Question: please do it correctly! this is very important! thank you sir! 800 QUESTION 2 a) A financial analyst for a manufacturer of BMV spare part

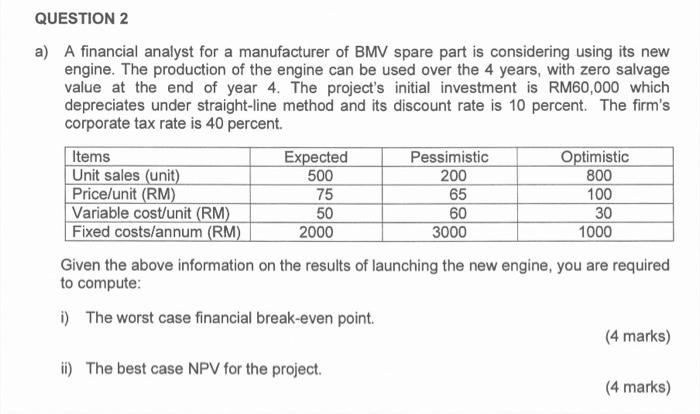

800 QUESTION 2 a) A financial analyst for a manufacturer of BMV spare part is considering using its new engine. The production of the engine can be used over the 4 years, with zero salvage value at the end of year 4. The project's initial investment is RM60,000 which depreciates under straight-line method and its discount rate is 10 percent. The firm's corporate tax rate is 40 percent. Items Expected Pessimistic Optimistic Unit sales (unit) 500 200 Price/unit (RM) 75 65 100 Variable cost/unit (RM) 50 60 Fixed costs/annum (RM) 2000 3000 1000 Given the above information on the results of launching the new engine, you are required to compute: i) The worst case financial break-even point. (4 marks) ii) The best case NPV for the project. (4 marks) 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts