Question: 7. (10 points) Indicate your answers on Ture or False. Only answers are required. (a) The current price of a dividend-paying stock is 35. Let

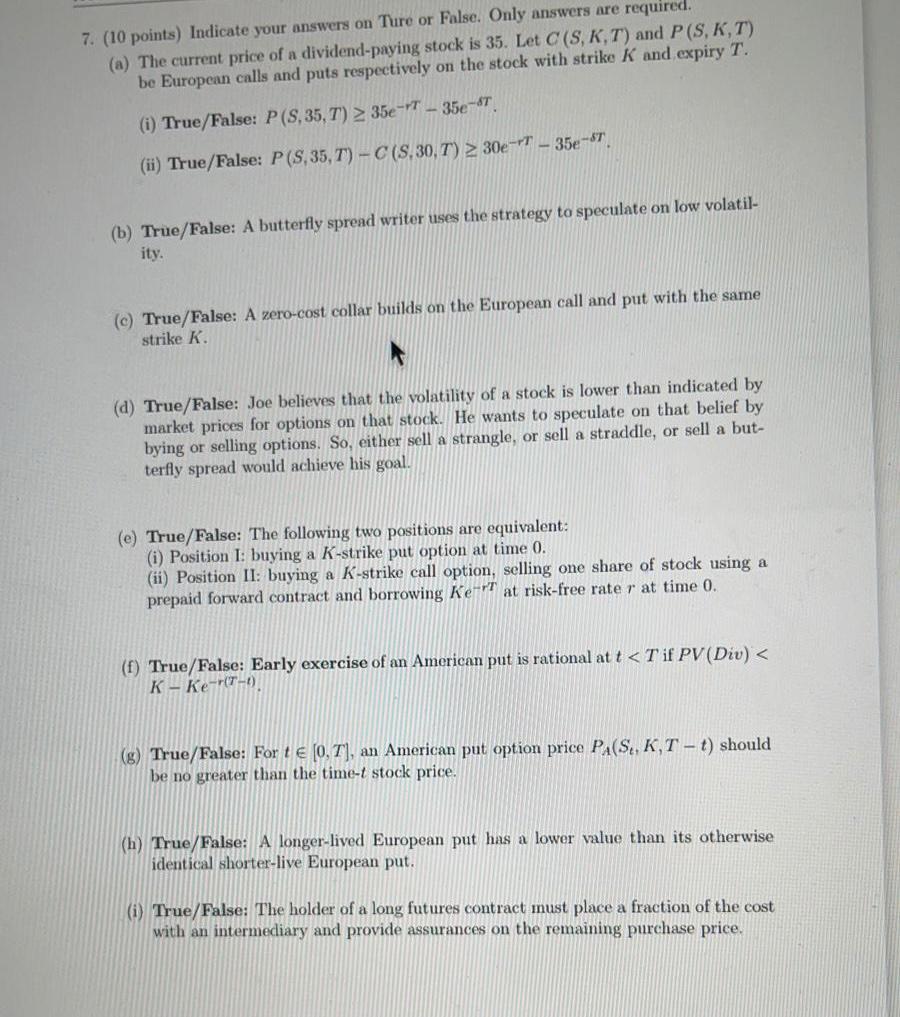

7. (10 points) Indicate your answers on Ture or False. Only answers are required. (a) The current price of a dividend-paying stock is 35. Let C (S, K, T) and P (S,K, T) be European calls and puts respectively on the stock with strike K and expiry T. (i) True/False: P(S, 35,T) 35e-T - 35e-T (ii) True/False: P(S.35, T) -C (S,30, T) 30e-T - 35e-ST. (b) True/False: A butterfly spread writer uses the strategy to speculate on low volatil- ity. (c) True/False: A zero-cost collar builds on the European call and put with the same strike K (d) True/False: Joe believes that the volatility of a stock is lower than indicated by market prices for options on that stock. He wants to speculate on that belief by bying or selling options. So, either sell a strangle, or sell a straddle, or sell a but- terfly spread would achieve his goal. (e) True/False: The following two positions are equivalent: (i) Position 1: buying a K-strike put option at time 0. (ii) Position II: buying a K-strike call option, selling one share of stock using a prepaid forward contract and borrowing Ke-rt at risk-free rate r at time 0. (f) True/False: Early exercise of an American put is rational at t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts