Question: please do it in 10 minutes will upvote maining Time: 1 hour, 58 minutes, 16 seconds. mestion Completion Status: QUESTION 10 Consider that you have

please do it in 10 minutes will upvote

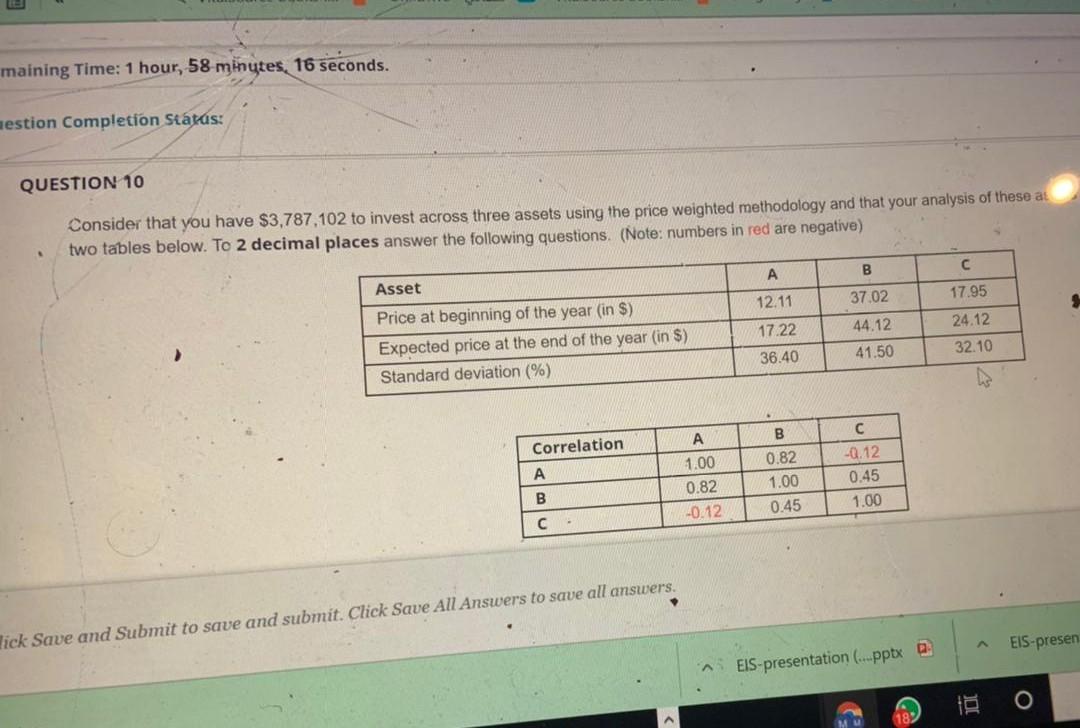

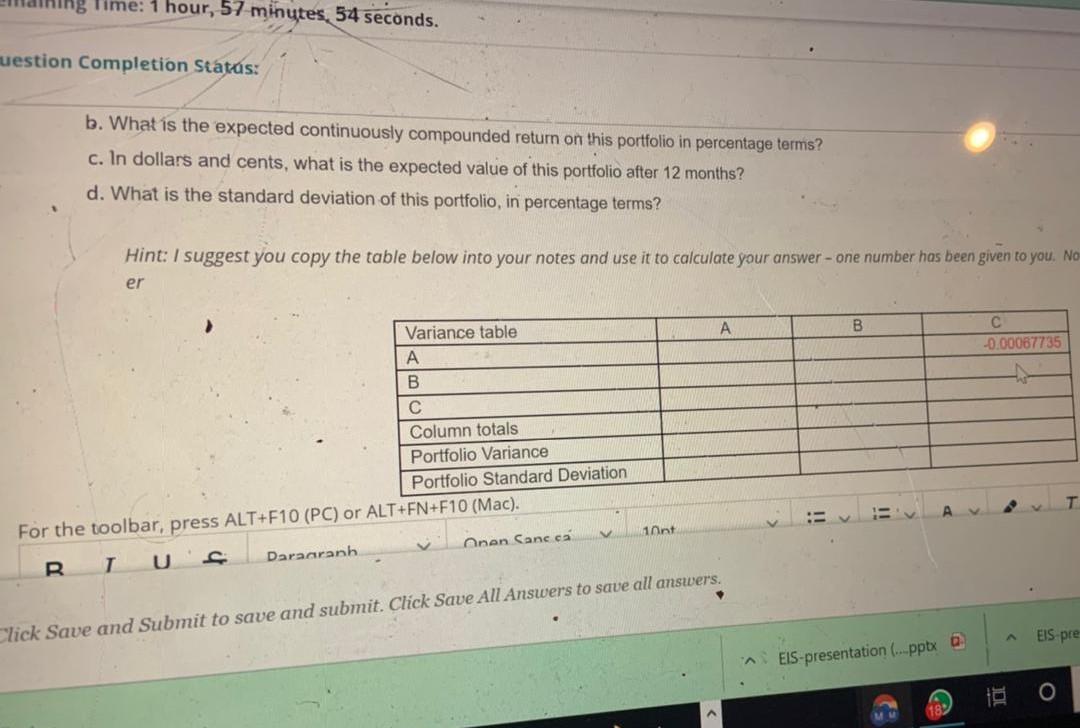

maining Time: 1 hour, 58 minutes, 16 seconds. mestion Completion Status: QUESTION 10 Consider that you have $3,787,102 to invest across three assets using the price weighted methodology and that your analysis of these at two tables below. To 2 decimal places answer the following questions. (Note: numbers in red are negative) B 37.02 Asset Price at beginning of the year (in $) Expected price at the end of the year (in $) Standard deviation (%) 12.11 17.22 36.40 44.12 17.95 24.12 32.10 41.50 B Correlation A 1.00 0.82 -0.12 0.82 1.00 0.45 -0.12 0.45 1.00 B C - lick Save and Submit to save and submit. Click Save All Answers to save all answers. EIS-presen EIS-presentation (.pptx : O 18% Time: 1 hour, 57 minutes, 54 seconds. muestion Completion Statas: b. What is the expected continuously compounded return on this portfolio in percentage terms? c. In dollars and cents, what is the expected value of this portfolio after 12 months? d. What is the standard deviation of this portfolio, in percentage terms? Hint: I suggest you copy the table below into your notes and use it to calculate your answer - one number has been given to you. No er A B Variance table A C -0.00067735 B Column totals Portfolio Variance Portfolio Standard Deviation For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). R. I Us Daraaranh nen Sans ca 10t Click Save and Submit to save and submit. Click Save All Answers to save all answers. EIS pre EIS-presentation (...pptx 0 18 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts