Question: please do it in 10 minutes will upvote the time expires. te, and 30 seconds remain. Not allowed. This test can only be taken once.

please do it in 10 minutes will upvote

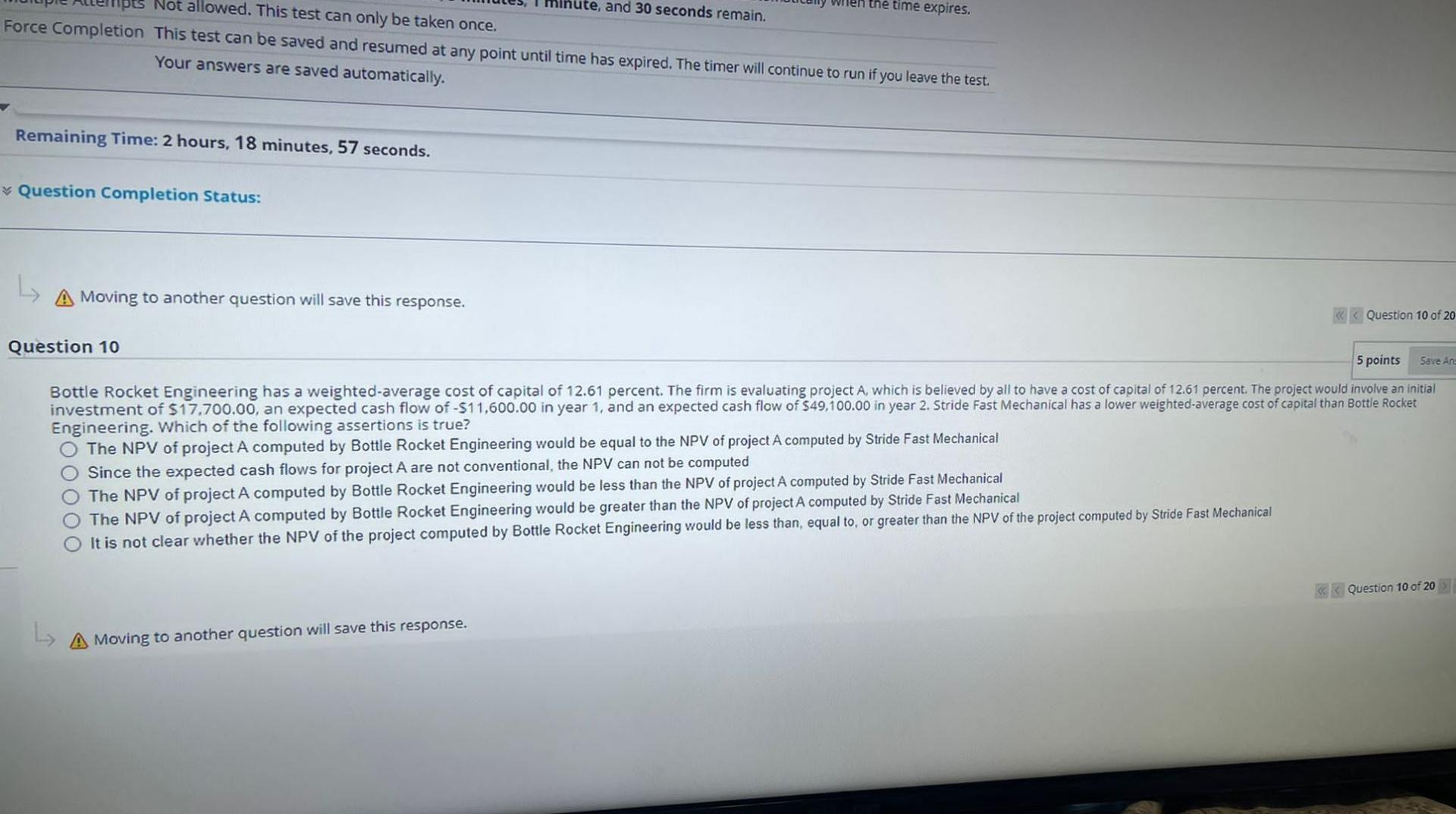

the time expires. te, and 30 seconds remain. Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. Your answers are saved automatically. Remaining Time: 2 hours, 18 minutes, 57 seconds. Question Completion Status: L A Moving to another question will save this response. Save Ang Question 10 of 20 Question 10 5 points Bottle Rocket Engineering has a weighted-average cost of capital of 12.61 percent. The firm is evaluating project A, which is believed by all to have a cost of capital of 12.61 percent. The project would involve an initial investment of $17,700.00, an expected cash flow of -511,600.00 in year 1, and an expected cash flow of $49,100.00 in year 2. Stride Fast Mechanical has a lower weighted-average cost of capital than Bottle Rocket Engineering. Which of the following assertions is true? O The NPV of project A computed by Bottle Rocket Engineering would be equal to the NPV of project A computed by Stride Fast Mechanical O Since the expected cash flows for project A are not conventional, the NPV can not be computed The NPV of project A computed by Bottle Rocket Engineering would be less than the NPV of project A computed by Stride Fast Mechanical The NPV of project A computed by Bottle Rocket Engineering would be greater than the NPV of project A computed by Stride Fast Mechanical It is not clear whether the NPV of the project computed by Bottle Rocket Engineering would be less than, equal to, or greater than the NPV of the project computed by Stride Fast Mechanical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts