Question: PLEASE Do it by hand, please do not use EXCEL or any other software!! PLEASE Do it by hand, please do not use EXCEL or

PLEASE Do it by hand, please do not use EXCEL or any other software!!

PLEASE Do it by hand, please do not use EXCEL or any other software!!

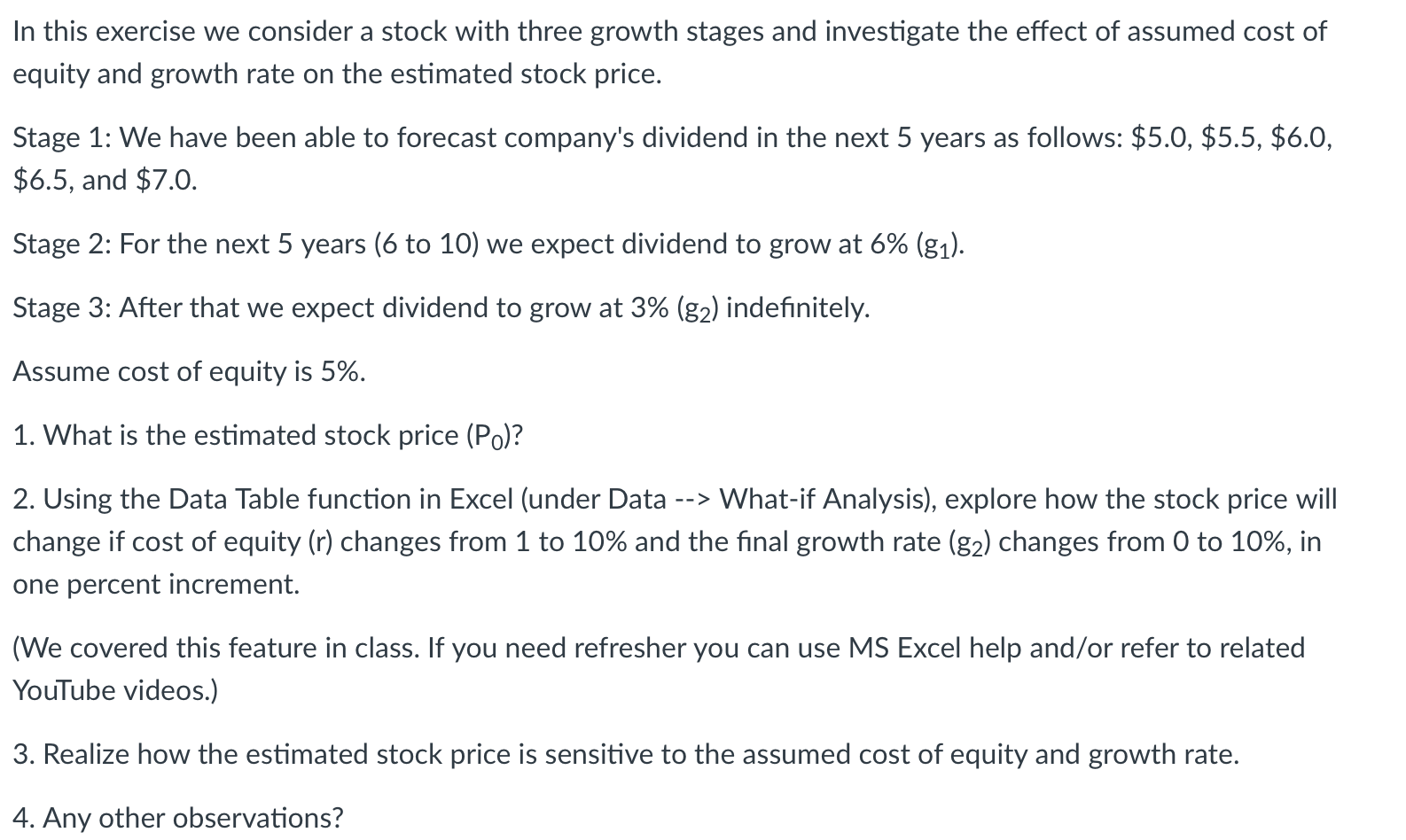

In this exercise we consider a stock with three growth stages and investigate the effect of assumed cost of equity and growth rate on the estimated stock price. Stage 1: We have been able to forecast company's dividend in the next 5 years as follows: $5.0,$5.5,$6.0, $6.5, and $7.0. Stage 2: For the next 5 years (6 to 10) we expect dividend to grow at 6%(g1). Stage 3: After that we expect dividend to grow at 3%(g2) indefinitely. Assume cost of equity is 5%. 1. What is the estimated stock price (P0) ? 2. Using the Data Table function in Excel (under Data --> What-if Analysis), explore how the stock price will change if cost of equity (r) changes from 1 to 10% and the final growth rate (g2) changes from 0 to 10%, in one percent increment. (We covered this feature in class. If you need refresher you can use MS Excel help and/or refer to related YouTube videos.) 3. Realize how the estimated stock price is sensitive to the assumed cost of equity and growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts