Question: Please do it in excel a. Use the information on the three default-free bonds in the following Table 1: Bond Maturity (Yr) Coupon Rate (%)

Please do it in excel

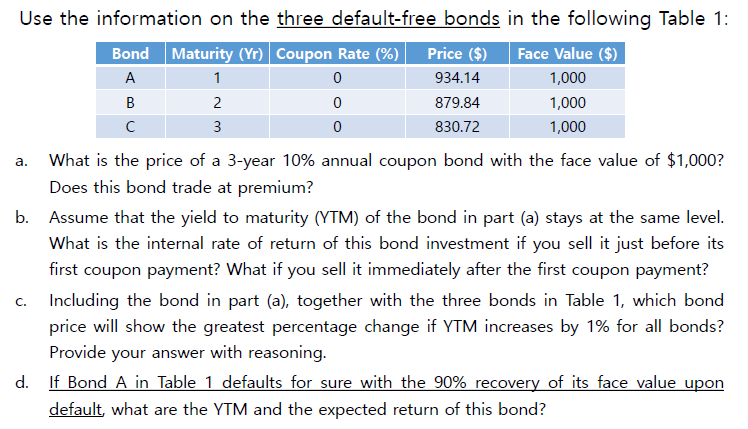

a. Use the information on the three default-free bonds in the following Table 1: Bond Maturity (Yr) Coupon Rate (%) Price ($) Face Value ($) A 1 0 934.14 1,000 B 2 0 879.84 1,000 C 3 0 830.72 1,000 What is the price of a 3-year 10% annual coupon bond with the face value of $1,000? Does this bond trade at premium? b. Assume that the yield to maturity (YTM) of the bond in part (a) stays at the same level. What is the internal rate of return of this bond investment if you sell it just before its first coupon payment? What if you sell it immediately after the first coupon payment? Including the bond in part (a), together with the three bonds in Table 1, which bond price will show the greatest percentage change if YTM increases by 1% for all bonds? Provide your answer with reasoning. d. If Bond A in Table 1 defaults for sure with the 90% recovery of its face value upon default, what are the YTM and the expected return of this bond? C. a. Use the information on the three default-free bonds in the following Table 1: Bond Maturity (Yr) Coupon Rate (%) Price ($) Face Value ($) A 1 0 934.14 1,000 B 2 0 879.84 1,000 C 3 0 830.72 1,000 What is the price of a 3-year 10% annual coupon bond with the face value of $1,000? Does this bond trade at premium? b. Assume that the yield to maturity (YTM) of the bond in part (a) stays at the same level. What is the internal rate of return of this bond investment if you sell it just before its first coupon payment? What if you sell it immediately after the first coupon payment? Including the bond in part (a), together with the three bonds in Table 1, which bond price will show the greatest percentage change if YTM increases by 1% for all bonds? Provide your answer with reasoning. d. If Bond A in Table 1 defaults for sure with the 90% recovery of its face value upon default, what are the YTM and the expected return of this bond? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts