Question: please do it in 20 minutes will upvote 2. Answer both parts of this question. (a) Explain in detail, using examples where possible, Put-Call parity.

please do it in 20 minutes will upvote

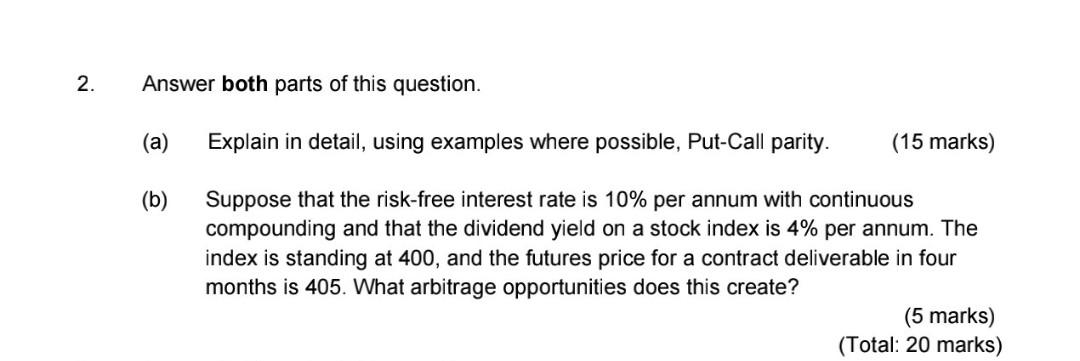

2. Answer both parts of this question. (a) Explain in detail, using examples where possible, Put-Call parity. (15 marks) (b) Suppose that the risk-free interest rate is 10% per annum with continuous compounding and that the dividend yield on a stock index is 4% per annum. The index is standing at 400, and the futures price for a contract deliverable in four months is 405. What arbitrage opportunities does this create? (5 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts