Question: Please do not copy and paste previous answers to this question, they are wrong. Consider an unincorporated firm with a two period (1 and 2)

Please do not copy and paste previous answers to this question, they are wrong.

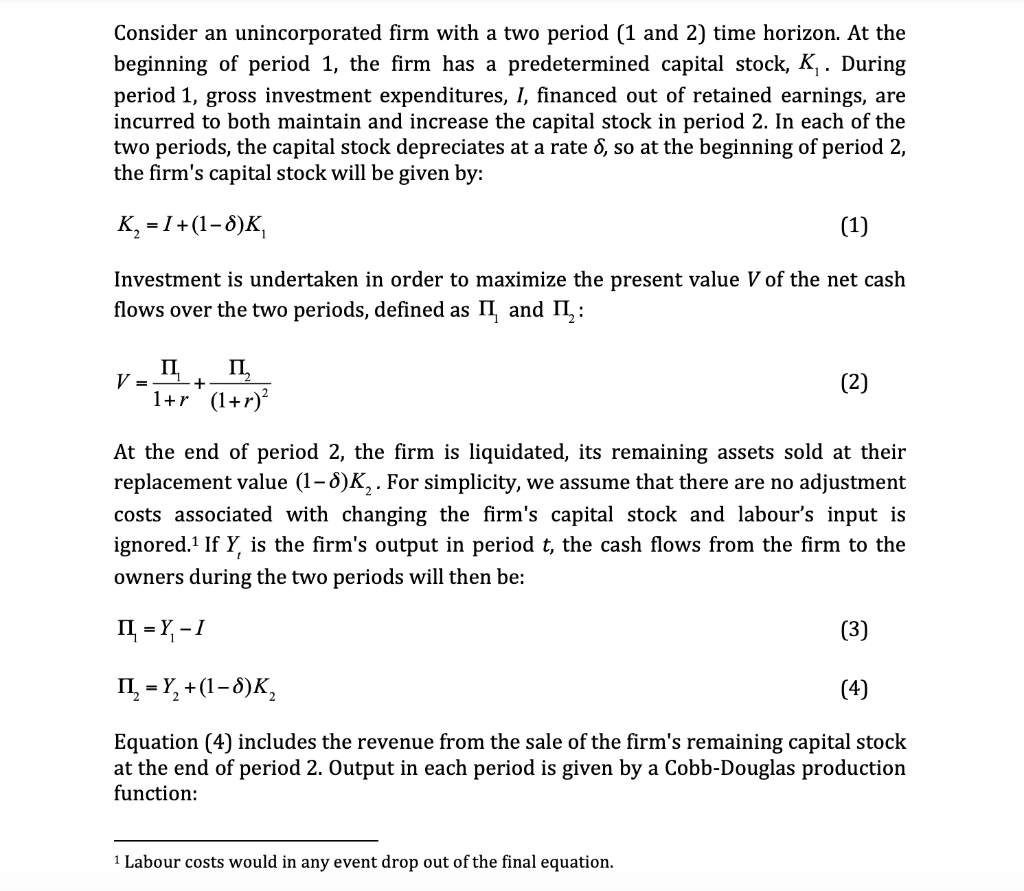

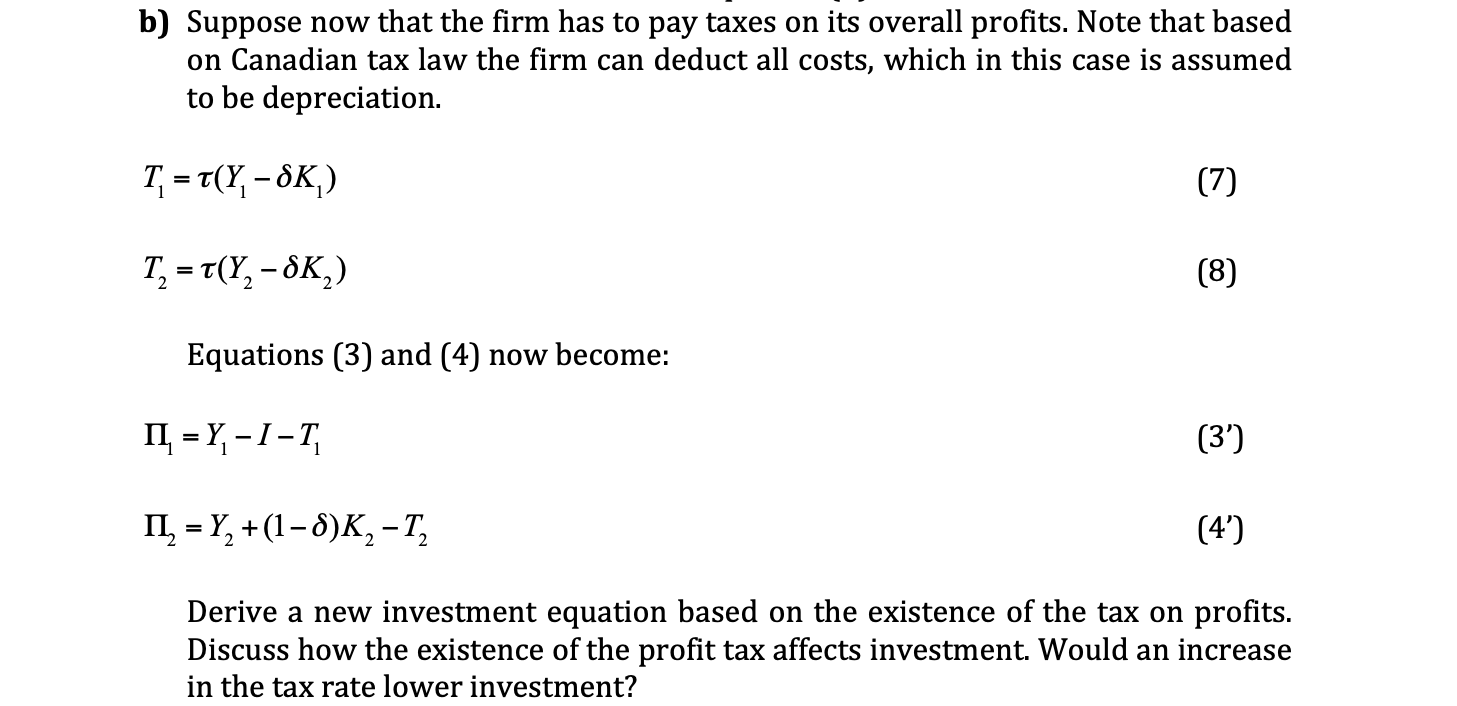

Consider an unincorporated firm with a two period (1 and 2) time horizon. At the beginning of period 1, the firm has a predetermined capital stock, K,. During period 1, gross investment expenditures, I, financed out of retained earnings, are incurred to both maintain and increase the capital stock in period 2. In each of the two periods, the capital stock depreciates at a rate , so at the beginning of period 2, the firm's capital stock will be given by: K, = 1 +(1-0)K, (1) Investment is undertaken in order to maximize the present value V of the net cash flows over the two periods, defined as II and II: II, , V = 1+r. (1+r)? + (2) At the end of period 2, the firm is liquidated, its remaining assets sold at their replacement value (1-8)K,. For simplicity, we assume that there are no adjustment costs associated with changing the firm's capital stock and labour's input is ignored.1 If Y, is the firm's output in period t, the cash flows from the firm to the owners during the two periods will then be: 11 = Y, -1 (3) N = Y+(1-0)K, (4) Equation (4) includes the revenue from the sale of the firm's remaining capital stock at the end of period 2. Output in each period is given by a Cobb-Douglas production function: 1 Labour costs would in any event drop out of the final equation. b) Suppose now that the firm has to pay taxes on its overall profits. Note that based on Canadian tax law the firm can deduct all costs, which in this case is assumed to be depreciation. T = T(Y, -8K) (7) T, = T(Y, -8K) = (8) Equations (3) and (4) now become: II = Y-I-T (3') II = Y, +(1-8)K, -T; (4') Derive a new investment equation based on the existence of the tax on profits. Discuss how the existence of the profit tax affects investment. Would an increase in the tax rate lower investment? Consider an unincorporated firm with a two period (1 and 2) time horizon. At the beginning of period 1, the firm has a predetermined capital stock, K,. During period 1, gross investment expenditures, I, financed out of retained earnings, are incurred to both maintain and increase the capital stock in period 2. In each of the two periods, the capital stock depreciates at a rate , so at the beginning of period 2, the firm's capital stock will be given by: K, = 1 +(1-0)K, (1) Investment is undertaken in order to maximize the present value V of the net cash flows over the two periods, defined as II and II: II, , V = 1+r. (1+r)? + (2) At the end of period 2, the firm is liquidated, its remaining assets sold at their replacement value (1-8)K,. For simplicity, we assume that there are no adjustment costs associated with changing the firm's capital stock and labour's input is ignored.1 If Y, is the firm's output in period t, the cash flows from the firm to the owners during the two periods will then be: 11 = Y, -1 (3) N = Y+(1-0)K, (4) Equation (4) includes the revenue from the sale of the firm's remaining capital stock at the end of period 2. Output in each period is given by a Cobb-Douglas production function: 1 Labour costs would in any event drop out of the final equation. b) Suppose now that the firm has to pay taxes on its overall profits. Note that based on Canadian tax law the firm can deduct all costs, which in this case is assumed to be depreciation. T = T(Y, -8K) (7) T, = T(Y, -8K) = (8) Equations (3) and (4) now become: II = Y-I-T (3') II = Y, +(1-8)K, -T; (4') Derive a new investment equation based on the existence of the tax on profits. Discuss how the existence of the profit tax affects investment. Would an increase in the tax rate lower investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts