Question: please do it asap 1. Business Equity Std Debt Equity Current Current Beta Deviation Firm Stock Value Price Kellogg 0.7 0.4 40% 60% $33 Ready-to-eat

please do it asap

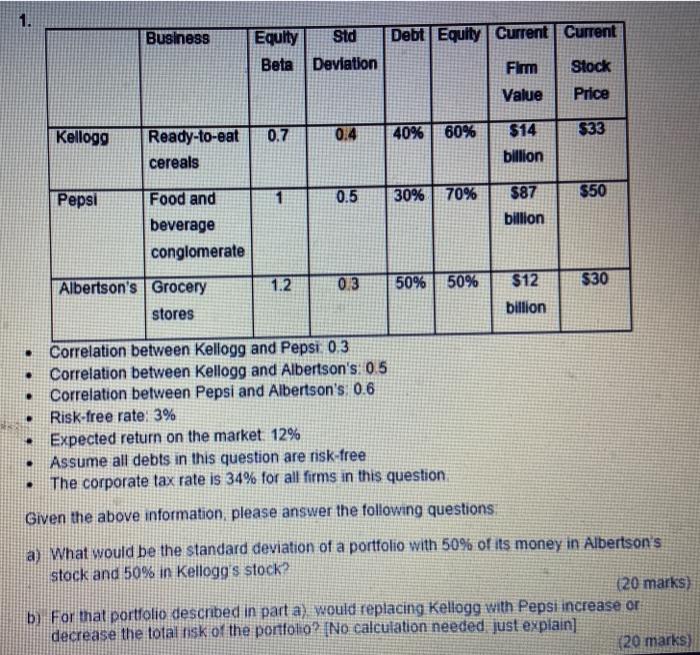

please do it asap1. Business Equity Std Debt Equity Current Current Beta Deviation Firm Stock Value Price Kellogg 0.7 0.4 40% 60% $33 Ready-to-eat cereals $14 billion Pepsi 1 0.5 $50 30% 70% $87 billion Food and beverage conglomerate 1.2 0.3 50% 50% $30 Albertson's Grocery stores $12 billion . . . Correlation between Kellogg and Pepsi 0.3 Correlation between Kellogg and Albertson's: 0.5 Correlation between Pepsi and Albertson's 0.6 Risk-free rate: 3% Expected return on the market. 12% Assume all debts in this question are risk-free The corporate tax rate is 34% for all firms in this question Given the above information, please answer the following questions . a) What would be the standard deviation of a portfolio with 50% of its money in Albertson's stock and 50% in Kellogg's stock? (20 marks) b For that portfolio described in part a) would replacing Kellogg with Pepsi increase or decrease the total risk of the portfolio? [No calculation needed just explain] (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts