Question: please do it asap Echo Question 3 The following data is related to three mutually exclusive investment projects: Project Project Project Charlie Delta () ()

please do it asap

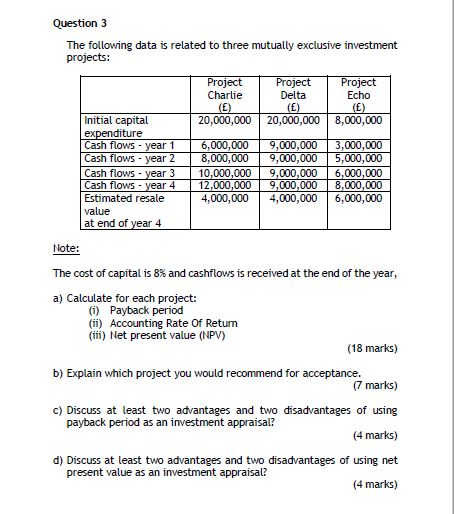

Echo Question 3 The following data is related to three mutually exclusive investment projects: Project Project Project Charlie Delta () () () Initial capital 20,000,000 20,000,000 8,000,000 expenditure Cash flows - year 1 6,000,000 9,000,000 3,000,000 Cash flows - year 2 8,000,000 9,000,000 5,000,000 Cash flows - year 3 10,000,000 9,000,000 6,000,000 Cash flows - year 4 12,000,000 9,000,000 8,000,000 Estimated resale 4,000,000 4,000,000 6,000,000 value at end of year 4 Note: The cost of capital is 8% and cashflows is received at the end of the year, a) Calculate for each project: (i) Payback period (ii) Accounting Rate Of Retum (iii) Net present value (NPV) (18 marks) b) Explain which project you would recommend for acceptance. (7 marks) c) Discuss at least two advantages and two disadvantages of using payback period as an investment appraisal? (4 marks) d) Discuss at least two advantages and two disadvantages of using net present value as an investment appraisal? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts