Question: please do it carefully. this question is very important to me PART B (Answer all 4 questions, Total 70 marks] QUESTION B-1 [20 marks] You

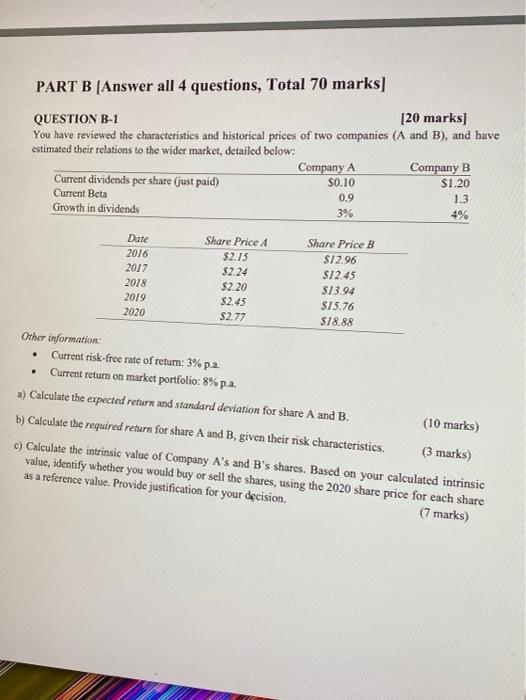

PART B (Answer all 4 questions, Total 70 marks] QUESTION B-1 [20 marks] You have reviewed the characteristics and historical prices of two companies (A and B), and have estimated their relations to the wider market, detailed below: Company A Company B Current dividends per share (just paid) S0.10 $1.20 Current Beta 0.9 1.3 Growth in dividends 3% 4% Date 2016 2017 2018 2019 2020 Share Price $2.15 $2.24 $2.20 $2.45 $2.77 Share Price B $12.96 $12.45 $13.94 $15.76 $18.88 . Other information: Current risk-free rate of return: 3% p.a. Current return on market portfolio: 8% p.a. a) Calculate the expected return and standard deviation for share A and B. (10 marks) b) Calculate the required return for share A and B, given their risk characteristics. (3 marks) c) Calculate the intrinsic value of Company A's and B's shares. Based on your calculated intrinsic value, identify whether you would buy or sell the shares, using the 2020 share price for each share as a reference value. Provide justification for your decision, (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts