Question: Please do it as soon as possible because i have no time for submission Question 1: (2.5 credits) In a world of Modigliani and Miller

Please do it as soon as possible because i have no time for submission

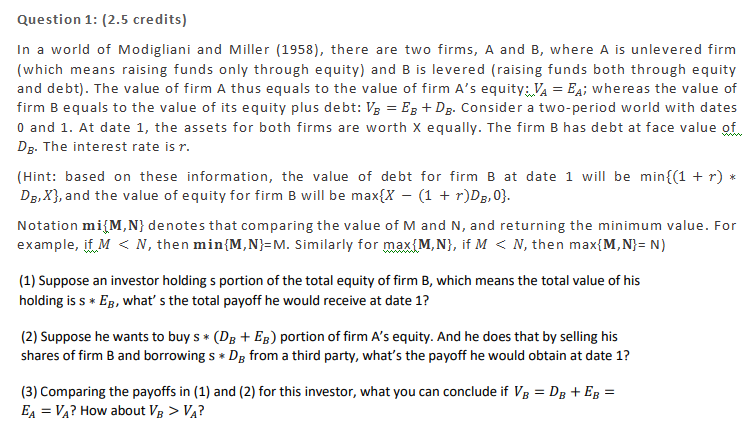

Question 1: (2.5 credits) In a world of Modigliani and Miller (1958), there are two firms, A and B, where A is unlevered firm (which means raising funds only through equity) and B is levered (raising funds both through equity and debt). The value of firm A thus equals to the value of firm A's equity: VA = EA; whereas the value of firm B equals to the value of its equity plus debt: Vg = Ep +DB. Consider a two-period world with dates 0 and 1. At date 1, the assets for both firms are worth X equally. The firm B has debt at face value of Ds. The interest rate is r. (Hint: based on these information, the value of debt for firm B at date 1 will be min{(1 + r) * DB,X), and the value of equity for firm B will be maxX - (1 + r) D3,0}. Notation mi{M,N} denotes that comparing the value of M and N, and returning the minimum value. For example, if M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts