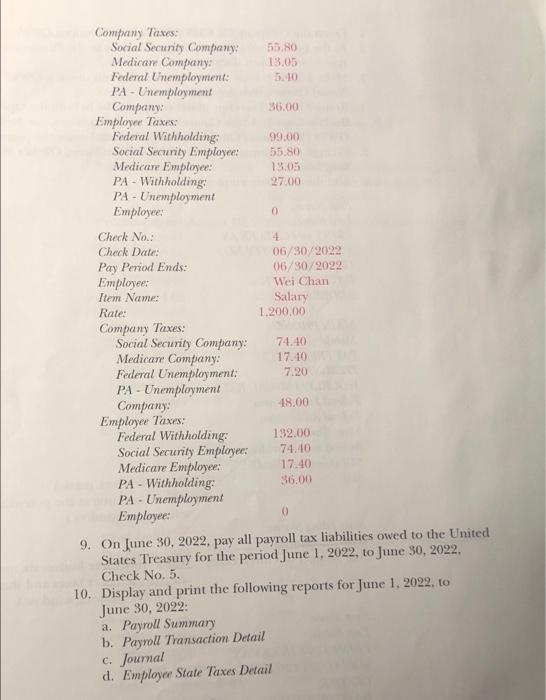

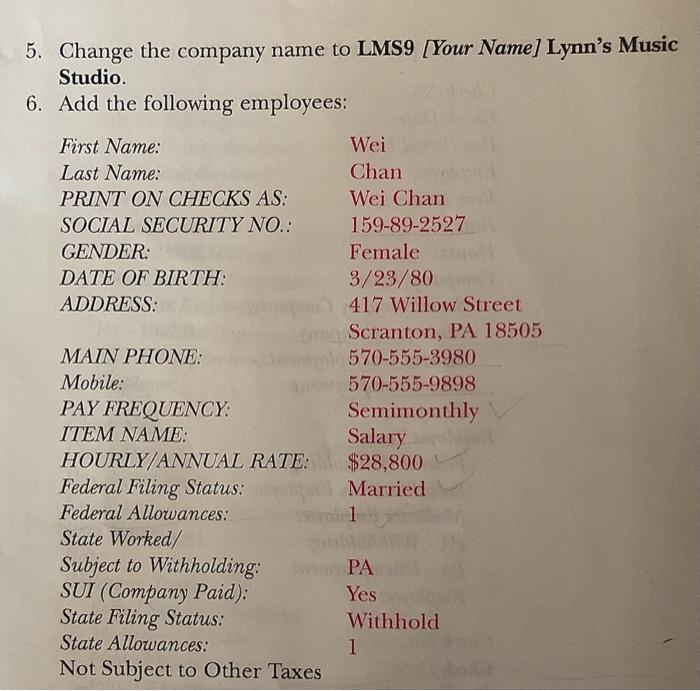

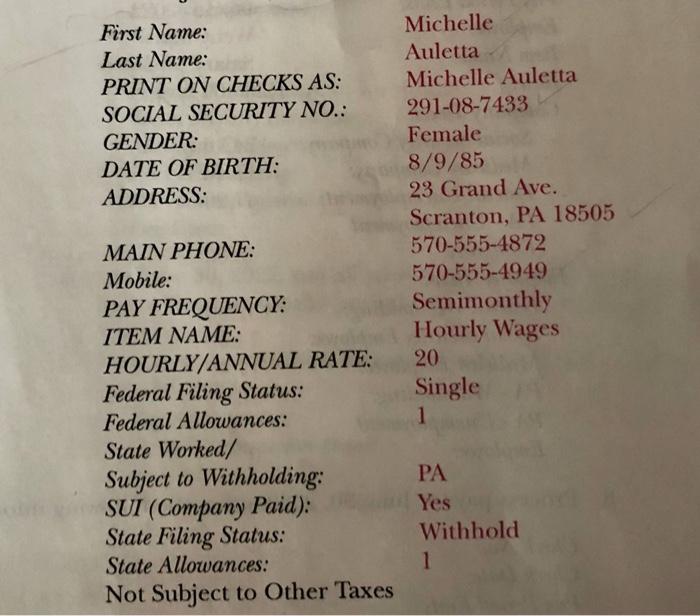

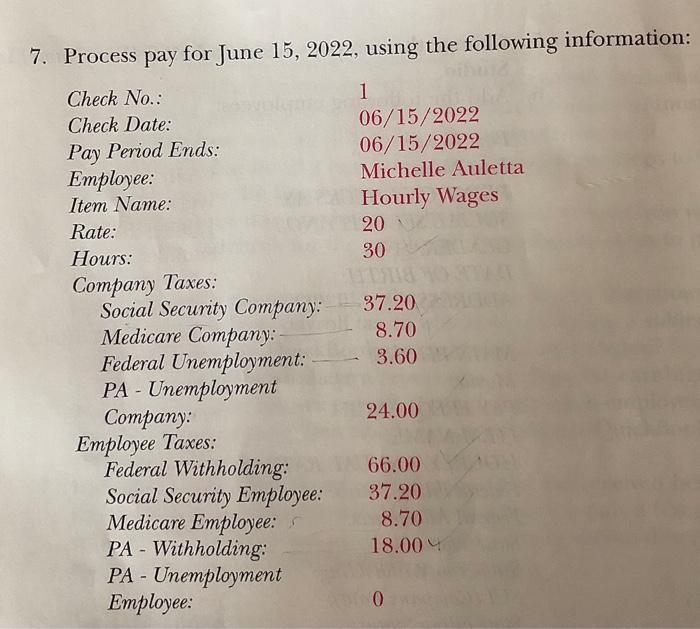

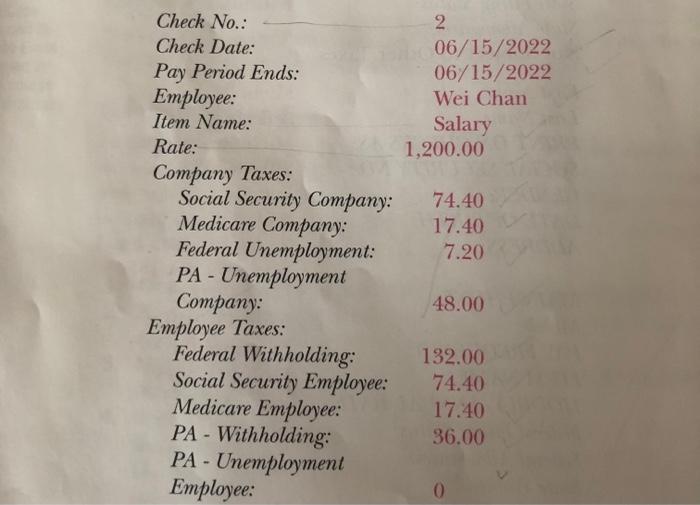

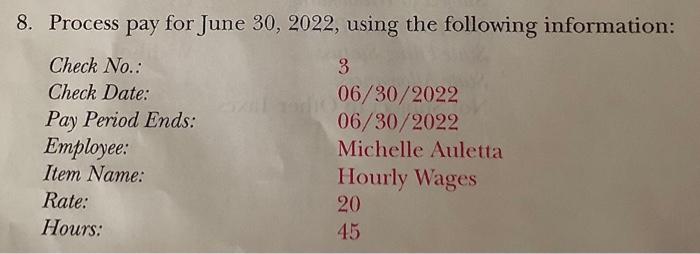

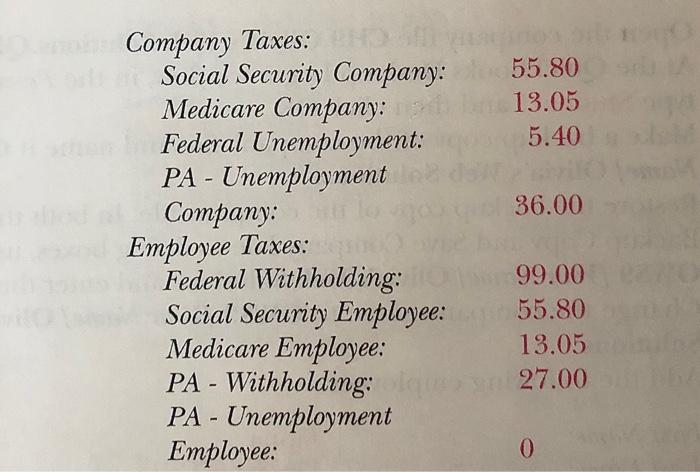

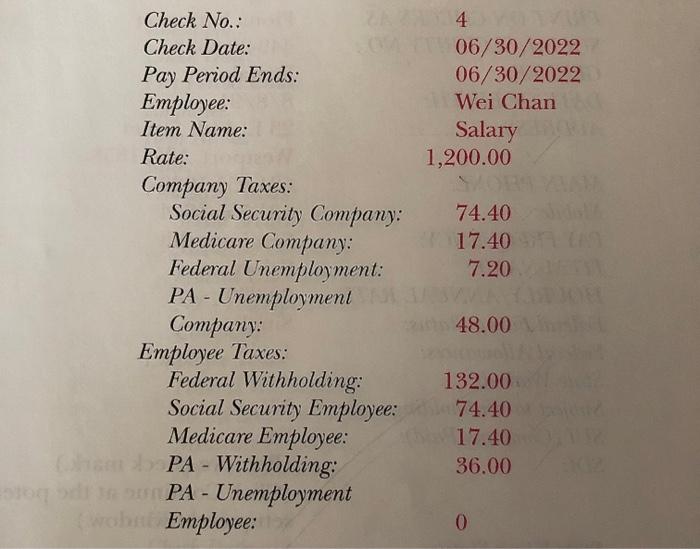

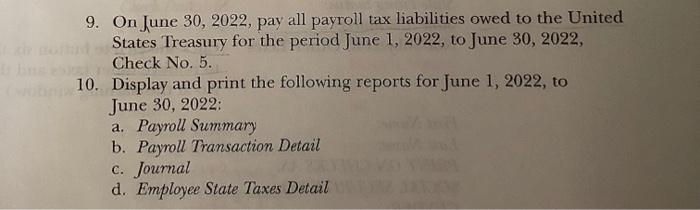

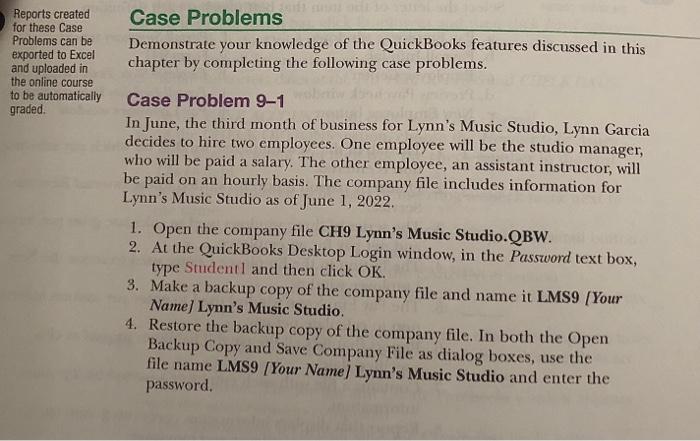

5. Change the company name to LMS9 / Your Name) Lynn's Music Studio 6. Add the following employees Fint Name Wei Est am: Chan PRINT ON CHECKS AS: Wri Chan SOCIAL SECURITY NO.: GENDER: Female DATE OF BIRTH: 3230 ADDRESS: 417 Willow Street Scranton PA18505 MAIN PHONE 570-555-10 Mobile 570-555-9898 PAY FREQUENCY: Semimonthly ITEM NAME Salary HOURLY/ANNUAL RATE: $28,800 Federal Filing Status: Married Federal Allowance State Worked/ Subject to Withholding PA SUT (Company Paid): Yes State Filing Status: Withhold State Allowances: Not Subject to Other Taxes First Name: Michelle Last Name: Aule PRINT ON CHECKS AS: Michelle Auleta SOCIAL SECURITY NO.: 291-08-74133 GENDER: Female DATE OF BIRTH: 8/9/85 ADDRESS: 23 Grand Ave Scranton, PA 18505 MAIN PHONE 870-335-1872 Mobile 570-535-1919 PAY FREQUENCY: Sammonthly ITEM NAME: Hourly War HOUR.Y/ANNUAL RATE Federal Filing Status Single Federal Allowances: State Worked PA Subject to Withholdings SUT (Company Pand); With State Filling State State Allow Not Subject to Other Taxes 7. Process pay for June 15, 2022, esing the following information Chart Check Pod Einde Employee Sichelle Anletta in Name How Rate How Company Times Social Security Company 720 Medicare Company TO Fedmal nem 60 PA - Unemployment Company 2000 Employer Tax Federal Withouting Social Security Empire 720 Medicare Employer -70 - Withholding PA - Unemployment Employer Chinc No 2 Check Date: 06/15/2002 Pay Period Ends 13022 Employee Wei Cha Item Name Salary Rate Company Taxes: Social Security Company Medicare Company Federal Unemployment PA - Unemployment Company: 18.00 Employer Tor Federal Withholding Social Security Employer 74.0 Medicare Employee IT. PA-Withholding PA. Employment Employee 8. Proces pay for June 30, 2022 using the following information: Chird No. Check wie Pay Prod End Empo Mbelle I am Hout Wawr Ralr Hours Company Taxes: Social Security Company: 59.80 Medicare Company 13.03 Federal Unemployment: PA - Unemployment Company 36,00 Employee Taxes: Federal Withholding 99.00 Social Security Employee: sa 80 Medicare Employees PA - Withholding 27.00 PA - Unemployment Employee 0 Check No: 4 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee Wei Chan Item Name: Salary Rate 1.200,00 Company Taxes: Social Security Company: 74.40 Medicare Company 17.40 Federal Unemployment 7.20 PA - Unemployment Company: -18.00 Employee Taxes: Federal Withholding 132.00 Social Security Employee: 7110 Medicare Employer: 17.10 PA - Withholding 36.00 PA - Unemployment Employee 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1. 2022, to June 30, 2022. Check No. 5 10. Display and print the following reports for June 1, 2022, to June 30, 2022 a Paymll Summary b. Payroll Transaction Detail . Journal d. Employee State Toxas Detail 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio. 6. Add the following employees: First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Wei Chan Wei Chan 159-89-2527 Female 3/23/80 417 Willow Street Scranton, PA 18505 570-555-3980 570-555-9898 Semimonthly Salary $28,800 Married MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Michelle Auletta Michelle Auletta 291-08-7433 Female 8/9/85 23 Grand Ave. Scranton, PA 18505 570-555-4872 570-555-4949 Semimonthly Hourly Wages 20 Single 1 MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 7. Process pay for June 15, 2022, using the following information: 1 06/15/2022 06/15/2022 Michelle Auletta Hourly Wages 20 30 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 37.20 8.70 3.60 24.00 66.00 37.20 8.70 18.00 2 06/15/2022 06/15/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 8. Process pay for June 30, 2022, using the following information: Check No.: 3 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Michelle Auletta Item Name: Hourly Wages Rate: 20 Hours: 45 55.80 13.05 5.40 36.00 Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 99.00 55.80 13.05 27.00 0 4. 06/30/2022 06/30/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment on Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022: a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail 5. Change the company name to LMS9 [Your Name) Lynn's Music Studio 6. Add the following employees First Nam Wei Last Name: Chan PRINT ON CHECKS AS Me Chan SOCIAL SECURITY NO.: 1892027 GENDER: Female DATE OF BIRTH SO ADDRESS: 417 Willow Street Santon, PA 1850 MAIN PHONE 070-350 Mobile 570-15 PAY FREQUENCY Semimonthly TIEM NAME Salary HOURLY/ANNUAL RATE $28.800 Federal Filing Status: Married Federal Allowances State Worked/ Subject to Withholding PA SUI (Company Paid Yes State Filing Status Withhold State Allonne 1 Not Subject to Other Taxes First Name: Michelle Last Name Aulett PRINT ON CHECKS AS Michelle Anletta SOCIAL SECURITY NO.: 20140718 GENDER: Female DATE OF BIRTH: 80/80 ADDRESS: 2 Grund Ave Scranton. PA 18505 MAIN PHONE: 570-555-1872 Mobile 70-355-1919 PAY FREQUENCY: Seminonthly ITEM NAME: Hourly Wages HOURLY/ANNUAL RATE 20 Federal Filing Status: Single Federal Allowances: State Vorked/ Subject to Withholding PA SUT (Company Paid): State Filing Status Withhold State Allowance 1 Not Subject to Other Taxes 720 7. Proces pay for June 15, 2009, using the following information Check No Check Tate 15200 Pay Period Ends 015/2021 Employee Michelle Anett Item Name Hourly Waters Rare Company Take Social Security Company Medicare Company 8,70 Peveral Unemployment: PA - Unemployment Company 21.00 Employer Taxe Federal Withholding 00 Social Security Employer 37.20 Medicare Employer 8.70 PA - Withholding 1800 PA Unemployment Emplo Check No. Chind Date 0615202 Pay Period Ends 06 15/2022 Employee Wei Chan Item Name: Salary Rate: 1.200,00 Company Taxes: Social Security Company 74.10 Medican Company 17.10 Federal Unemployment: 7.20 PA - Unemployment Company: -18.00 Employee Taxes: Federal Withholding 192.00 Social Security Employer: 74.10 Medicare Employees 17:10 PA - Withholding 36.00 PA - Unemployment Employees 8. Process pay for June 30, 2022, using the following information: Check No: Check Date 06/30/2020 Pay Period Ends: 06/30/2020 Employee Michielle Auletta Item Name: Hourly Wages Rate: 20 Hours: 0 0 Company Taxes: Social Security Company 5580 Medicare Company: 13.05 Federal Unemployment: 5.10 PA - Unemployment Company: 36.00 Employer Taxes: Federal Withholding 99.00 Social Security Employee: 55.80 Medicare Employee 19.05 PA - Withholding 27.00 PA - Unemployment Employee Check No.: 1 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Wei Chan Tem Name: Salary Rate: 1.200,00 Company Taxes: Social Security Company: 74.10 Medicare Company: 17.10 Federal Unemployment: 7.20 PA - Unemployment Company: 18.00 Employee Taxes: Federal Withholding: 192.00 Social Security Employer: 74.10 Medicare Employee: 17.40 PA - Withholding: 36.00 PA - Unemployment Employee: 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022. to June 30, 2022 a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio. 6. Add the following employees: First Name: Wei Last Name: Chan PRINT ON CHECKS AS: Wei Chan SOCIAL SECURITY NO.: 159-89-2527 GENDER: Female DATE OF BIRTH: 3/23/80 ADDRESS: 417 Willow Street Scranton, PA 18505 MAIN PHONE: 570-555-3980 Mobile: 570-555-9898 PAY FREQUENCY: Semimonthly ITEM NAME: Salary HOURLY/ANNUAL RATE: $28,800 Federal Filing Status: Married Federal Allowances: State Worked/ Subject to Withholding: PA SUI (Company Paid): Yes State Filing Status: Withhold State Allowances: 1 Not Subject to Other Taxes First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Michelle Auletta Michelle Auletta 291-08-7433 Female 8/9/85 23 Grand Ave. Scranton, PA 18505 570-555-4872 570-555-4949 Semimonthly Hourly Wages 20 Single 1 MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 7. Process pay for June 15, 2022, using the following information: 1 06/15/2022 06/15/2022 Michelle Auletta Hourly Wages 20 30 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 37.20 8.70 - 3.60 24.00 66.00 37.20 8.70 18.00 0 2 06/15/2022 06/15/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 8. Process pay for June 30, 2022, using the following information: Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: 3 06/30/2022 06/30/2022 Michelle Auletta Hourly Wages 20 45 55.80 13.05 5.40 36.00 Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding PA - Unemployment Employee: 99.00 55.80 13.05 27.00 0 4 06/30/2022 06/30/2022 Wei Chan Salary 1,200.00 Check No.. Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022: a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail Reports created for these Case Problems can be exported to Excel and uploaded in the online course to be automatically graded Case Problems Demonstrate your knowledge of the QuickBooks features discussed in this chapter by completing the following case problems. Case Problem 9-1 In June, the third month of business for Lynn's Music Studio, Lynn Garcia decides to hire two employees. One employee will be the studio manager, who will be paid a salary. The other employee, an assistant instructor, will be paid on an hourly basis. The company file includes information for Lynn's Music Studio as of June 1, 2022. 1. Open the company file CH9 Lynn's Music Studio.QBW. 2. At the QuickBooks Desktop Login window, in the Password text box, type Student and then click OK. 3. Make a backup copy of the company file and name it LMS9 [Your Name) Lynn's Music Studio. 4. Restore the backup copy of the company file. In both the Open Backup Copy and Save Company File as dialog boxes, use the file name LMS9 [Your Name) Lynn's Music Studio and enter the password. 5. Change the company name to LMS9 / Your Name) Lynn's Music Studio 6. Add the following employees Fint Name Wei Est am: Chan PRINT ON CHECKS AS: Wri Chan SOCIAL SECURITY NO.: GENDER: Female DATE OF BIRTH: 3230 ADDRESS: 417 Willow Street Scranton PA18505 MAIN PHONE 570-555-10 Mobile 570-555-9898 PAY FREQUENCY: Semimonthly ITEM NAME Salary HOURLY/ANNUAL RATE: $28,800 Federal Filing Status: Married Federal Allowance State Worked/ Subject to Withholding PA SUT (Company Paid): Yes State Filing Status: Withhold State Allowances: Not Subject to Other Taxes First Name: Michelle Last Name: Aule PRINT ON CHECKS AS: Michelle Auleta SOCIAL SECURITY NO.: 291-08-74133 GENDER: Female DATE OF BIRTH: 8/9/85 ADDRESS: 23 Grand Ave Scranton, PA 18505 MAIN PHONE 870-335-1872 Mobile 570-535-1919 PAY FREQUENCY: Sammonthly ITEM NAME: Hourly War HOUR.Y/ANNUAL RATE Federal Filing Status Single Federal Allowances: State Worked PA Subject to Withholdings SUT (Company Pand); With State Filling State State Allow Not Subject to Other Taxes 7. Process pay for June 15, 2022, esing the following information Chart Check Pod Einde Employee Sichelle Anletta in Name How Rate How Company Times Social Security Company 720 Medicare Company TO Fedmal nem 60 PA - Unemployment Company 2000 Employer Tax Federal Withouting Social Security Empire 720 Medicare Employer -70 - Withholding PA - Unemployment Employer Chinc No 2 Check Date: 06/15/2002 Pay Period Ends 13022 Employee Wei Cha Item Name Salary Rate Company Taxes: Social Security Company Medicare Company Federal Unemployment PA - Unemployment Company: 18.00 Employer Tor Federal Withholding Social Security Employer 74.0 Medicare Employee IT. PA-Withholding PA. Employment Employee 8. Proces pay for June 30, 2022 using the following information: Chird No. Check wie Pay Prod End Empo Mbelle I am Hout Wawr Ralr Hours Company Taxes: Social Security Company: 59.80 Medicare Company 13.03 Federal Unemployment: PA - Unemployment Company 36,00 Employee Taxes: Federal Withholding 99.00 Social Security Employee: sa 80 Medicare Employees PA - Withholding 27.00 PA - Unemployment Employee 0 Check No: 4 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee Wei Chan Item Name: Salary Rate 1.200,00 Company Taxes: Social Security Company: 74.40 Medicare Company 17.40 Federal Unemployment 7.20 PA - Unemployment Company: -18.00 Employee Taxes: Federal Withholding 132.00 Social Security Employee: 7110 Medicare Employer: 17.10 PA - Withholding 36.00 PA - Unemployment Employee 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1. 2022, to June 30, 2022. Check No. 5 10. Display and print the following reports for June 1, 2022, to June 30, 2022 a Paymll Summary b. Payroll Transaction Detail . Journal d. Employee State Toxas Detail 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio. 6. Add the following employees: First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Wei Chan Wei Chan 159-89-2527 Female 3/23/80 417 Willow Street Scranton, PA 18505 570-555-3980 570-555-9898 Semimonthly Salary $28,800 Married MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Michelle Auletta Michelle Auletta 291-08-7433 Female 8/9/85 23 Grand Ave. Scranton, PA 18505 570-555-4872 570-555-4949 Semimonthly Hourly Wages 20 Single 1 MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 7. Process pay for June 15, 2022, using the following information: 1 06/15/2022 06/15/2022 Michelle Auletta Hourly Wages 20 30 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 37.20 8.70 3.60 24.00 66.00 37.20 8.70 18.00 2 06/15/2022 06/15/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 8. Process pay for June 30, 2022, using the following information: Check No.: 3 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Michelle Auletta Item Name: Hourly Wages Rate: 20 Hours: 45 55.80 13.05 5.40 36.00 Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 99.00 55.80 13.05 27.00 0 4. 06/30/2022 06/30/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment on Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022: a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail 5. Change the company name to LMS9 [Your Name) Lynn's Music Studio 6. Add the following employees First Nam Wei Last Name: Chan PRINT ON CHECKS AS Me Chan SOCIAL SECURITY NO.: 1892027 GENDER: Female DATE OF BIRTH SO ADDRESS: 417 Willow Street Santon, PA 1850 MAIN PHONE 070-350 Mobile 570-15 PAY FREQUENCY Semimonthly TIEM NAME Salary HOURLY/ANNUAL RATE $28.800 Federal Filing Status: Married Federal Allowances State Worked/ Subject to Withholding PA SUI (Company Paid Yes State Filing Status Withhold State Allonne 1 Not Subject to Other Taxes First Name: Michelle Last Name Aulett PRINT ON CHECKS AS Michelle Anletta SOCIAL SECURITY NO.: 20140718 GENDER: Female DATE OF BIRTH: 80/80 ADDRESS: 2 Grund Ave Scranton. PA 18505 MAIN PHONE: 570-555-1872 Mobile 70-355-1919 PAY FREQUENCY: Seminonthly ITEM NAME: Hourly Wages HOURLY/ANNUAL RATE 20 Federal Filing Status: Single Federal Allowances: State Vorked/ Subject to Withholding PA SUT (Company Paid): State Filing Status Withhold State Allowance 1 Not Subject to Other Taxes 720 7. Proces pay for June 15, 2009, using the following information Check No Check Tate 15200 Pay Period Ends 015/2021 Employee Michelle Anett Item Name Hourly Waters Rare Company Take Social Security Company Medicare Company 8,70 Peveral Unemployment: PA - Unemployment Company 21.00 Employer Taxe Federal Withholding 00 Social Security Employer 37.20 Medicare Employer 8.70 PA - Withholding 1800 PA Unemployment Emplo Check No. Chind Date 0615202 Pay Period Ends 06 15/2022 Employee Wei Chan Item Name: Salary Rate: 1.200,00 Company Taxes: Social Security Company 74.10 Medican Company 17.10 Federal Unemployment: 7.20 PA - Unemployment Company: -18.00 Employee Taxes: Federal Withholding 192.00 Social Security Employer: 74.10 Medicare Employees 17:10 PA - Withholding 36.00 PA - Unemployment Employees 8. Process pay for June 30, 2022, using the following information: Check No: Check Date 06/30/2020 Pay Period Ends: 06/30/2020 Employee Michielle Auletta Item Name: Hourly Wages Rate: 20 Hours: 0 0 Company Taxes: Social Security Company 5580 Medicare Company: 13.05 Federal Unemployment: 5.10 PA - Unemployment Company: 36.00 Employer Taxes: Federal Withholding 99.00 Social Security Employee: 55.80 Medicare Employee 19.05 PA - Withholding 27.00 PA - Unemployment Employee Check No.: 1 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Wei Chan Tem Name: Salary Rate: 1.200,00 Company Taxes: Social Security Company: 74.10 Medicare Company: 17.10 Federal Unemployment: 7.20 PA - Unemployment Company: 18.00 Employee Taxes: Federal Withholding: 192.00 Social Security Employer: 74.10 Medicare Employee: 17.40 PA - Withholding: 36.00 PA - Unemployment Employee: 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022. to June 30, 2022 a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio. 6. Add the following employees: First Name: Wei Last Name: Chan PRINT ON CHECKS AS: Wei Chan SOCIAL SECURITY NO.: 159-89-2527 GENDER: Female DATE OF BIRTH: 3/23/80 ADDRESS: 417 Willow Street Scranton, PA 18505 MAIN PHONE: 570-555-3980 Mobile: 570-555-9898 PAY FREQUENCY: Semimonthly ITEM NAME: Salary HOURLY/ANNUAL RATE: $28,800 Federal Filing Status: Married Federal Allowances: State Worked/ Subject to Withholding: PA SUI (Company Paid): Yes State Filing Status: Withhold State Allowances: 1 Not Subject to Other Taxes First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Michelle Auletta Michelle Auletta 291-08-7433 Female 8/9/85 23 Grand Ave. Scranton, PA 18505 570-555-4872 570-555-4949 Semimonthly Hourly Wages 20 Single 1 MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 7. Process pay for June 15, 2022, using the following information: 1 06/15/2022 06/15/2022 Michelle Auletta Hourly Wages 20 30 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 37.20 8.70 - 3.60 24.00 66.00 37.20 8.70 18.00 0 2 06/15/2022 06/15/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 8. Process pay for June 30, 2022, using the following information: Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: 3 06/30/2022 06/30/2022 Michelle Auletta Hourly Wages 20 45 55.80 13.05 5.40 36.00 Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding PA - Unemployment Employee: 99.00 55.80 13.05 27.00 0 4 06/30/2022 06/30/2022 Wei Chan Salary 1,200.00 Check No.. Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022: a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail Reports created for these Case Problems can be exported to Excel and uploaded in the online course to be automatically graded Case Problems Demonstrate your knowledge of the QuickBooks features discussed in this chapter by completing the following case problems. Case Problem 9-1 In June, the third month of business for Lynn's Music Studio, Lynn Garcia decides to hire two employees. One employee will be the studio manager, who will be paid a salary. The other employee, an assistant instructor, will be paid on an hourly basis. The company file includes information for Lynn's Music Studio as of June 1, 2022. 1. Open the company file CH9 Lynn's Music Studio.QBW. 2. At the QuickBooks Desktop Login window, in the Password text box, type Student and then click OK. 3. Make a backup copy of the company file and name it LMS9 [Your Name) Lynn's Music Studio. 4. Restore the backup copy of the company file. In both the Open Backup Copy and Save Company File as dialog boxes, use the file name LMS9 [Your Name) Lynn's Music Studio and enter the password

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts