Question: PLEASE DO IT FAST.. Sandra works for Shaw. In the evenings, Sandra also makes additional money by teaching piano lessons. In 2020 Shaw paid Sandra

PLEASE DO IT FAST..

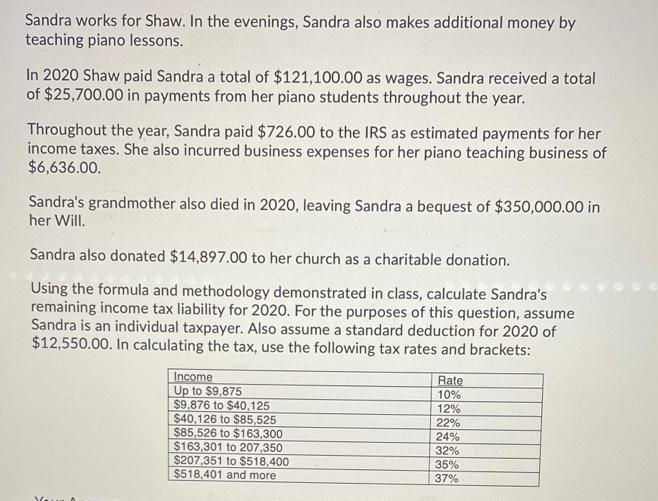

Sandra works for Shaw. In the evenings, Sandra also makes additional money by teaching piano lessons. In 2020 Shaw paid Sandra a total of $121,100.00 as wages. Sandra received a total of $25,700.00 in payments from her piano students throughout the year. Throughout the year, Sandra paid $726.00 to the IRS as estimated payments for her income taxes. She also incurred business expenses for her piano teaching business of $6,636,00 Sandra's grandmother also died in 2020, leaving Sandra a bequest of $350,000.00 in her Will. Sandra also donated $14,897.00 to her church as a charitable donation. Using the formula and methodology demonstrated in class, calculate Sandra's remaining income tax liability for 2020. For the purposes of this question, assume Sandra is an individual taxpayer. Also assume a standard deduction for 2020 of $12,550.00. In calculating the tax, use the following tax rates and brackets: Income Up to $9.875 $9,876 to $40.125 $40,126 to $85,525 $85,526 to $163,300 S163,301 to 207,350 $207,351 to $518,400 $518,401 and more Rate 10% 12% 22% 24% 32% 35% 37%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock