Question: Please do not copy and paste other exiting answer! where mathematical calculations are required, state the equation used and all workings in the answer b)

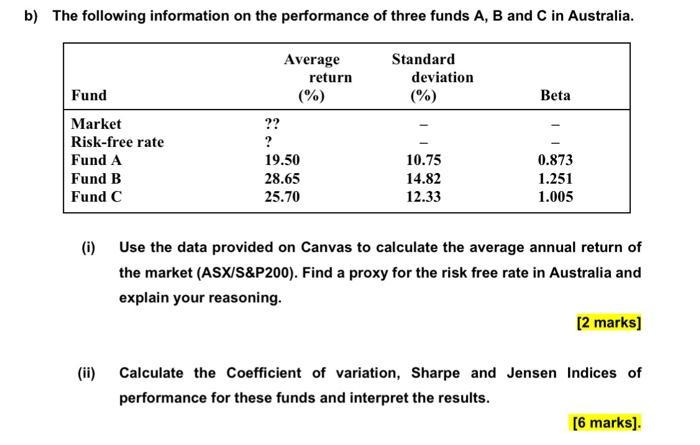

b) The following information on the performance of three funds A, B and C in Australia. Standard deviation (%) Beta Fund Market Risk-free rate Fund A Fund B Fund C Average return (%) ?? ? 19.50 28.65 25.70 10.75 14.82 12.33 0.873 1.251 1.005 (i) Use the data provided on Canvas to calculate the average annual return of the market (ASX/S&P200). Find a proxy for the risk free rate in Australia and explain your reasoning. [2 marks] (ii) Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. [6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts