Question: please do it correctly will upvote 4. Answer all parts of this question. (a) Explain what happens when an investor shorts a certain share and

please do it correctly will upvote

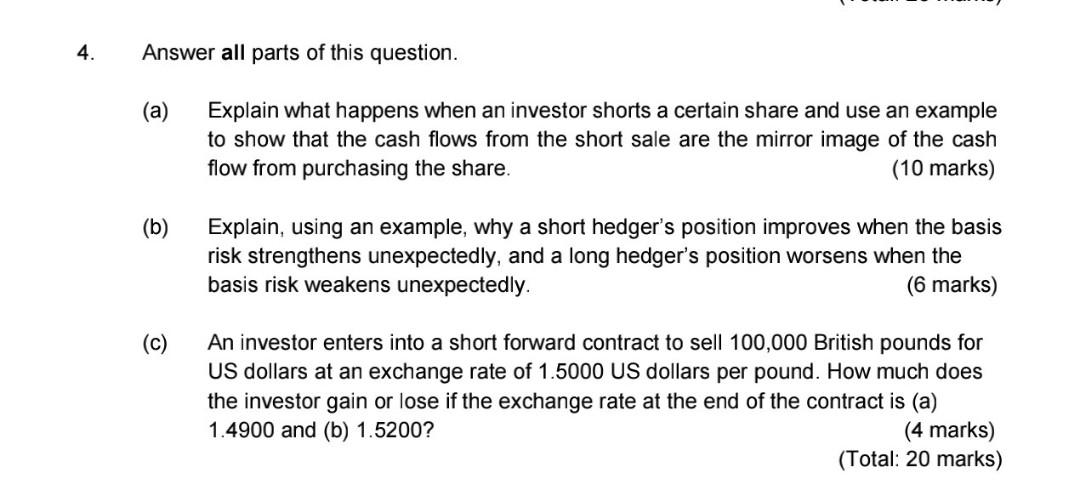

4. Answer all parts of this question. (a) Explain what happens when an investor shorts a certain share and use an example to show that the cash flows from the short sale are the mirror image of the cash flow from purchasing the share. (10 marks) (b) Explain, using an example, why a short hedger's position improves when the basis risk strengthens unexpectedly, and a long hedger's position worsens when the basis risk weakens unexpectedly. (6 marks) (c) An investor enters into a short forward contract to sell 100,000 British pounds for US dollars at an exchange rate of 1.5000 US dollars per pound. How much does the investor gain or lose if the exchange rate at the end of the contract is (a) 1.4900 and (b) 1.5200? (4 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts