Question: Please do it on excel and show the formulas! AFF 210 AssIGNMENT Two WINTER 2019 Problem Five (15 marks DDD is debating the purchasc of

Please do it on excel and show the formulas!

Please do it on excel and show the formulas!

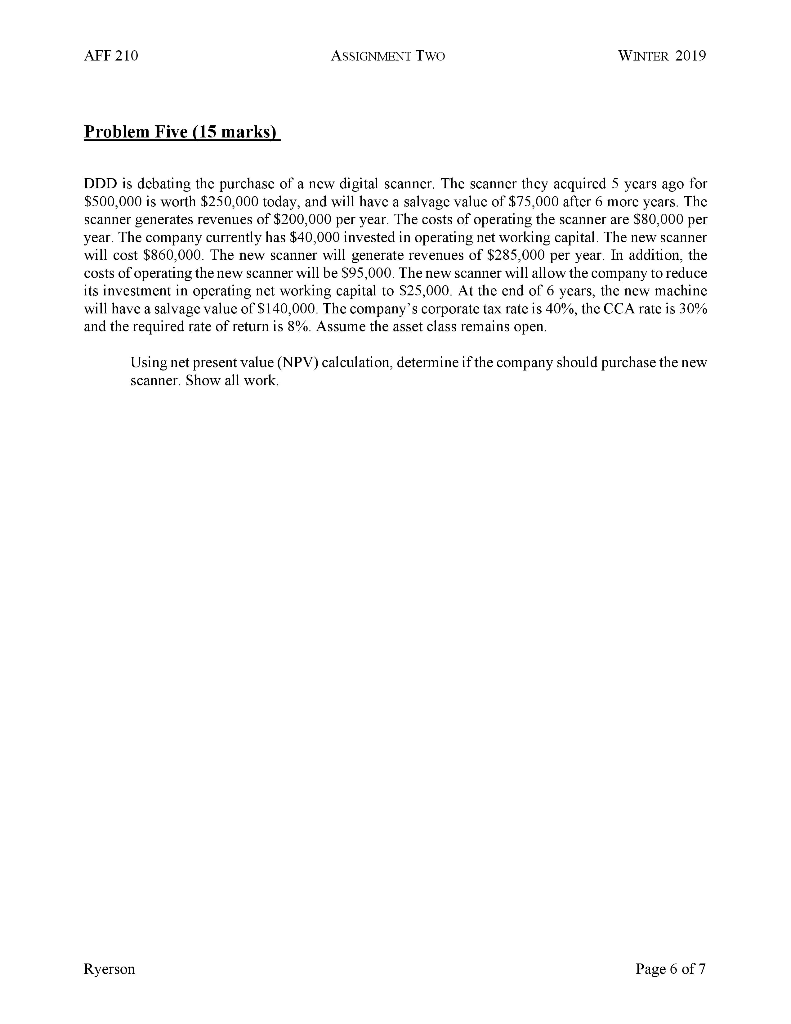

AFF 210 AssIGNMENT Two WINTER 2019 Problem Five (15 marks DDD is debating the purchasc of a new digital scanncr. The scanncr thcy acquircd 5 ycars ago for $500,000 is worth $250,000 today, and will havc a salvagc valuc of $75,000 after 6 morc ycars. Thc scanner generates revenues of $200,000 per year. The costs of operating the scanner are $80,000 per year. The company currently has $40,000 will cost $860.000. The new scanner will generate revenues of $285,000 yea. In addition, the costs of operating the new scanner will be S95,000. The new scanner will allow the company to reduce its investment in opcrating net working capital to S25,000. At the end of 6 ycars, the new machinc will have a salvage value of $140,000 The company's corporate tax rate is 40%, the CCA rate is 30% and the required rate of return is 8%. Assume the asset class remains open invested in operating net working capital. The new scanner Using net present value (NPV) calculation, determine if the company should purchase the new scanner. Show all work. Ryerson Page 6 of7 AFF 210 AssIGNMENT Two WINTER 2019 Problem Five (15 marks DDD is debating the purchasc of a new digital scanncr. The scanncr thcy acquircd 5 ycars ago for $500,000 is worth $250,000 today, and will havc a salvagc valuc of $75,000 after 6 morc ycars. Thc scanner generates revenues of $200,000 per year. The costs of operating the scanner are $80,000 per year. The company currently has $40,000 will cost $860.000. The new scanner will generate revenues of $285,000 yea. In addition, the costs of operating the new scanner will be S95,000. The new scanner will allow the company to reduce its investment in opcrating net working capital to S25,000. At the end of 6 ycars, the new machinc will have a salvage value of $140,000 The company's corporate tax rate is 40%, the CCA rate is 30% and the required rate of return is 8%. Assume the asset class remains open invested in operating net working capital. The new scanner Using net present value (NPV) calculation, determine if the company should purchase the new scanner. Show all work. Ryerson Page 6 of7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts