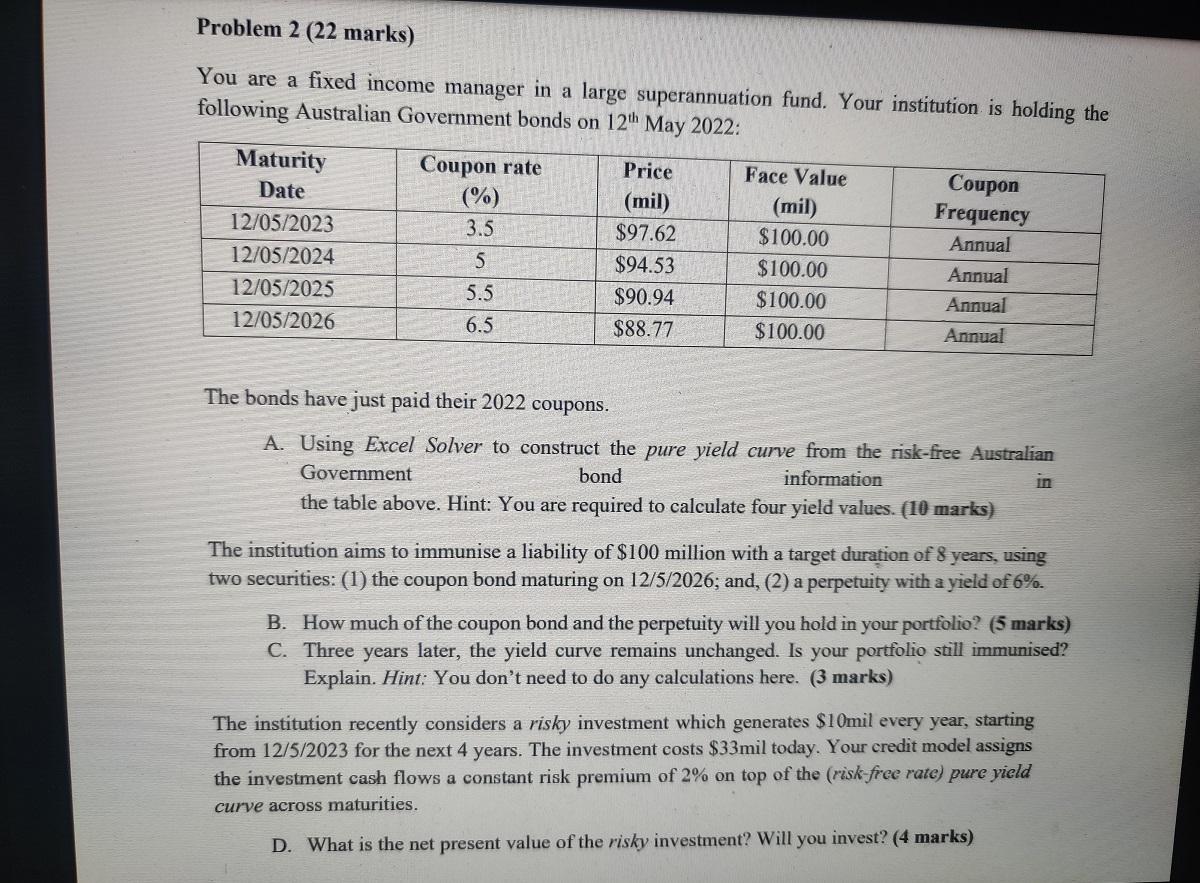

Question: Problem 2 (22 marks) You are a fixed income manager in a large superannuation fund. Your institution is holding the following Australian Government bonds on

Problem 2 (22 marks) You are a fixed income manager in a large superannuation fund. Your institution is holding the following Australian Government bonds on 12th May 2022: Maturity Date Coupon rate Price Face Value (%) (mil) Coupon Frequency (mil) 12/05/2023 3.5 $97.62 $100.00 Annual 12/05/2024 5 $94.53 $100.00 Annual 12/05/2025 5.5 $90.94 $100.00 Annual 12/05/2026 6.5 $88.77 $100.00 Annual The bonds have just paid their 2022 coupons. A. Using Excel Solver to construct the pure yield curve from the risk-free Australian Government bond information the table above. Hint: You are required to calculate four yield values. (10 marks) The institution aims to immunise a liability of $100 million with a target duration of 8 years, using two securities: (1) the coupon bond maturing on 12/5/2026; and, (2) a perpetuity with a yield of 6%. B. How much of the coupon bond and the perpetuity will you hold in your portfolio? (5 marks) C. Three years later, the yield curve remains unchanged. Is your portfolio still immunised? Explain. Hint: You don't need to do any calculations here. (3 marks) The institution recently considers a risky investment which generates $10mil every year, starting from 12/5/2023 for the next 4 years. The investment costs $33mil today. Your credit model assigns the investment cash flows a constant risk premium of 2% on top of the (risk-free rate) pure yield curve across maturities. D. What is the net present value of the risky investment? Will you invest? (4 marks) Problem 2 (22 marks) You are a fixed income manager in a large superannuation fund. Your institution is holding the following Australian Government bonds on 12th May 2022: Maturity Date Coupon rate Price Face Value (%) (mil) Coupon Frequency (mil) 12/05/2023 3.5 $97.62 $100.00 Annual 12/05/2024 5 $94.53 $100.00 Annual 12/05/2025 5.5 $90.94 $100.00 Annual 12/05/2026 6.5 $88.77 $100.00 Annual The bonds have just paid their 2022 coupons. A. Using Excel Solver to construct the pure yield curve from the risk-free Australian Government bond information the table above. Hint: You are required to calculate four yield values. (10 marks) The institution aims to immunise a liability of $100 million with a target duration of 8 years, using two securities: (1) the coupon bond maturing on 12/5/2026; and, (2) a perpetuity with a yield of 6%. B. How much of the coupon bond and the perpetuity will you hold in your portfolio? (5 marks) C. Three years later, the yield curve remains unchanged. Is your portfolio still immunised? Explain. Hint: You don't need to do any calculations here. (3 marks) The institution recently considers a risky investment which generates $10mil every year, starting from 12/5/2023 for the next 4 years. The investment costs $33mil today. Your credit model assigns the investment cash flows a constant risk premium of 2% on top of the (risk-free rate) pure yield curve across maturities. D. What is the net present value of the risky investment? Will you invest? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts