Question: PLEASE DO LETTERS G, H, & I . Calculate the 15 Price/ eai expected to have a high or low opinion of the company? &

PLEASE DO LETTERS G, H, & I

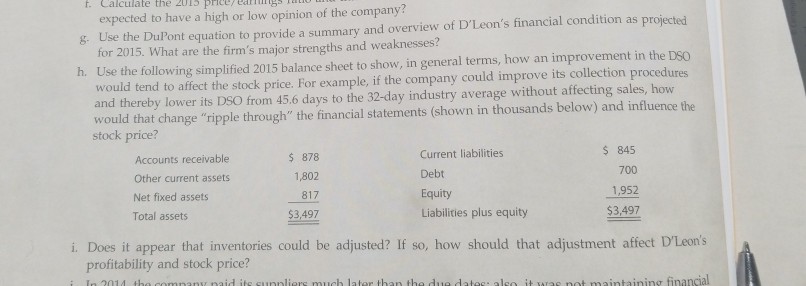

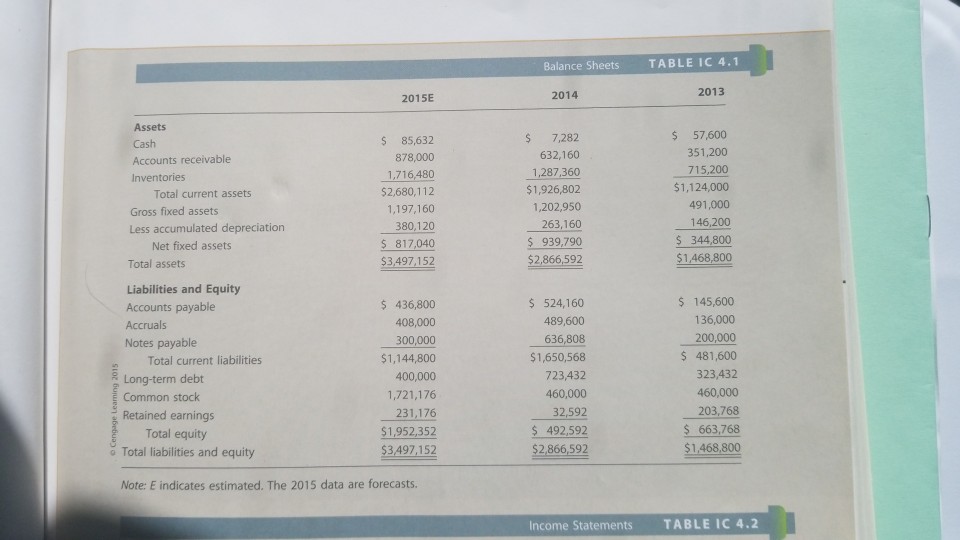

. Calculate the 15 Price/ eai expected to have a high or low opinion of the company? & Use the DulPont equation to provide a summary and overview of D'Leon's financial condition as projected for 2015. What are the firm's major strengths and weaknesses? the following simplified 2015 balance sheet to show, in general terms, how an improvement in the DSO would tend to affect the stock price. For example, if the company could improve its collection procedures and thereby lower its DSO from 45.6 days to the 32-day industry average without affecting sales, how would that change "ripple through" the financial statements (shown in thousands below) and influence the stock price? Accounts receivable Other current assets Net fixed assets Total assets $ 878 1,802 817 $3,497 Current liabilities Debt Equity Liabilities plus equity s 845 700 1,952 $3,497 i. Does it appear that inventories could be adjusted? If so, how should that adjustment affect D'Leon's profitability and stock price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock