Question: Please do it follow the format I have posted in the picture, especially part a. I will definitely do a thumb up. Thanks a lot!

Please do it follow the format I have posted in the picture, especially part a. I will definitely do a thumb up. Thanks a lot!

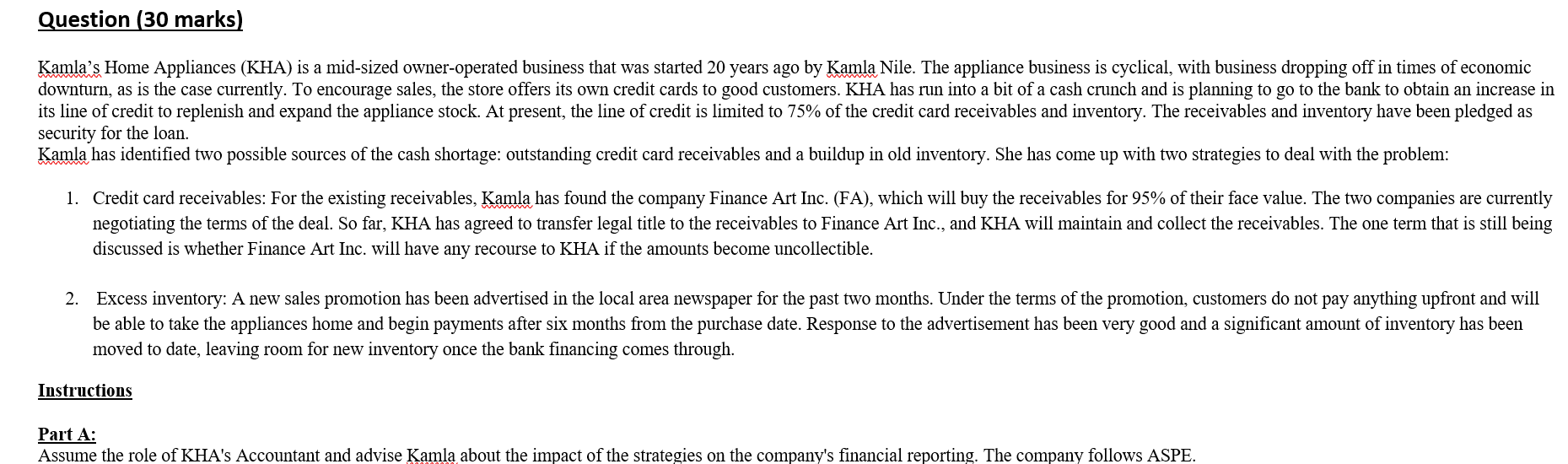

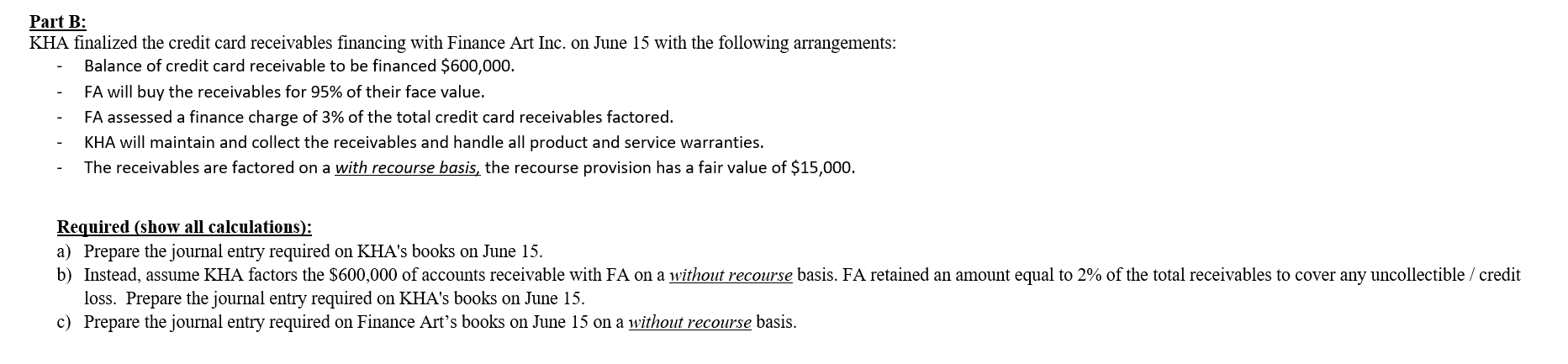

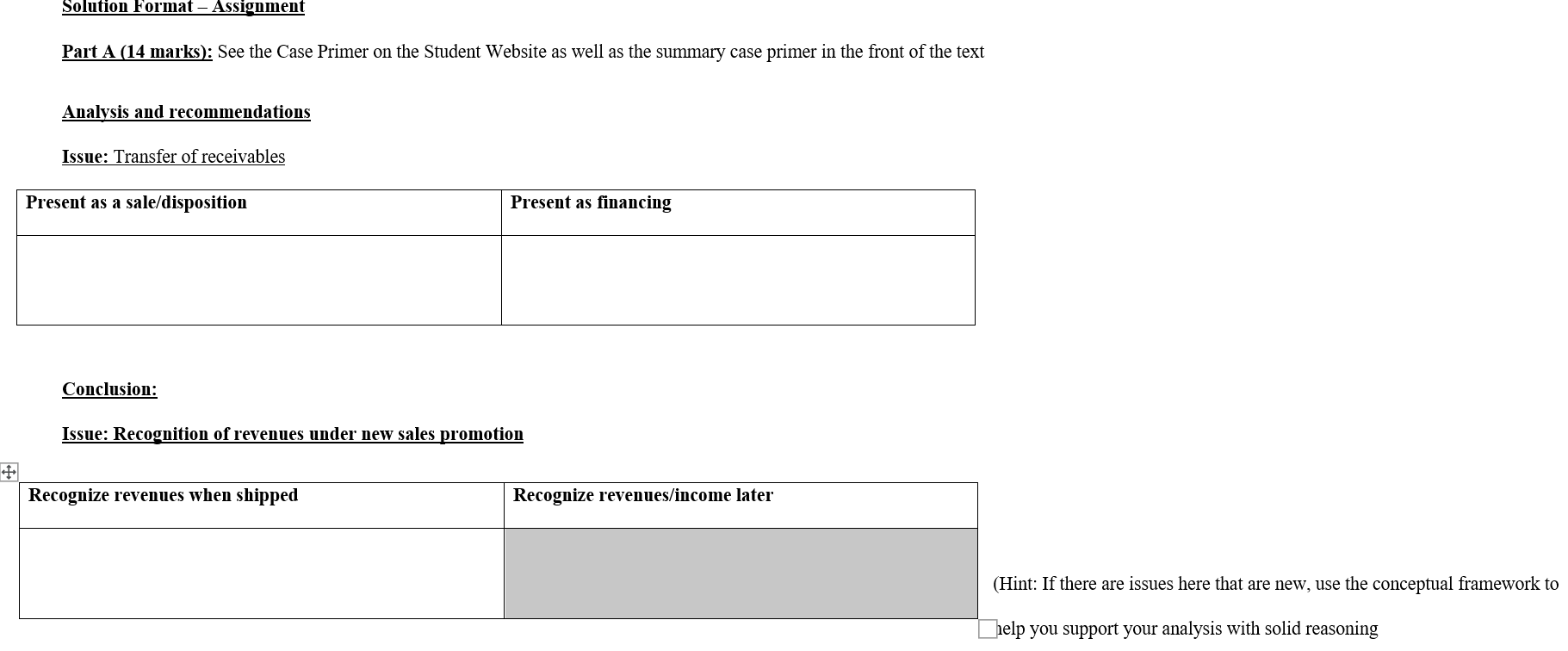

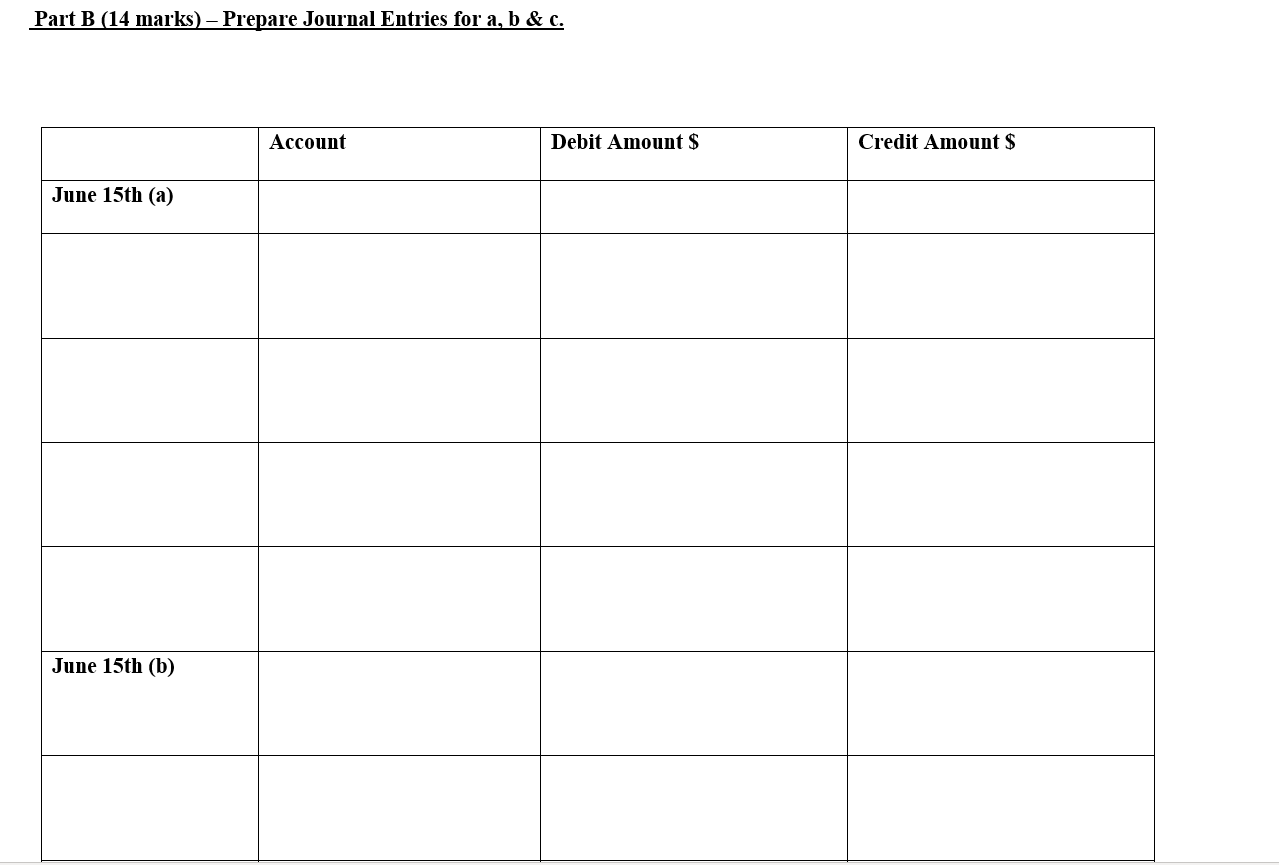

Kamla's Home Appliances (KHA) is a mid-sized owner-operated business that was started 20 years ago by Kamla Nile. The appliance business is cyclical, with business dropping off in times of economic downturn, as is the case currently. To encourage sales, the store offers its own credit cards to good customers. KHA has run into a bit of a cash crunch and is planning to go to the bank to obtain an increase in its line of credit to replenish and expand the appliance stock. At present, the line of credit is limited to 75% of the credit card receivables and inventory. The receivables and inventory have been pledged as security for the loan. Kamla has identified two possible sources of the cash shortage: outstanding credit card receivables and a buildup in old inventory. She has come up with two strategies to deal with the problem: 1. Credit card receivables: For the existing receivables, Kamla has found the company Finance Art Inc. (FA), which will buy the receivables for 95% of their face value. The two companies are currently negotiating the terms of the deal. So far, KHA has agreed to transfer legal title to the receivables to Finance Art Inc., and KHA will maintain and collect the receivables. The one term that is still being discussed is whether Finance Art Inc. will have any recourse to KHA if the amounts become uncollectible. 2. Excess inventory: A new sales promotion has been advertised in the local area newspaper for the past two months. Under the terms of the promotion, customers do not pay anything upfront and will be able to take the appliances home and begin payments after six months from the purchase date. Response to the advertisement has been very good and a significant amount of inventory has been moved to date, leaving room for new inventory once the bank financing comes through. Instructions Part B: KHA finalized the credit card receivables financing with Finance Art Inc. on June 15 with the following arrangements: - Balance of credit card receivable to be financed $600,000. - FA will buy the receivables for 95% of their face value. - FA assessed a finance charge of 3% of the total credit card receivables factored. - KHA will maintain and collect the receivables and handle all product and service warranties. - The receivables are factored on a with recourse basis, the recourse provision has a fair value of $15,000. Required (show all calculations): a) Prepare the journal entry required on KHA's books on June 15. loss. Prepare the journal entry required on KHA's books on June 15. c) Prepare the journal entry required on Finance Art's books on June 15 on a without recourse basis. Part A (14 marks): See the Case Primer on the Student Website as well as the summary case primer in the front of the text Analysis and recommendations Issue: Transfer of receivables Conclusion: Issue: Recognition of revenues under new sales promotion (Hint: If there are issues here that are new, use the conceptual framework to relp you support your analysis with solid reasoning Part B (14 marks) - Prepare Journal Entries for a, b \& c. June 15th (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts