Question: Please do not copy and paste the answer from Chegg. This question has already been posted but they only provided the WACC Question 27 4

Please do not copy and paste the answer from Chegg. This question has already been posted but they only provided the WACC

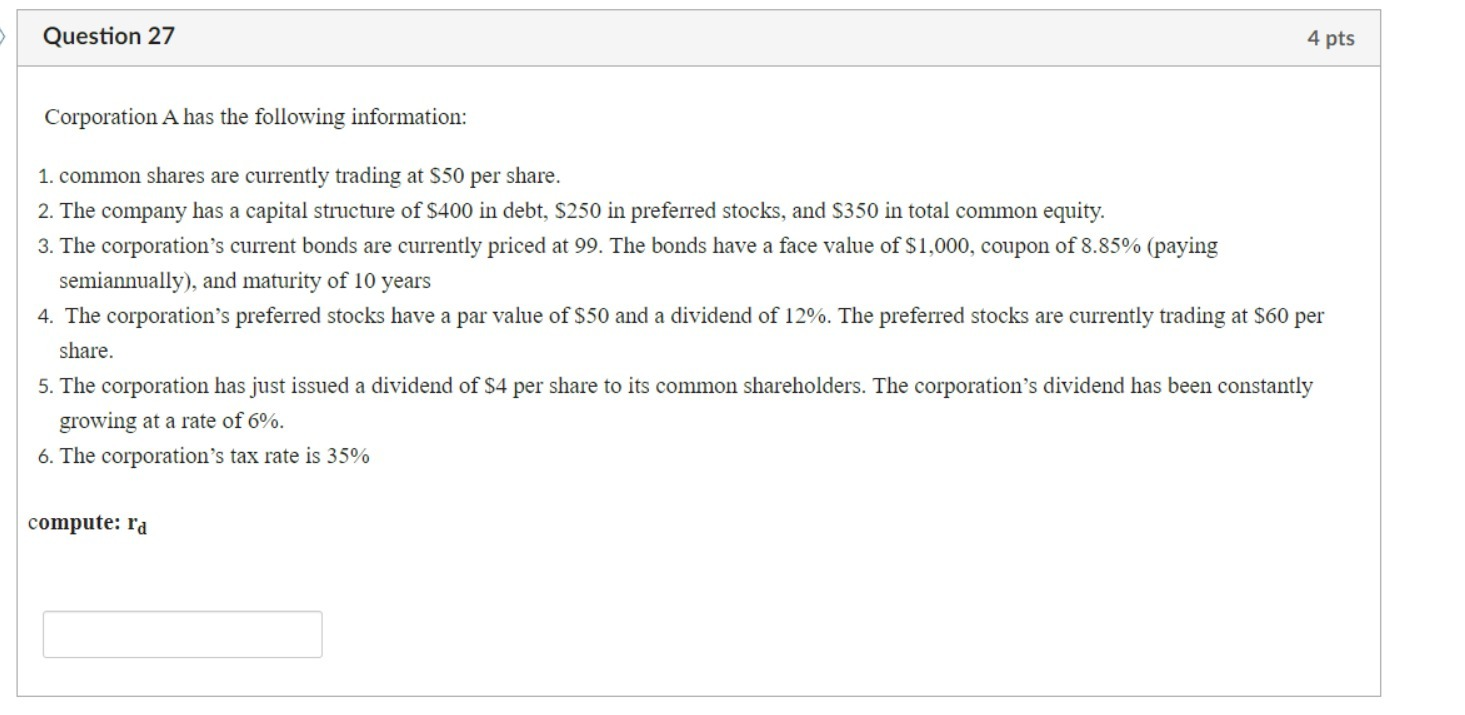

Question 27 4 pts Corporation A has the following information: 1. common shares are currently trading at $50 per share. 2. The company has a capital structure of S400 in debt, S250 in preferred stocks, and $350 in total common equity. 3. The corporation's current bonds are currently priced at 99. The bonds have a face value of $1,000, coupon of 8.85% (paying semiannually), and maturity of 10 years 4. The corporation's preferred stocks have a par value of $50 and a dividend of 12%. The preferred stocks are currently trading at $60 per share. 5. The corporation has just issued a dividend of $4 per share to its common shareholders. The corporations dividend has been constantly growing at a rate of 6%. 6. The corporation's tax rate is 35% compute: ra compute: 'pr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts