Question: . . please do it by above income statement and balance sheets Question 5 Calculate the 'Current Ratio' using the data from the Financial Statements

.

. please do it by above income statement and balance sheets

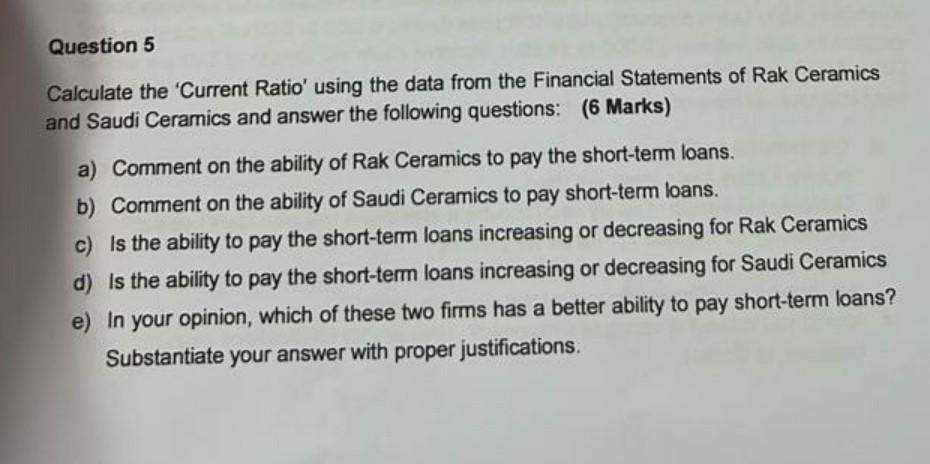

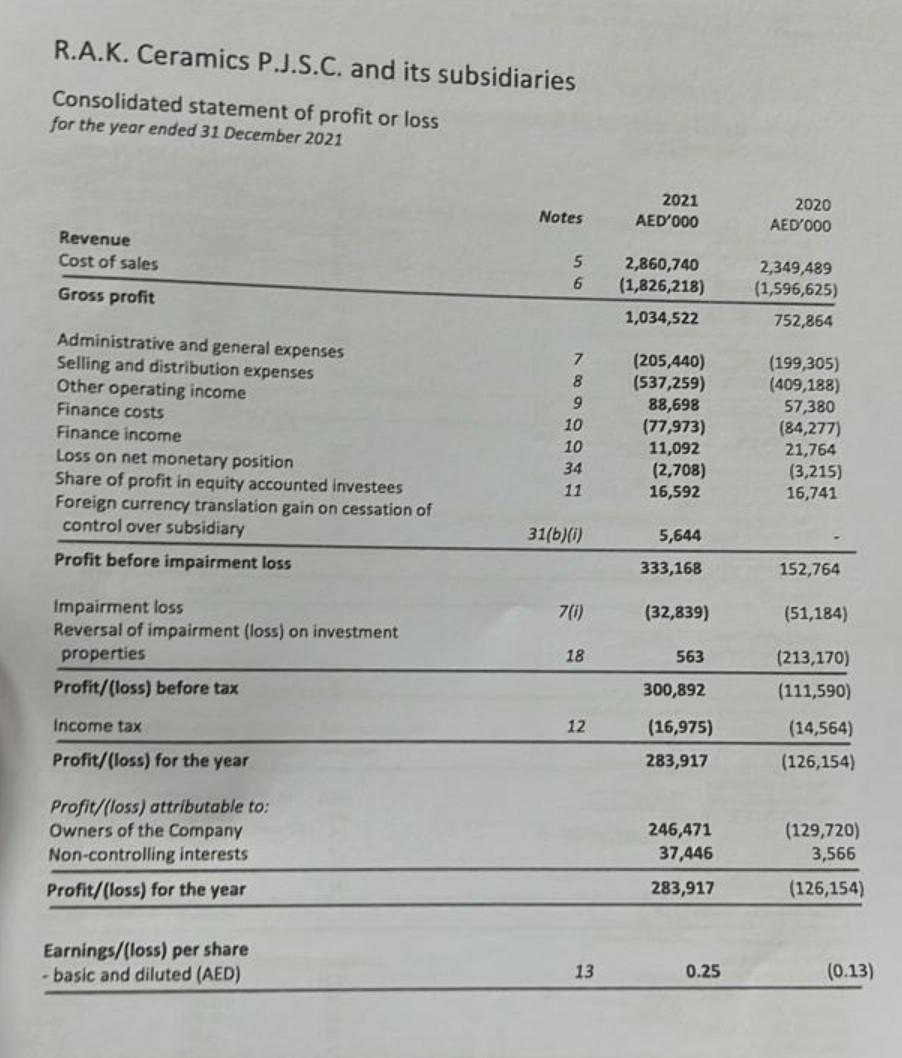

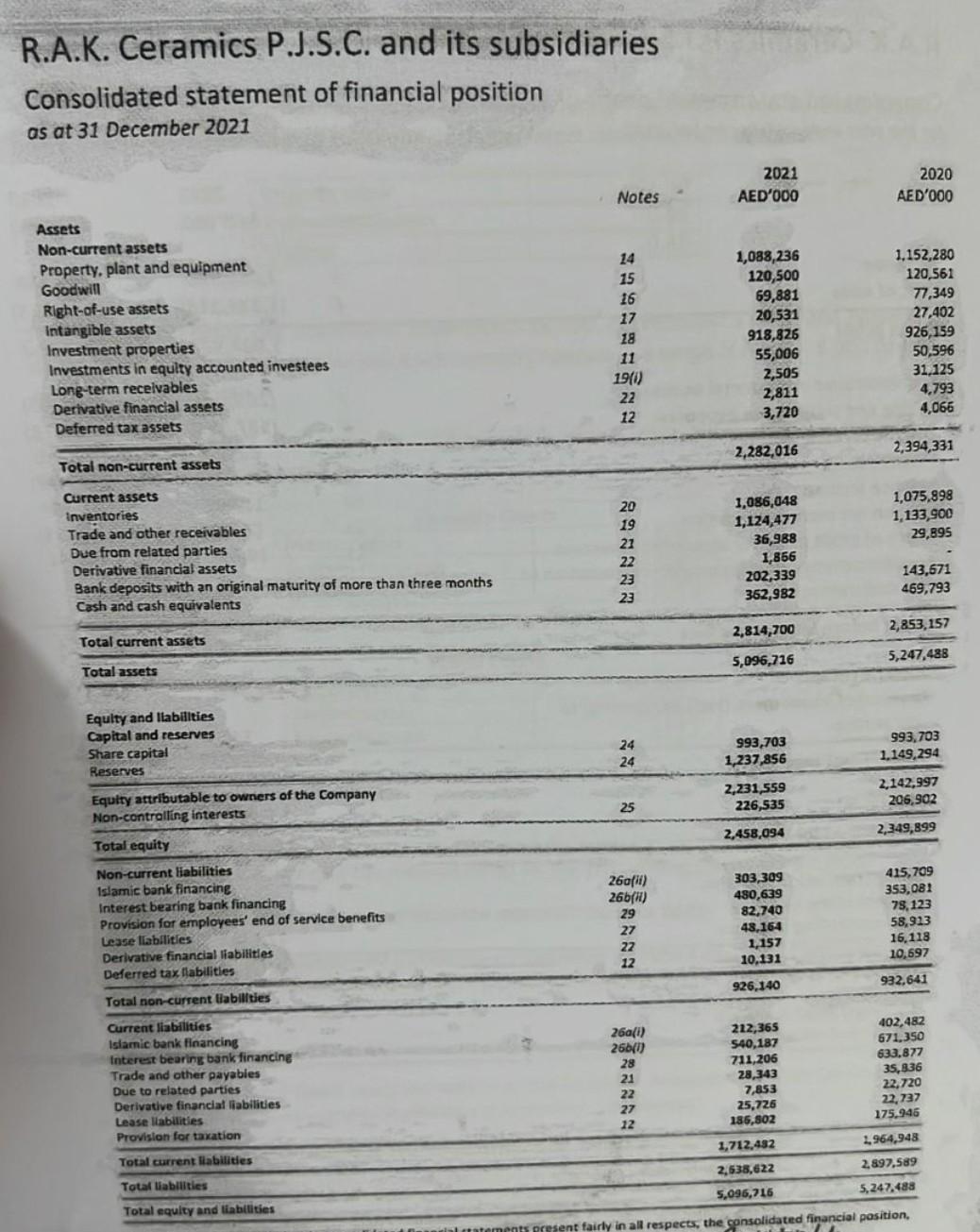

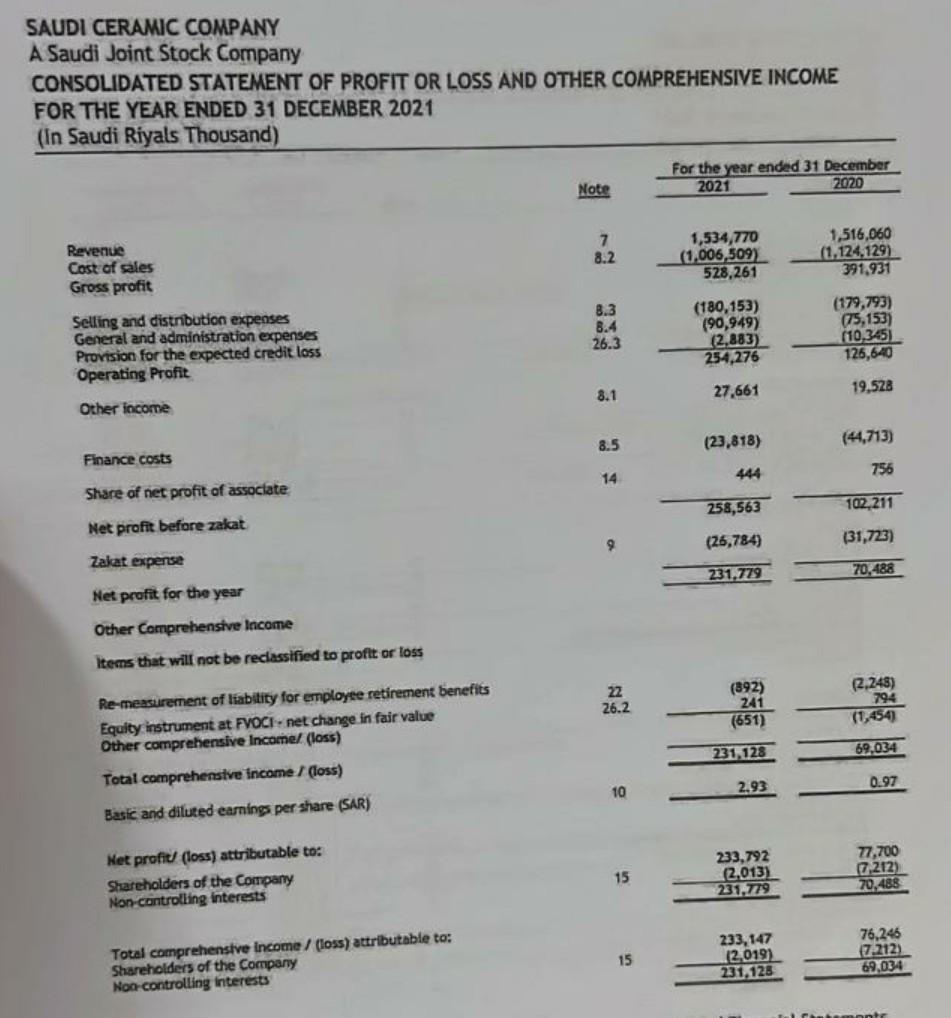

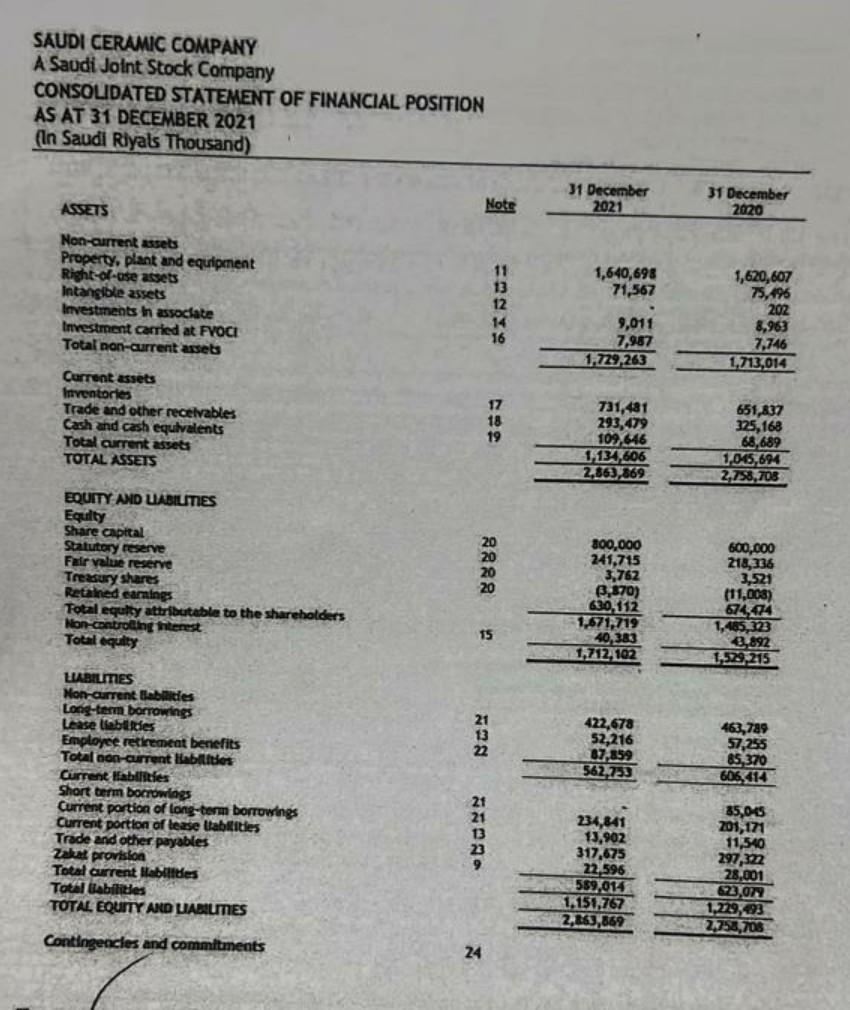

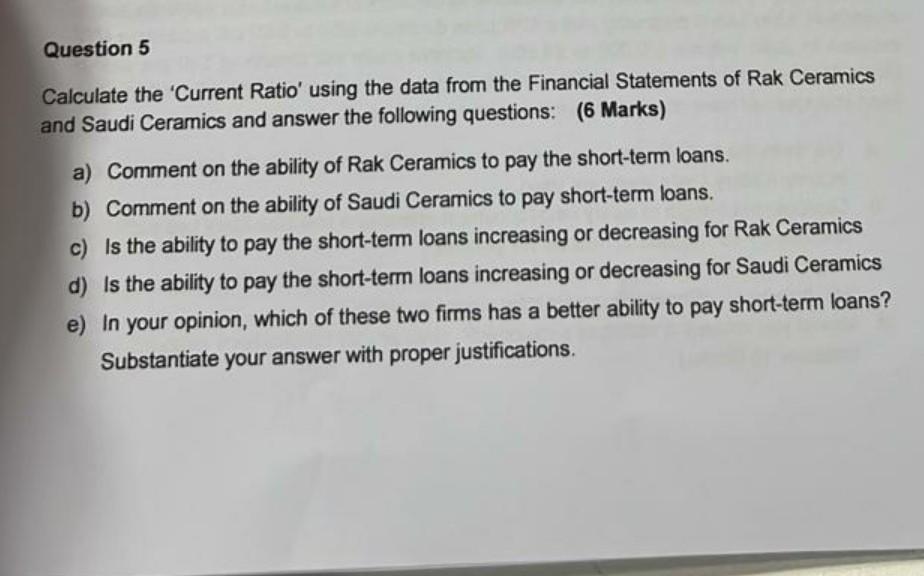

Question 5 Calculate the 'Current Ratio' using the data from the Financial Statements of Rak Ceramics and Saudi Ceramics and answer the following questions: (6 Marks) a) Comment on the ability of Rak Ceramics to pay the short-term loans. b) Comment on the ability of Saudi Ceramics to pay short-term loans. c) Is the ability to pay the short-term loans increasing or decreasing for Rak Ceramics d) Is the ability to pay the short-term loans increasing or decreasing for Saudi Ceramics e) In your opinion, which of these two firms has a better ability to pay short-term loans? Substantiate your answer with proper justifications. R.A.K. Ceramics P.J.S.C. and its subsidiaries Consolidated statement of profit or loss for the year ended 31 December 2021 R.A.K. Ceramics P.J.S.C. and its subsidiaries Ca1 as SAUDI CERAMIC COMPANY A Saudi Joint Stock Company SAUDI CERAMIC COMPANY A Saudi Joint Stock Company CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 Calculate the 'Current Ratio' using the data from the Financial Statements of Rak Ceramics and Saudi Ceramics and answer the following questions: (6 Marks) a) Comment on the ability of Rak Ceramics to pay the short-term loans. b) Comment on the ability of Saudi Ceramics to pay short-term loans. c) Is the ability to pay the short-term loans increasing or decreasing for Rak Ceramics d) Is the ability to pay the short-term loans increasing or decreasing for Saudi Ceramics e) In your opinion, which of these two firms has a better ability to pay short-term loans? Substantiate your answer with proper justifications

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts