Question: please do not copy and paste from other answers. I checked all the answers but couldnt find a proper one, please help QUESTION 3 The

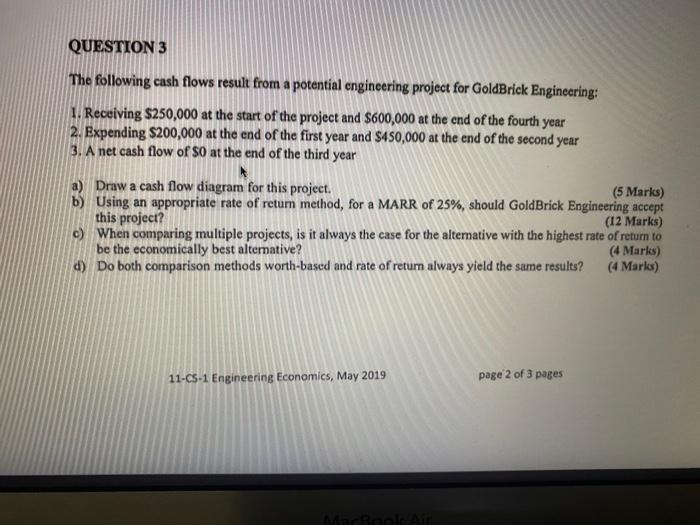

QUESTION 3 The following cash flows result from a potential engineering project for GoldBrick Engineering: 1. Receiving $250,000 at the start of the project and $600,000 at the end of the fourth year 2. Expending $200,000 at the end of the first year and $450,000 at the end of the second year 3. A net cash flow of $0 at the end of the third year a) Draw a cash flow diagram for this project. (5 Marks) b) Using an appropriate rate of retum method, for a MARR of 25%, should GoldBrick Engineering accept this project? (12 Marks) c) When comparing multiple projects, is it always the case for the alternative with the highest rate of return to be the economically best alternative? (4 Marks) d) Do both comparison methods worth-based and rate of return always yield the same results? (4 Marlos) 11-C5-1 Engineering Economics, May 2019 page 2 of 3 pages MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts